Whether you are intending to buy, rent or buy-to-rent, property trends and customs in Thailand can be quite different to other countries.

Foreign ownership

Nowadays, non-Thai nationals can own property in the country in their name; although the law on this is highly restrictive. They can own up to 49 percent of the units in a condominium project; however, in other types of property development, foreigners are not permitted to own freehold land.

It is also now permitted for people who are not Thai nationals to borrow money in Thailand for the purpose of buying property in the country. They may bring in capital for investment from outside the country; albeit with certain restrictions: the total cash must be the equivalent of more than THB40 million and used for the purpose of buying a residence no greater than 1 rai (1,600 m2, 17,222 sq. ft) in size.

Local banks have recently made overseas foreign currency loans available to foreigners; although there are generally restrictions on factors such as age, income, location of the property; as well as added costs incurred.

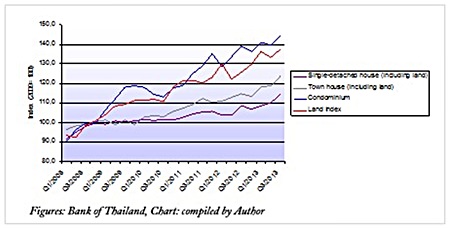

Chart 1

Chart 1

As for currency conversion, the Baht’s exchange rate with the US dollar and other major currencies has weakened since the protests began. However, it is still far stronger than 2009 levels, so converting foreign currency into THB is generally a more expensive business than five years ago.

Buying a property – House Prices

House prices in Thailand have risen substantially over the last five years; most notably in condominiums and in land (see chart 1).

In Bangkok, a 10 percent rise in residential property prices was recorded in 2012. However, when the 2013 results are published, this growth is expected to have slowed down to 5%. Experts believe this is because an abundance of newly-completed residences have hit the market. <Asia Real Estate 2013 Forecast, Colliers International 2013> That said, this over-supply may not last, as many schemes still under construction are delayed through a lack of available construction labour.

Buying a property – other costs

Unlike some other countries, there is no set fee property lawyers charge for their services. Fees are therefore negotiable. There is no requirement to use a qualified lawyer for purchasing property, in Thailand but it is highly recommended. The legislation which regulates real estate transactions doesn’t provide as much consumer protection as in many other countries.

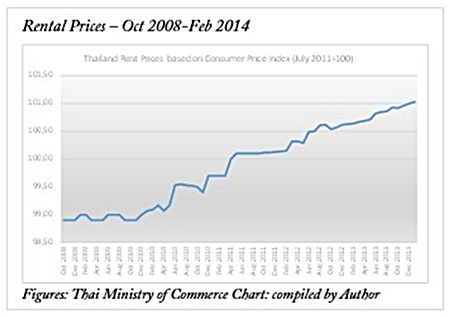

Chart 2

Chart 2

Apart from legal fees, there are four types of tax which must be paid by the seller in a real estate transaction: a transfer fee, stamp duty, a specific business tax (SBT) and a withholding tax. These taxes typically total just under 6% of the selling price.

Estate agent fees vary depending on the agreement between the agent and the client; one publication estimates sellers paying a range of 3%-5% of the selling price. <Global Property Guide: http://www.global propertyguide.com/Asia/Thailand>

Renting a Property

There is no official benchmark for rent prices, which are freely negotiated, and they are not usually adjusted to inflation or other conditions during the contract. However, if a contract is due for renewal, landlords must give their tenants advance notice of any intended rent adjustments.

In Thailand as a whole, rental prices have experienced a steady increase of around 2% above inflation over the last five years. <Thai Ministry of Commerce http://www.price.moc .go.th/en/content1.aspx? cid=1> Within the Bangkok area, however, there was a 10% year-on-year rise in real prices in 2012 and prices are 5% higher in 2013. As with buying prices, the market is adjudged to have slowed down because of the completion of several projects, thus increasing the supply significantly. <Colliers International Asia Real Estate Forecast 2013: http://www. colliers.com/~/media/files/marketresearch/apac/hongkong/asia-research/asia_2013_forecast.ashx>

In Bangkok, rent prices translate into a yield ranging between 5.3% and 6.6% for the landlord. Smaller apartments generally earn much higher rental yields, although over the last year the difference has become much less significant.

In a typical rental agreement, the landlord has a distinct advantage, as the agreement comes purely under contract law; meaning there is no specific protection for a tenant. Both parties – particularly the tenant – should therefore ensure all terms and conditions are clearly stipulated to avoid future problems.

At the beginning of a rental agreement, landlords usually receive one month’s rent in advance, as well as a security deposit equal to two to three months’ rent. The deposit could be forfeited if the tenant terminates the lease before the first year has elapsed and the tenant has no right to stop paying rent if the landlord fails to carry out repairs.

Many landlord and tenant disputes are resolved through negotiation, without the need for a court hearing. Resolution through the court system can be a slow and highly bureaucratic process.

Always ask an advisor

Whether you are planning to buy a property, it is highly recommended to seek professional assistance. This is advisable in any country but particularly in Thailand, where there are so many nuances in the process.

| MBMG Group Investment Advisory is a Thai SEC regulated investment advisory firm in Thailand that provides sound and impartial advice to assist private, corporate and institutional clients in all aspects of their financial life. For more information, please contact us at [email protected] or call 02 665 2534-9. Please Note: 1.While every effort has been made to ensure that the information contained herein is correct, MBMG Investment Advisory cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Investment Advisory. Views and opinions expressed herein may change with market conditions and should not be used in isolation. 2. With investment comes risks. Please study all relevant information carefully before making any investment decision. 3. An investment is not a deposit, it carries investment risk. Investors are encouraged to make an investment only when investing in such an asset corresponds with their own objectives and only after they have acknowledged all risks and have been informed that the return may be more or less than the initial sum. |