Recently, my business partner, Paul Gambles and AEC Group’s Carey Ramm gave AustCham members a lively debate about the health of the Thai, Australian and global economies. Carey gave a very well-informed view of where the Australian economy is right now, whereas Paul took more of a look at what is coming down the track.

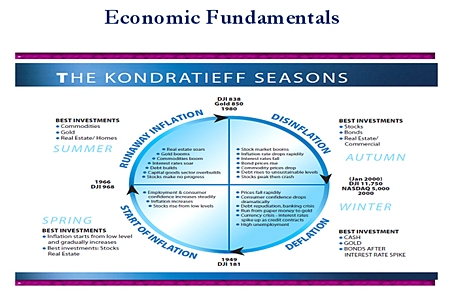

He used the four seasons Kondratieff chart that has been a reference point in presentations by MBMG Group and MitonOptimal over the years – it is also well known to regular readers of this column. Interestingly, MitonOptimal’s institutional asset allocation expert, Professor Evan Gilbert, also used the same chart in his Global Weekly Comment the very next day – great minds think alike!

We have written several pieces in the past on the need for flexible rather than static asset allocation in a world that evolves over time. To successfully implement such an approach you need an investment process that allows fund managers to position themselves reliably for these changes before they happen. MitonOptimal believes it has developed such a process.

The process they use involves taking positions on two levels – the strategic and the tactical. The strategic position reflects their long term perspective on the likely performance of asset classes over the next ten year view. This view is then implemented through the specification of their (risk) neutral asset allocations.

We recently discussed some of the changes to these allocations. They form the centre of gravity for MitonOptimal’s portfolios, but they also recognize that long term conditions are not always perfectly reflected in the short term. That is why they allow for deviations from the neutral risk position to reflect the current environment. They also spend a large amount of time thinking about how to optimally implement the desired asset allocations. These are their tactical positions.

The whole process starts with the strategic position so it is very important to have that right. Miton often gets its guidance from the Kondratieff Seasons chart. As pictured on this page, this is a cycle describing different stages of inflation, interest rates and economic growth for national economies, and their concomitant influence on financial markets.

Where are we now? Miton believes that some emerging market economies (China, India, South Africa and Australia) lie in the Autumn phase – at about two o’clock. While prices of almost all assets rise in this environment, the future is not rosy – winter is coming as debt levels start to build in these apparently benign conditions. Developed markets have been suffering through winter in the last four years and it is not quite over yet – Scott Campbell, Chief Investment Officer at Miton, sees them at around five o’clock.

It is expected for them to move into the Spring phase in the next five to ten years. This is the basis for Miton’s increased allocation to equities and decreased allocation to bonds as bonds are now entering into a bear market. The Miton strategic positioning is fundamentally for Spring, but they are also very conscious of the onset of Winter in emerging markets – and that is what is going to guide Miton’s tactical allocations.

What I would add to this is that ASEAN markets entered into the winter phase in 1997 and took remedial action that has seen them already return to Spring – however, the early days of this season will be a particularly cold as chill winds from Western and Japanese winters blow through these markets.

Tim Price of PFP Wealth Management’s recent missive entitled “The final countdown” had the following to say on European policy errors: “Nassim Taleb (author of “Fooled by Randomness” and “Black Swans”) shows how the efforts of our authorities to suppress volatility actually end up making the world less predictable and more dangerous.

“Although the stated intention of political leaders and economic policymakers is to stabilize the system by inhibiting fluctuations, the result tends to be the opposite. These artificially constrained systems become prone to “Black Swans” – that is, they become extremely vulnerable to large-scale events that lie far from the statistical norm and were largely unpredictable to a given set of observers.

“There is an analogy from the natural world. In the 1960s and 1970s, mid-western American states fell victim to scores of wildfires. Constant interventions by the US Forest Service appeared to have little positive impact – if anything, the problems seemed to worsen. Over time, foresters came to appreciate that fires were a normal and healthy element of the forest ecosystem. By continually suppressing small fires, they were unwittingly creating the conditions for larger and less containable wildfires in the future. Naturally occurring fires are necessary to remove old forest cover, underbrush and debris. If they are suppressed, the inevitable fire to come has a far greater store of latent fuel at its disposal.”

The firefighters in Australia, South Africa and elsewhere would all agree with this. By continually suppressing small fires they are unwittingly creating the conditions for larger and less containable wildfires in the future. The fire service in any country area is a vital necessity to ensure the wellbeing of all homeowners and other residents. However, all country folk have come to understand that fires are a normal and healthy element of a forest ecosystem and constant intervention will worsen, not help the process. Can someone please replace Western central bankers and politicians with these clever country folk as the interference of governments desperate to stay in power has not helped one iota.

In a perfect world, a central banker who wishes to end a depression with the economy returning to normal prosperity should follow the following motto: Don’t interfere with the market adjustment process as it only fans bigger problems. The more the government intervenes to delay the markets adjustment, the longer and more grueling the depression will be, and the more difficult will the road to complete recovery.

ASEAN will still be the healthiest region in which to invest but the best opportunities will come when markets are significantly below their current levels. These are markets in which patience and stock picking are most definitely the virtues to believe in. There are also some good fixed interest/income funds offering in excess of 8.00% which may appeal to the more cautious investor. However, if you do not want to tie your money up for any length of time then remember our old mantra of, above all, remaining liquid.

| The above data and research was compiled from sources believed to be reliable. However, neither MBMG International Ltd nor its officers can accept any liability for any errors or omissions in the above article nor bear any responsibility for any losses achieved as a result of any actions taken or not taken as a consequence of reading the above article. For more information please contact Graham Macdonald on [email protected] |