Wall Street Crash:

Have we actually learnt anything?

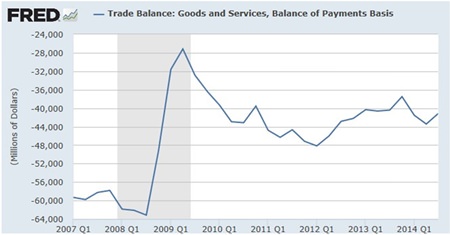

Source: FRED and US Department

of Commerce

November is a time of year when many Europeans and

Americans reflect on Armistice Day, a commemoration of the end of the First

World War. Having grown up in the UK, I have a childhood memory of the

autumn turning to winter and putting on my overcoat on a frosty morning,

poppy firmly attached to the lapel.

2014 is of course especially poignant as we commemorate

the centenary of the outbreak of that dreadful war. It seems that every

modern historian has his/her own theory as to why it all began, what the

implicated governments’ motives were. That debate will never be resolved,

yet a few times since the centenary commemorations began in July, it has

crossed my mind what the world was like before war broke in 1914, and how

the future would have looked if the peace had been kept.

Source: FRED and US Department

of Labor: Bureau of Labor Statistics

One interesting theory, from Scottish-born Harvard

professor Niall Ferguson,1 is that if the British

government had said no to war, at that fateful cabinet meeting on 4th August

1914, the outcome would have been different - even if all the other powers

had mobilized troops.

Ferguson points out that Britain was not obliged to

declare war on Germany and without its intervention, the Germans could have

quickly won the war and created a European union, without the catastrophic

loss of life on all sides. Whilst this may seem like mere speculation, it’s

worth considering that part of the German government’s war aims was to

create a European economic association, dominated by Germany of course.2

Source: USDA

Had that become a reality, there may not have been the

level of resentment, which pulled the delegates at the resulting Paris Peace

Conference away from the task of creating a new peaceful world, back to the

demons of the recent past. In his excellent eyewitness account of the peace

talks John Maynard Keynes’ observed that the French delegation was out for

revenge for defeats in 1871 and 1914 - led by the crusty Tigre, Prime

Minister Georges Clemenceau.3

Keynes became dismayed about the future, commenting: “The

proceedings of Paris all had this air of extraordinary importance and

unimportance at the same time. The decisions seemed charged with

consequences to the future of human society; yet the air whispered that the

word was not flesh, that it was futile, insignificant, of no effect,

dissociated from events; and one felt most strongly the impression,

described by Tolstoy in War and Peace or by Hardy in The Dynasts, of events

marching on to their fated conclusion uninfluenced and unaffected by the

cerebrations of Statesmen in Council.”

It makes you realize how tragic the two world wars really

were when considering where we are today. Just like in the summer of 1914,

the global economy is struggling - a look at US trade, employment and the

number of people requiring food stamps shows the current situation.

Back in 1914, the Austrian ultimatum to Serbia caused

global financial panic and a liquidity crisis on, amongst others, the London

Stock Exchange as investors rushed to turn cash into gold.4

As for the US, the economy was in recession.5 Just as

in 1939, economic woe relieved demand for American goods after the outbreak

of war.

A century later, we find ourselves in a global economic

downturn with no end in sight. Not only that, Europe is relying heavily on

Germany to help out6, while analysts call for it to

reduce its intervention.7 Not only that but today, as

in 1919, policy leaders appear to be carrying on regardless of the reality

in front of their eyes, with a dismissive air of inevitability. In spite of

finally abandoning its Quantitative Easing money-printing programme, the

Federal Reserve is yet to come up with a credible solution to, or even

recognition of, the debt crisis. Like Keynes in 1919, there are some highly

credible economists shouting from the rooftops that this is an opportunity

and a necessity to start a fresh approach to the world before we hit another

crisis. Among them are Steve Keene, Ann Pettifor, James K. Galbraith and

Michael Hudson who are part of IDEA Economics8, an

institute of which I am an advisory board member.

Given that economics failed to predict the Global

Financial Crisis - the biggest economic event in generations, failed to

repair the damage and still fails to provide relief to real businesses and

real people in the aftermath, IDEA has based its approach on three basic

principles: debt matters, money matters and the economy is dynamic.

‘Debt matters’ means that stagnation and decline will

continue until we actually deal with the debt. ‘Money matters’ is the point

that credit creates money, not a central bank: continued unmanaged money

creation by banks (e.g. when lending) will continue crises and instability.

‘The economy is dynamic’ principle is the observation that the economic

theory of equilibrium (i.e. the automatic return to normal) is not

supported by either logic or evidence.

We cannot rely on equilibrium or a third world war

to solve the next economic crisis. It’s time to change our perspective and

use 2008 as a lesson of how not to structure our modern economy. We can’t

afford to let the opportunity slip through our fingers this time.

There’s a cyclicality in debt and inequality that has

tended to result in war for as long as mankind has organized itself into

competing societies - a global conflict in the coming decades would be

cyclically consistent with this. We therefore need to break this cycle if

war is to be avoided - the proliferation implications of nuclear holocaust

by themselves probably only amount to a limited not an absolute deterrent.

For the deterrent to be absolute we need to combine a version of nuclear

horror with a healthy respect and remembrance for all those who put their

lives on the line in the belief that they were fighting wars to end all

wars.

Footnotes:

1 N. Ferguson, Virtual History: Alternatives and Counterfactuals

(1997).

2 B. Tuchman, The Guns of August (1962), p.315

3 J M Keynes, The Economic Consequences of the Peace (1919)

4

http://www.telegraph.co.uk/finance/personalfinance/investing/11113621/Edward-Bonham-Carter-The-forgotten-financial-crisis-of-1914-has-parallels-100-years-on.html

5 http://www.nber.org/digest/jan05/w10580.html

6

http://www.spiegel.de/international/germany/german-economic-growth-helps-move-euro-zone-out-of-recession-a-916553.html

7 http://www.telegraph.co.uk/finance/economics/11160944

/Eurozone-in-crisis-Germany-could-enter-third-recession-in-six-years.html

8 http://www.ideaeconomics.org/

|

Please Note: While

every effort has been made to ensure that the information

contained herein is correct, MBMG Group cannot be held

responsible for any errors that may occur. The views of the

contributors may not necessarily reflect the house view of MBMG

Group. Views and opinions expressed herein may change with

market conditions and should not be used in isolation.

MBMG Group is an advisory firm that assists expatriates and

locals within the South East Asia Region with services ranging

from Investment Advisory, Personal Advisory, Tax Advisory,

Private Equity Services, Corporate Services, Insurance Services,

Accounting & Auditing Services, Legal Services, Estate Planning

and Property Solutions. For more information: Tel: +66 2665

2536; e-mail: [email protected]; Linkedin: MBMG Group;

Twitter: @MBMGIntl; Facebook: /MBMGGroup |