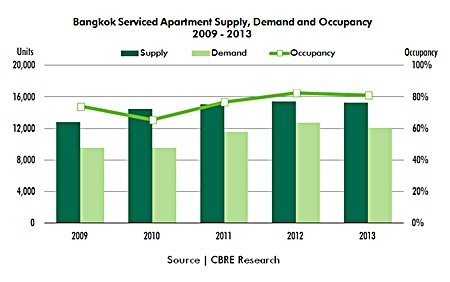

Despite the political turmoil in Bangkok, demand for serviced apartments in 2013 remained largely unchanged in most areas of the city, according to international real estate advisors CBRE Thailand.

The average occupancy rate for the whole year of 2013 stood at 81%, a slight decrease of 1% from 2012, as a result of lower occupancy rates in some serviced apartments located close to the areas where there were demonstrations.

Generally, serviced apartments in Bangkok target two types of customers: long-term tenants who are usually single expatriates working in the city, where serviced apartments compete with non-serviced apartments and condominiums for rent; and short-term-rate tenants who are usually tourists or business travellers, where serviced apartments compete with hotels. Most serviced apartments have one-bedroom or studio units.

The number of expatriates with work permits based in Bangkok increased by 12% Year-on-Year. Japanese nationals working in Bangkok make up the highest percentage of the long-term rental market for serviced apartments.

Serviced apartment rental rates did not increase due to competition from the many one-bedroom condominium units available for rent in the long-term market. As of Q4 2013, the average rent of grade A serviced apartments in Bangkok was just above THB 1,000 per square metre per month and the Sukhumvit area achieved the highest average rents of almost THB 1,200 per square metre per month.

According to CBRE Research, there are very few new serviced apartments under construction in the capital; however, there are more than 5,000 hotel rooms under construction, increasing the competition for the short-term rate market.

There are over 20,000 condominium units under construction in downtown Bangkok of which 70% will be one-bedroom and studio units, many of which have been bought by investors looking to rent out their units. This will increase competition in the long-term rental market for studio and one-bedroom units.

To date, the political unrest has had limited impact although the short-term rate market has suffered from a decline in visitor numbers, especially in those properties located close to the protest areas.

There has not been a decline in expatriates working in Bangkok however and so the long term market remains largely unaffected. As of Q4 2013, the average occupancy rate of the overall serviced apartment market stood at 80%, only a slight decrease from Q3 2013.

Demand for serviced apartments is concentrated in a limited number of areas, principally Sukhumvit, Lumpini and Sathorn. These are the areas favoured by expatriates living in Bangkok and by tourists.

CBRE believes there will be limited potential to develop serviced apartments outside of these core locations as rental rates for properties outside of these areas decline considerably.

Despite competition from hotels and rental condominiums, the limited new supply of serviced apartments means that there is a possibility that owners will be able to raise rental rates.