Vorapol Socatiyanurak, the Secretary-General of Thailand’s Securities and Exchange Commission (SEC), said in a recent interview with the global publishing, research and consultancy firm Oxford Business Group (OBG), that the SEC has opted for a proactive approach when it comes to taking advantage of the current influx of capital into Thailand and recognizes the importance of making funds available for projects, especially infrastructure development, as they offer a key means of boosting private sector participation in Thailand’s economic expansion.

“Infrastructure funds allow the private sector to replace spending by the government which can reserve its public funding for priorities such as education system, social welfare, and public healthcare,” he said. “Thailand needs US$3bn-4bn a year to develop infrastructure because of its location as an economic bridge for the region.”

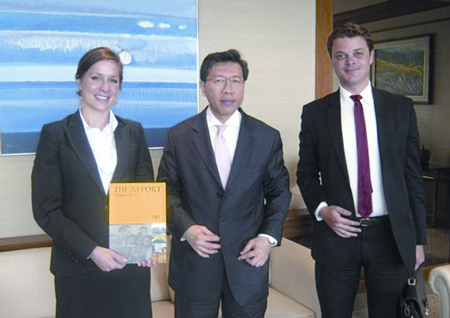

(Left-right): Anne Schlagel, Country Director, OBG; Vorapol Socatiyanurak, Secretary-General, SEC; and Alex Gordy, Editorial Manager, OBG.

(Left-right): Anne Schlagel, Country Director, OBG; Vorapol Socatiyanurak, Secretary-General, SEC; and Alex Gordy, Editorial Manager, OBG.

Socatiyanurak also highlighted the commission’s decision to pave the way for the introduction of real estate investment trusts (REITs) as an alternative financial instrument for developers seeking project funding. He said Thailand’s healthy real estate sector could make REITs an attractive option for developers by providing them with more flexibility. “Unlike property funds, REITs allow more flexible investment and leverage,” he said. “The rules should be finalised during 2012.”

The interview with Socatiyanurak was conducted as part of a nine month investigative research program for the OBG’s forthcoming guide on the country’s economic activity and investment opportunities.