In times gone by, investors always believed that it the only way to run a portfolio was to have a 70:30 ratio of equities and bonds – in that order. This method of investing should now have gone the way of the dinosaurs. There is a simple but effective way of investing these days and that is going with multi-asset, multi-manager funds. However, what the canny investor needs to also do is see how the manager of these funds decides which funds to use.

Up until recently, the average investor always assumed that the Emerging Markets were very much a large rick area and so only a small weighting of a portfolio should be dedicated to them. However, over time it is these Emerging Markets that have saved portfolios on many an occasion although I am the first to admit the ride could well have been more than a tad bumpy.

It is because of these potential returns that more and more people are now looking at the Emerging Markets with more interest. Up until now, as stated before, these were only a small part of anyone’s investment. However, the problems of the old traditional western markets that have shaken the more established markets to the core have persuaded people to look elsewhere for their returns. As one fund manager at Miton recently said, “Many investors (are looking) to reassess both the absolute risk associated with emerging market investments, as well as the risk relative to other asset classes, especially previously perceived safer developed market assets.” He also went on to state that, “We have been gradually increasing our exposure to emerging markets … over the last 12 months.”

The other piece of good news for new investors is that it is becoming much easier to actually invest in this particular asset class. Also, liquidity is getting better as many funds are no longer asking people to tie their money up for a certain length of time. One caveat to this though is that it is difficult to discern if these Emerging Markets are getting more attention because of the fact they are more accessible or if it is just they are receiving more interest because of more investor demand.

These days there are loads of investment trusts, open-ended funds and Exchange Traded Funds (ETF), etc., which are available to investors. These offer the possibility of investing in index trackers, equities, bonds, commodities, property and currencies which are either hedged or not as the case may be. Also, potential investors can also dip their toes into the Emerging Market scene by putting their money into companies which are in major indices such as the Dow Jones or FTSE. This indirect approach by the more cautious investor will allow them to access what is developing in the world of Emerging Markets whilst at the same time allowing them to deal with companies that use well known, transparent and accepted western business practices.

Why is there this new interest in Emerging Markets as an attractive asset class? Simple. The economic outlook for these places seems to be a lot more favourable than the actual developed markets and good looking economic fundamentals show a healthy state of affairs for risk assets.

Naturally, there have to be some concerns. The politicians and economists in charge of the Emerging Markets must be careful and they have to ensure their countries respective economies do not overheat as this could create pressure on local interest rates. This may create a dilemma for the potential investor as he/she knows the returns could be a lot more than the older markets but then so is the risk. However, there has been a great improvement over the last ten or so years with excellent Finance Ministers like Korn Chatikavanij, who won “Global Finance Minister of the Year” from The Financial Times’ Banker magazine last year, leading the way.

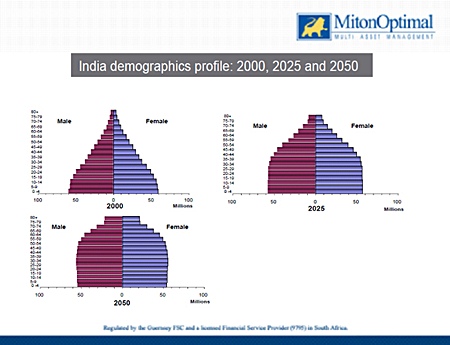

So, why are things looking so rosy for the Emerging Markets and developing countries? Two very important factors are population growth and productivity. Much of the developing world is benefitting from the former and good demographic trends – an expanding working age population which has come from urbanization and natural evolution. This means more and more young people are starting to join the workforce. Goldman Sachs have recently calculated that in India, the demographic trends will contribute four percent of annual Gross Domestic Product by 2020.

To be continued…

The above data and research was compiled from sources believed to be reliable. However, neither MBMG International Ltd nor its officers can accept any liability for any errors or omissions in the above article nor bear any responsibility for any losses achieved as a result of any actions taken or not taken as a consequence of reading the above article. For more information please contact Graham Macdonald on [email protected]