The low interest rates on bank deposit savings accounts is currently driving investment demand in the residential market where investors are seeking annual yields as well as capital appreciation. According to CB Richard Ellis (CBRE) research and leasing transactions data, the average gross yield of downtown condominiums in Bangkok in 2010 was 6.1%, substantially higher than bank deposit rates, which at best are below 2% for fixed deposits.

The key to maintaining a consistent yield is underpinned by picking the right properties and an understanding of what the tenant requirements are and what they can afford. The key factors to take into consideration when picking properties for your rental portfolio include location, picking the right building and unit size.

Location is the number one factor for the rental market, particularly for expatriate tenants which are the key market for downtown condominiums in Bangkok. Based on analysis of leasing transactions completed by CBRE in 2010, expatriate tenants continue to be very selective on location. Developments which offer easy access to mass transit stations and in close proximity to amenities such as restaurants, shopping centres, schools and hospitals are much more in demand.

From CBRE’s leasing transactions data, 50% were concentrated in the Sukhumvit area between Soi 1 to 63 and 2 to 42, followed by Silom/Sathorn and Central Lumpini. Popular developments amongst expatriates are Plaza Athenee in Ruam Rudee, Park Chidlom and Domus in Sukhumvit 16-18. There are generally fewer re-sale units in these established developments which offer good rental opportunities and investors need to work with motivated agents to find available units.

Whilst prices may substantially differ by location, rental yields do not vary significantly between Sukhumvit, Lumpini, Silom/Sathorn. Property prices per square metre in the Lumpini area are higher compared to Sukhumvit, but statistics also show that this location attracts quality expatriate tenants with the highest rental budgets. For example, recent re-sale transactions in Plaza Athenee achieved nearly THB 160,000 per sq.m., while re-sale transactions in the Sukhumvit area range from THB 120,000 to THB 130,000 per sq.m.

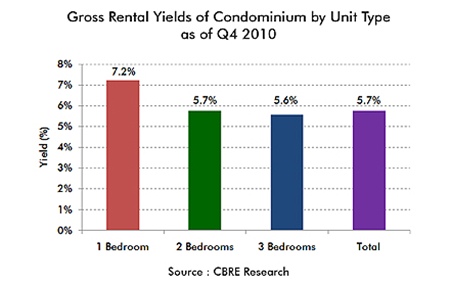

Picking the right unit sizes is also important. Smaller 1-bedroom units achieve the highest yield of 7.2%, but there is also most competition in this segment which may cause downward pressure on yields. Rental demand for this segment is underpinned by the local white collar market, unlike larger 2 and 3-bedroom units in high-end and luxury buildings which attract quality expatriate tenants with larger budgets. Whilst average yield for larger units is lower at 5.6%, the occupancy level is comparatively better in this segment.

With approximately 11,000 one-bedroom units in the pipeline under construction in Bangkok alone, investors should also beware of buying into projects with large numbers of identical units and need to assess the demand for these units before purchasing.

Another key factor is the efficiency and functionality of the unit layout, combined with the attractiveness of the location, rather than the unit size in square metres alone. For example, a modern 150 sq.m. 3-bedroom unit close to a BTS station can achieve the same rent as a larger 3-bedroom unit that is not as attractive in terms of location, unit layout, design and decoration.

In addition to picking the right location and unit size, picking the right property is essential to maintaining a consistent yield. Selecting the right properties can ensure a yield in excess of 5% as well as medium to long-term capital appreciation. Apart from location, the common facilities are an important consideration for tenants. Swimming pool, gym, sauna/steam rooms, recreational and garden areas should be available, particularly if one is investing in larger units which target expatriate families with children.

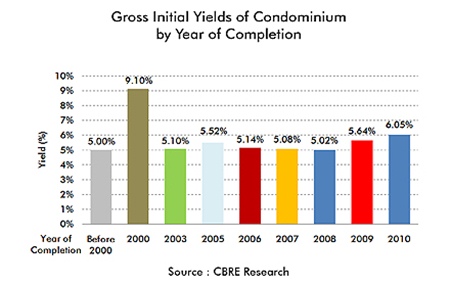

The age of a building is also a factor which directly affects yield. As a generalisation, newer buildings tend to provide better yields. There are, however, selected buildings which are older but are located in very prime locations that are no longer available and have been well maintained, for example Somkid Gardens; units in such projects should be considered.

According to CBRE Research, yields were similar across a range of properties, some of which were completed over 10 years ago. So long as the location is attractive and the common areas are well maintained and renovated, older buildings can also maintain good yields as prices of older buildings are lower and owners can therefore accept lower rents and still achieve similar yields to new buildings.

However, it is important to note that a consistent yield can only be achieved for older buildings which are well maintained. Buildings where common areas had not been renovated or where owners had not redecorated their units would provide lower yields. Older buildings tend to also be more costly to maintain and will likely to incur additional capital requirements for upgrades and renovations if the sinking fund is insufficient, therefore knowing when to buy and sell the properties in your portfolio is also the key to maintaining a consistent yield, as well as maximise the realised capital gain.

Unlike shares or bank deposits, there are operating costs involved in buy to let properties such as common area management fees, insurance, unit repairs and maintenance, void periods when the property is empty between tenants. Taking all these costs into consideration, the average yield net of expenses before tax is 3.7%, still exceeding bank deposit rates.

“In the present environment with low interest rates and bank savings and fears about inflation, the investment characteristics of residential property with potential for both capital gain and rental income and a hedge against inflation will continue to attract investors,” said Aliwassa Pathnadabutr, Managing Director of CBRE Thailand. (Press release CBRE Thailand)