This 31st March sees the deadline for Thai personal income tax (PIT) submissions – 8th April if you submit your return online. It represents the first use of the new tax regime, which has altered the boundaries significantly.

New Rates

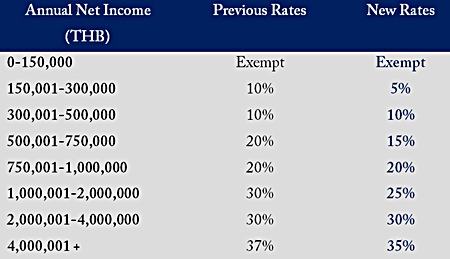

The main changes to the system are the imposition of new rates of 15% and 20%, which will be implemented on 2013 tax returns. For a breakdown of the new rates, see table 1.

Table 1

Table 1

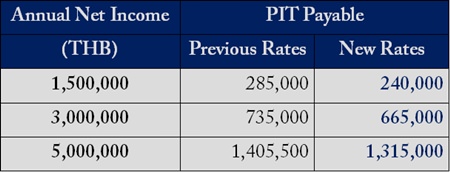

As under the previous system, the new regime does not charge tax up to THB 150,000; thus annual incomes of, for example, THB 1.5 million, 3 million or 5 million would result in PIT bills of THB 240,000, THB 665,000 and THB 1,315,000 respectively (see table 2).

Table 2

Table 2

You are liable to pay PIT if you were either resident in Thailand for at least 180 days in 2013 and you received an income exceeding THB 150,000; or if you were in Thailand for less than 180 days during 2013 but received income from a Thai source.

Allowances and Exemptions

There are several possibilities to receive tax allowances based on your investments and your family situation. Below are just a few of the possible ways to reduce your tax bill; although it’s by no means an exhaustive list.

* Personal allowance: If you do come under the Thai taxation system, you are entitled to a THB 30,000 tax-free personal allowance, as well as THB 60,000 personal expenses allowance. People over 65 years old are not assessed on the first THB 190,000 they earn.

* Life insurance: Policyholders could receive a tax allowance for the policy premium (to a maximum of THB 100,000 for each of the taxpayer and spouse). The policy must be contributed to for a minimum of 5 years with 10-year coverage.

* LTFs, RTFs and provident funds: Investment in Long-Term equity Funds (LTFs), Retirement Mutual Fund (RMFs) and/or provident funds (i.e. employer & employee funds) may entitle you to an allowance of up to 15% of a person’s annual income, not exceeding THB 500,000.

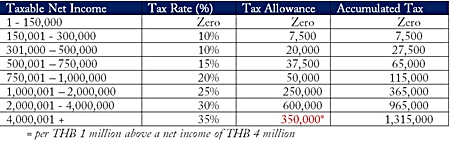

A person with an annual salary of THB 5 million, who put THB 1 million of this into an LTF or RTF, could save THB 350,000 on their tax bill. Table 3 illustrates the possible savings.

Table 3

Table 3

* Child allowance: You may be entitled to a child allowance if you have a dependent son or daughter under 20, or under 25 if still in education, and their assessable income is under THB 15,000. This allowance is limited to three children.

If you and your spouse decide to file your tax returns separately – and you were married in 2013 – each person would typically receive THB 17,000 per child if in education in Thailand and THB 15,000 if in education abroad.

Ask advice

It’s always wise to contact an independent advisor regarding tax returns. With the new system now in place and the various possibilities to claim tax allowances, it’s even more important.

| MBMG Group Investment Advisory is a Thai SEC regulated investment advisory firm in Thailand that provides sound and impartial advice to assist private, corporate and institutional clients in all aspects of their financial life. For more information, please contact us at [email protected] or call 02 665 2534-9. Please Note: 1.While every effort has been made to ensure that the information contained herein is correct, MBMG Investment Advisory cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Investment Advisory. Views and opinions expressed herein may change with market conditions and should not be used in isolation. 2. With investment comes risks. Please study all relevant information carefully before making any investment decision. 3. An investment is not a deposit, it carries investment risk. Investors are encouraged to make an investment only when investing in such an asset corresponds with their own objectives and only after they have acknowledged all risks and have been informed that the return may be more or less than the initial sum. |