There are the Optimists and the Pessimists. There are also the Realists. We like to think we lie in the latter camp. There is so much information out there that needs to be digested it is almost impossible to know where to start. Naturally, it can also be interpreted in different ways.

MBMG’s current views can be summarized as follows: Event risk remains high and a Greek exit from the Euro, whether orderly or disorderly, is NOT reflected in the price of assets at the moment. The upside potential in risk assets remains small under the circumstances and valuations are almost irrelevant in the short term.

There are many signals out there that make us remain cautious in our current asset allocation. Some of these signals for offshore markets include the following:

* Too little evidence for growth in Europe.

* A slowdown of GDP growth in China.

* Little improvement in job numbers in USA; the potential for a negative US economic surprise is increasing.

In places such as South Africa, inflation fears and the potential for a negative European growth shock could adversely affect local growth in the short term.

It is our belief that only the adoption of additional Quantitative Easing (QE) and agreements on key political changes in the Euro zone can change our current outlook. Whilst the former is a probability, the latter is highly problematic as European politicians rarely agree on anything these days unless it suits their own particular needs. It is no longer, “All for one and all for one” but “one for one and the rest can look after themselves.”

The firm, Cross Border Capital, studies liquidity trends in the global economy. Their current observation is that liquidity in capital markets is fading fast in the US, UK, Europe and Asia. However, at least Asian central bankers have the ability to implement unilateral easing. But what ammunition do the US, UK and Europe have other than kicking the can down the road by introducing additional growth stimulating QE programmes? The answer is – none!

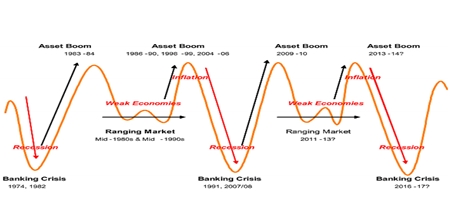

Cross Border Capital’s research indicates that we may currently be in a ranging capital market due to weak developed market economies. If correct, this should be followed by an inflationary boom and bust period for asset prices, leading us right into our next banking crisis – as if we have not had enough of them!

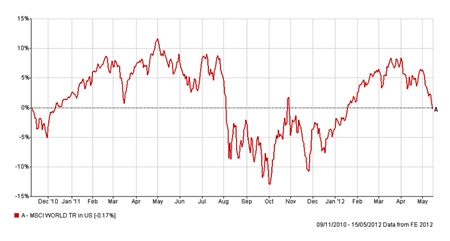

MBMG’s favourite fund managers, MitonOptimal, tested the theory across a range trending periods. In this article, you will see various graphs. One is of the MSCI World in USD from 9 November 2010 to 15 May 2012. As you can see, it looks like a ranging market to me!

Developed market bond yields are very low at the moment (US 10 year yield at 1.78%). The only scenarios that can make them attractive are a recession, deflation and/or lower interest rates.

Equities continue to remain the most attractive long term asset class but volatility will put a lot of people off and investor sentiment currently remains more supportive of bonds than equities because of the short term risks involved – Facebook being a classic example as stated in this column recently.

Corporate balance sheets are a lot healthier relative to those of most governments and are likely to be sustainable as most of their underlying business models actually work! The S&P earnings yield is 7.5% relative to the US 10 year treasury yield of 1.78%, which kind of says it all really, as it will continue to offer a lot better long term potential for the future providing we can generate consistent positive global growth going forward.

Asset allocation continues to be the key factor in determining the performance and volatility of long-term portfolio investments. Deciding on an appropriate strategic asset allocation requires the consideration of a wide range of factors. However, at a time when ranging markets are particularly unpredictable, disciplined tactical asset allocation allows an investor a way to generate more consistent returns at reduced volatility by taking calculated risks. The importance of experience and common sense, as well as a robust and well considered approach to modelling, should not be underestimated.

Nonetheless, remember the old adage, if you cannot afford to lose anything then do not invest in the first place. As you can see from Graph 2, the next couple of years are going to be more than a tad interesting. Volatility is a given. However, there will be the potential to make good profits in the very short term AND the long term.

For the former, just remember that the markets will be more than a bit jumpy so you should remain liquid and not tie your money up into anything that will take an age to get out of or exact restrictive penalties for early withdrawal. And, if you are in it for the long haul then do not panic and, above all, be patient.

| The above data and research was compiled from sources believed to be reliable. However, neither MBMG International Ltd nor its officers can accept any liability for any errors or omissions in the above article nor bear any responsibility for any losses achieved as a result of any actions taken or not taken as a consequence of reading the above article. For more information please contact Graham Macdonald on [email protected] |