Just after 14:46, local time on March 11th, a 9.0-magnitude undersea earthquake occurred some 45 miles off the coast of North Eastern Japan. What we now know as the “Eastern Japan Great Earthquake Disaster” triggered a devastating tsunami almost 40 metres high which travelled up to 6 miles inland. The awful human toll still continues to become apparent, with the confirmed death toll continuing to rise. The scale of contamination and fallout from the stricken Fukushima nuclear power plants remains a grave concern, with the scale of the nuclear crisis now upgraded to the maximum of 7 – matching only Chernobyl.

The financial implications of the crisis are only now starting to become clear, especially with regard to its impact on the Australian economy.

Since the first quarter of 2009, Australia has witnessed one of its longest, strongest economic rebounds and asset market turnarounds, largely due to the flooding of global capital markets and the global economy with a massive amount of liquidity created by a combination of quantitative easing and additional borrowing by indebted governments, primarily in the USA, Eurozone, Japan and the UK. This liquidity has found its way to marginally priced assets, such as commodities, where relatively small differences in demand or supply can have a significant impact on prices as well as to ‘risk assets’ such as Thai stocks.

Commentators had started to wonder what would be the consequences if this liquidity dried up or was withdrawn by changes in central bank policies. Answers were starting to become clear at the end of February, as the effects of the Fed’s QE2 programme started to unwind:

– Global stock markets were declining,

– Industrial commodity prices were suddenly vulnerable,

– The Australian Dollar fell by over 5% against the US Dollar and

– The long bull market in Australian property also began to unravel.

The catastrophic events in Japan dramatically changed all this. Central banks, led by the Bank of Japan, turned on the liquidity taps once again. Consequently in the aftermath of terrible human tragedy, financial markets, risk assets and commodity currencies like the AUD once again rallied strongly.

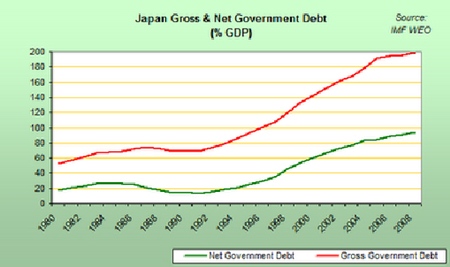

It is unlikely that this marks the beginning of the next stage of an inevitable or sustainable economic or financial boost. Although liquidity has been the key factor for the last couple of years, this cannot continue indefinitely. Japan is both printing and borrowing money right now but comparisons with the stimulatory effect on the Japanese economy of the aftermath of the 1994 Kobe earthquake are misplaced. Japan’s net sovereign debt 17 years ago was only a quarter of today’s levels. Gross government debt then stood at a high but manageable 80%. Today it has breached 200% – more than twice the accepted sustainable maximum.

As James Sullivan of MBMG Group’s associated client portfolio managers, Miton, put it, “There’s an optimistic perception that natural disasters can eventually be turned into a positive because of the boost to demand from reconstruction work…however, markets are being far too complacent about the implications of what is happening in Japan. Private domestic demand was already fragile before the disaster struck and the public finances are in a dire state…this could have significant repercussions globally.”

Subsequently we have seen further evidence that the global economy is unable to sustain its recently acquired addiction to cheap liquidity:

– The Eurozone peripheral countries have seen debt pricing hit levels indicative of highly probabilities of default,

– The UK has seen GDP numbers reflect a marked slowdown and apparent turn towards the direction of recession,

– America has seen its credit outlook downgraded.

The continued ability of the four big debtor currencies to carry on feeding the liquidity bubble now seems a remote possibility. For an Australian economy that has become increasingly dependent on the minerals and commodity sectors, this is a flashing red light. The biggest casualties of any financial fallout from chickens coming home to roost in the four major debtor economies are likely to be commodity suppliers, especially as China is attempting to rein in inflation by restricting capital flows and liquidity within the seemingly overheating engine of global growth.

That is not to say that there will not be further attempts to provide stimulus to the markets – there almost certainly will – many people are talking of a QE3 taking over when the present QE2 runs out in June. However, the risk that these attempts will fail is increasing every day. US stimulus has been having a greater impact on the recently increasing oil price (something which as a major input cost serves to strangle growth and productivity) than on economic activity within America – in other words stimulus has now become counter-productive. In such an environment, stimulus is self-defeating and slowdown is inevitable.

So there may be a period of weeks or even months in which the attempts to continue giving the moribund indebted economies the kiss of life appears to be working, to the Australian economy’s benefit but the global economy’s day of reckoning, which was postponed two years ago and cannot be avoided indefinitely.

Australia’s commodity-driven economy may enjoy the benefits of marginal pricing for a while longer, miners in Western Australia may allegedly continue to earn more than doctors, accountants or solicitors in Sydney for a few more months, Perth house prices may well carry on going up while Melbourne prices fall but the bursting of current bubble this year or next with ensuing dramatic corrections on the All Ordinaries and for the Australian Dollar look an even more certain bet after the recent tragic events in Japan. The human losses in Japan are a tragedy that will be remembered for many years to come. The financial impact on Australia of the bubble that now looks certain to burst will be a drama that will also be very hard to forget.

The above data and research was compiled from sources believed to be reliable. However, neither MBMG International Ltd nor its officers can accept any liability for any errors or omissions in the above article nor bear any responsibility for any losses achieved as a result of any actions taken or not taken as a consequence of reading the above article. For more information please contact Graham Macdonald on [email protected]