It is easy to think that the presence of global trading markets is a recent phenomenon. After all, it is now far easier than ever before to buy and sell commodities across the world.

Yet, people have been selling things from one country to another throughout history. So with this in mind, how does the trading relationship between Thailand and Australia fit into this pattern more specifically, and what are the key Thai commodities that reach Australia?

The introduction of the Thailand-Australia Free Trade Agreement at the start of 2005 ushered in a new era of trading between these countries. Figures from the Department of Foreign Affairs and Trade revealed that the value of traded goods increased from the 2004 figure of $6.8 billion to an impressive $18.9 billion in 2017.

What Thai commodities are sought after in Australia?

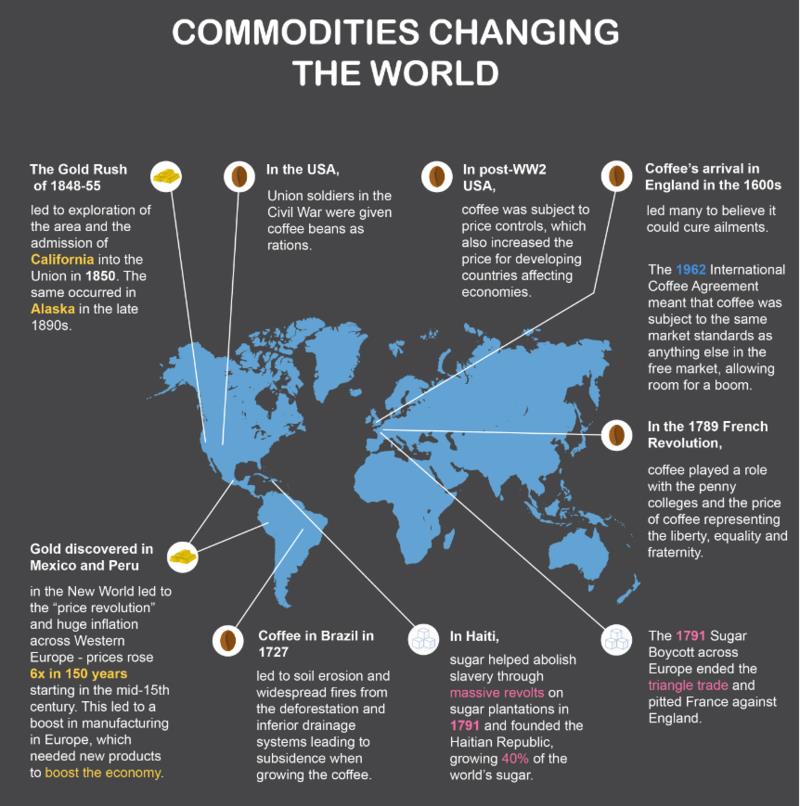

The arrival of exciting new products from foreign shores has been the catalyst for some of the biggest developments in the last few centuries. For example, when gold was discovered in Mexico and Peru, it caused inflation to rise six-fold in Europe over 150 years and led to a huge surge in manufacturing.

Source: IG

Source: IG

The trading relationship between Thailand and Australia isn’t as revolutionary as this, but it is still hugely important. According to the Australian Trade & Investment Commission, Thailand is the country’s 6th biggest two-way trading partner. It is the second biggest economy in South-East Asia and was rated third in the region in 2018 according to the World Bank’s Ease of Doing Business index.

Thailand is known for producing a wide range of attractive products. These include cars, electronic goods and food. In terms of commodities from their agricultural production, rice, rubber, sugar and palm oil are all highly sought after in Australia.

What does Australia export to Thailand?

So what Australian goods make the trip in the opposite direction? Gold, aluminium, coal and crude petroleum are among the many goods that come from Australia.

It is worth remembering that not everything traded between two countries is classed as a commodity. To be regarded as a commodity, it needs to be natural and standardised globally so that it can be used to trade goods against.

How do we identify which products moving between these countries are considered commodities? If we look at the IG trading app for mobile devices, we can see numerous different commodity markets available to investors. These include gold, silver, copper and oil, including the other commodities we have mentioned so far such as rice, palm oil, aluminium, coal and sugar.

How does this relationship benefit both countries?

As with most trading relationships, the idea is that both sides benefit. Ideally, one country obtains a product that is difficult or expensive to produce at home. The other country then has a reliable market to sell something that is easier and more affordable to supply but that is in demand elsewhere.

A good example here is with the barrels of crude petroleum that Australia sends to Thailand. The Asian country has limited natural resources in this respect and imports around 70% of its crude oil requirements.

In the other direction, we can see products such as rubber that are produced cheaply and easily in Thailand. While it isn’t impossible to produce this in Australia, it would ultimately be costlier to the consumer than bringing it over from Asia.

The large sugar manufacturing industry in Australia is organised by the Australian Sugar Milling Council, but importing more sugar from Thailand to meet demand makes sense. In the same way, 819,000 tons of rice are grown here each year. This is mainly in the New South Wales Murray and Murrumbidgee regions, but much of this is exported. Therefore, local demand is met through importing from abroad.

Overall, this looks like an increasingly important and beneficial relationship for both countries. The signs that this is going to carry on being a two-way arrangement are optimistic.