There are three investment mistakes that most investors will almost certainly make over the coming years, all of which are eminently avoidable.

The next two to three decades should be one of the most rewarding periods for investors as long as they know where they are going, are prepared and keep their eyes open. In other words equip themselves with a strategic understanding of long term cycles, an awareness of the suitability of specific assets to their particular risk profile and a flexible mindset adapting to rapidly changing conditions.

Sadly the vast majority of investors and investment managers will fail to do so.

The extreme range of opinions about the health of the global economy highlights the fact that while some investors may correctly guess the precise path from the current deflationary spiral back to a growth trajectory this depends on unknown variables dictated by unpredictable politicians. That means trusting your financial future entirely to luck.

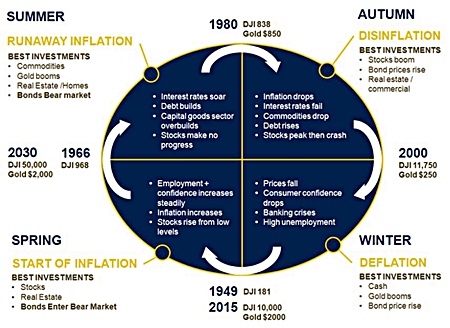

Prudent judgment involves applying a coherent macro-strategic overview, understanding risk and being ready, every minute of the day, to take corrective action if events unwind differently to your game plan. These essential disciplines are a prerequisite to realizing the exceptional potential of the upcoming economic seasonal opportunity within the long term cycle. This cycle typically tends to last between 50-80 years. With business and socio-economic cycles fundamentally rooted in human behaviour, we do not believe that this time will be any different.

As we will not be at this part of the cycle again for 50-80 years, decisions taken today will have a once in a lifetime impact. The change from autumn cycle to winter cycle in 2000 was a significant shift – many global stock indices still remain below their highest levels of 12-13 years ago – but the shift to economic spring is equally, if not more, dramatic. Many fortunes were made or lost during the last transition; the same will apply this time.

The three most common investment mistakes during this period are:

1. Lack of strategic direction

The winter cycle has been most successful for investors who decided to favour gold, cash and government bonds. However, when winter turns to spring, opportunities and risks will once again change diametrically:

– Gold and bonds will become the ugly twin sisters of investment asset classes.

– Cash will be far outpaced by the returns on risk assets such as equities or property.

Investors of all appetites, shapes and sizes need to realize that economic spring is almost a mirror image of economic winter.

While spring may not yet be upon is, now is the best time to start thinking ahead about suitable responses once springtime bursts out. Note the word “when”. Spring is not here yet and there will be a rocky road until it does arrive. Economists are still discussing whether we have reached the bottom and will just suffer a bumpy ride of the next year or two or if we have a long way to go yet on the downward spiral but then bounce back.

2. Inappropriate risk profiling

As stated above, the global economy remains mired in the depths of winter and we do not know how soon spring will be upon us or how severe the rest of winter will be. Rather than speculating on these unknowns, each investor needs to understand the imminent risks and opportunities, to relate those to their own situations and to make risk-appropriate asset allocation decisions. We are aware that many investors who rely on their assets to produce income have stepped up the risk pyramid from cash to T-Bills to longer bonds to Emerging Market debt to corporate bonds to high dividend stocks little realizing that each step progressively involves greater risk. In 2008, the high dividend stock index underwent a dramatic fall that saw investors lose over 50%.

Irrespective of target investment returns or deeply held opinions about the state of the global economy, individual investment strategies must be grounded in sound risk principles and not result in a mix of assets that might cause losses greater than you can afford.

Aggressive investors can afford to focus on not missing the strong rebound that will occur as growth replaces deflation. They should already be looking out for valuation driven opportunities, perhaps gently dipping toes into European equity markets where distressed valuations attaching to Eurozone-listed multi-nationals might be approaching the lows of the cycle – the likes of BMW and Siemens are almost at historic lows at the moment.

For cautious investors, however, the most suitable portfolio stance is best described as being ‘aggressively defensive’, currently holding those assets which provide the greatest real protection to capital in the current environment thus avoiding the bear traps that high yield stock and corporate bond portfolios represent at this time. For investors unable to tolerate a permanent and significant loss of capital the costs or downside risks of a wrong call are too expensive to contemplate and they should avoid ‘betting the ranch’ on recovery, whatever their personal opinions of how benign the inter-seasonal shift may be.

3. Asset Allocation Passivity

The change from freezing deflation to sunny growth will, necessarily, be dramatic. Successful investors not only need to have a good strategic compass and an understanding of appropriate risk exposure but they also need to be responsive – adapting to the rapidly changing landscape.

We often cite the example of William Henry Harrison, who enjoyed the shortest tenure of the office of President of the United States of America. Harrison was widely believed to have caught his death of pneumonia because of the lack of an overcoat and hat on the event of his inauguration during a very cold day in early March – when he gave the longest Presidential inauguration speech on record. Prior to that day, the weather had been temperate for the time of year. Harrison tragically did not adapt to the changed conditions.

Therefore, while investors need to understand long term strategic issues and an appropriate portfolio they also need to monitor daily economic signals within a very disciplined and focused process. Aggressive investors must be poised to take corrective action and protect capital if economic temperatures fall further, frost permeates and the onset of springtime is delayed.

If the overall picture remains so confused and unclear, it is vital not to get led astray by misreading the daily flow of news, data and information. One unseasonably mild warmer day or week in mid-December does not signal the end of winter – anyone throwing away their coat and hat will be as badly caught out by the weather as President Harrison was.

Short term optimism should be tempered by the memory that in 1931 many commentators called an end to the Great Depression – which was more than a tad premature to say the least!

Even with a strategic compass and suitable risk-profiling, passive investors will be mere spectators in the highest octane economic event of the 21st century, active, adaptive investors of all risk profiles who read the runes well will be spectacular winners.

Summary

The three little ‘piggies’, i.e. avoidable mistakes, are:

* A lack of a strategy to accommodate the change from deflationary winter to the green shoots of springtime growth.

* Allocation to assets inappropriate to individual risk appetite.

* Failure to adapt to the ever changing economic landscape.

Just looking at equities, we expect that by the end of the spring cycle that the both the SET and the S&P500 should be trading in a range of between 4000-5000. However, before we get there, it is entirely possible that both will be back below 700. This will create fantastic opportunities for investors who can avoid the three mistakes listed above.

Sadly, our expectation is that the vast majority of investors will, just like William Henry Harrison, pay a heavy price for being unprepared. The vast majority will make at least one of these mistakes and most investors will make all of them. The frustrating thing is just how readily they can all be avoided.

1932: The Tragic Year In 1931, politicians and economists were bullish on the New Year bringing recovery. In fact, it brought the collapse of Austria’s largest bank – Kredit Anstalt. The Austrian government, who supported the bank to the tune of USD150m, eventually, unable to support its currency any longer, had to leave the Gold Standard along with Germany, the United Kingdom and many other European countries. The US continued expanding credit to try to support European governments despite considerable doubts as to the US’ ability to hold the Gold Standard. The US economy contracted, the Federal Reserve cut rates to 1.5% and lack of trust in the banking system led to renewed crisis and rising federal expenditure. It became clear that the green shoots had obscured the fact that the situation was graver than ever. |

| The above data and research was compiled from sources believed to be reliable. However, neither MBMG International Ltd nor its officers can accept any liability for any errors or omissions in the above article nor bear any responsibility for any losses achieved as a result of any actions taken or not taken as a consequence of reading the above article. For more information please contact Graham Macdonald on [email protected] |