Is the Australian property market truly resistant to a bubble burst, or is it just a disaster that’s taken a while, but is now ready to happen?

Why hasn’t the bubble already burst?

I’ve been saying since 2012 that a sword of Damocles hangs over the head of the Australian economy. Any single event – a global crisis, a crash in China, something completely different; or even a gradual culmination of several factors could bring the whole market crashing down.

Yet four years on and there is apparently no sign of a burst. But if you look under the surface, the cracks are clearly visible in the form of a narrowing base. Before the Wall Street Crash of 1929, stocks were at record highs; though it was in fact only the hot stocks (e.g. RCA) which were rising in value: many other stocks were already starting to decline.1 Similarly, rises in the Australian property market are dominated by the Sydney, non-first-time buyer markets, in new developments.2

Future scenarios

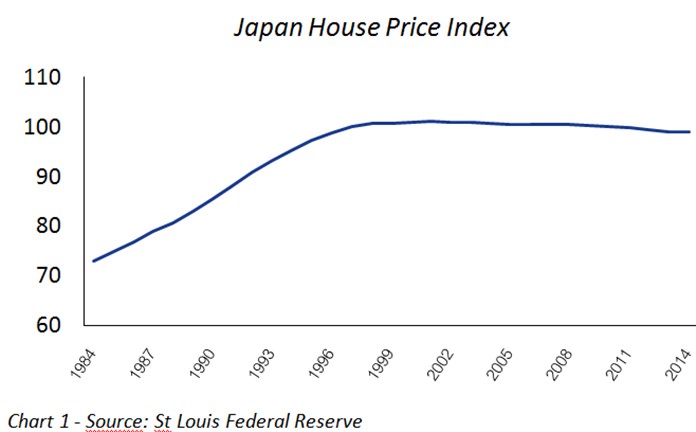

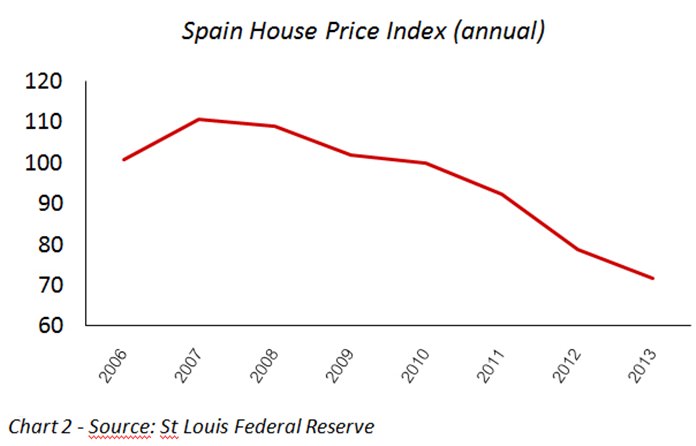

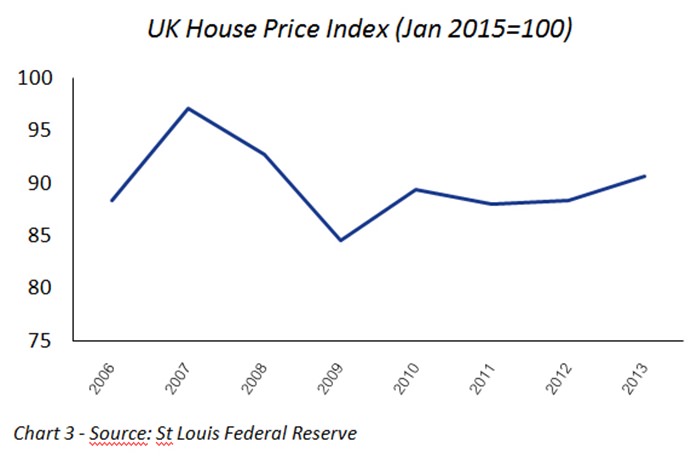

It’s impossible to predict when the bubble will burst, but it will at some point. Once that happens I can see three possible scenarios: the Japanese scenario (see chart 1), the Spanish (see chart 2) or the British (see chart 3).

The Japanese scenario is a 20-year stagnation,3 caused by low demand, low – even negative – inflation, an increase in temporary employment but not permanent contracts. All-in-all, few have confidence to spend and thus house price remain flat for two decades.

Another possible result is what happened in Spain – a freefall in prices.4 This would mean homeowners falling into negative equity, banks losing money, government panic and finally a deflationary cycle.

The final possible scenario is the bust and recovery cycle, which the UK has experienced post-GFC.5

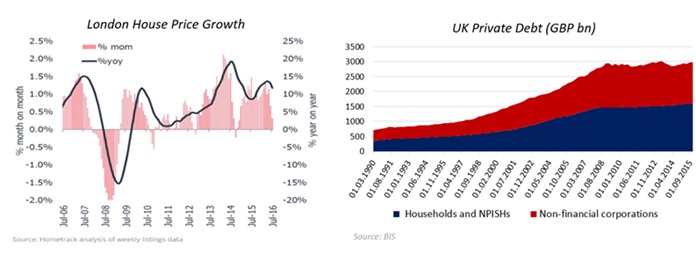

House price growth tends to be concentrated around one major city, whilst private debt is not deleveraged; meaning that there is always another crisis just around the corner (see chart 4).

When and how all this will unfold is impossible to predict with any accuracy. The best advice I can give is to be prepared for the inevitable burst.

Footnotes:

1 Dow Jones

2 Australian Bureau of Statistics

3 St Louis Federal Reserve

4 idem

5 idem

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation.

MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: |