As the dust settles after UK Chancellor of the Exchequer George Osborne’s ‘Budget’ speech in March, it is becoming increasingly apparent that his attempt at “pulling a rabbit from the hat” is to radically change the UK pensions system.

The previous system

The Chancellor announced changes to the law which had effectively obliged members of defined contribution pension schemes to purchase annuities on retirement. Most members of such schemes who had built up a pension pot were forced, either when they wanted to convert their accumulated retirement savings into a pension income or upon reaching the age of 75, to purchase an annuity. 420,000 savers were forced into purchasing such a scheme in 2012.1

UK non-residents (or those intending to become non-resident) still have other options (the most widely known being transferring pension money from the UK to a QROPS or Qualified Recognised Overseas Pension Scheme). Theoretically, the annuity system ensured retirees were guaranteed a fixed (or even indexed) payment for life, calculated by insurance companies based on current interest rates and actuarial life expectancy.

The reality, though, was that pension recipients whose retirement income started to be drawn in the last few years have received very little because of the linkage of annuity payments to interest rates, which have been at record lows since the 2008 global financial crisis. Added to that was a cocktail of ineffective competition and regulation, making commission charges too high. In fact, a Financial Conduct Authority (FCA) inquiry into the annuity system was already underway before the Chancellor’s announcement.2

A brave new world

George Osborne’s plans represent the biggest change to the pension system since 1921.3 However, the Chancellor announced measures in two parts: some effective immediately, others, which require a period of consultation with the pensions industry, are expected to form part of the 2015 Budget (just ahead of the May 7th 2015 General Election).

In the first stage, defined contribution pension scheme members who are retiring now will have the option not to purchase annuities but to use other forms of investment instead.

The second stage next year plans to give even greater complete control of pensions by allowing members of both defined contribution and defined benefit (i.e. final salary) schemes to be able to take their entire money in a cash lump sum. At what rate this sum will be taxed is not yet certain, though the government is proposing that it be at the marginal income tax rate. Still, savers will have the opportunity to put their money into funds which bring about a far greater return than interest rates over the last six years.

The knock-on effect

As part of a Budget that was touted as being designed to encourage saving, the Chancellor also announced an increase in the personal tax allowance. As announced previously, it is already due to rise to GBP 10,000 in April of this year and will now go up to GBP 10,500 in April 2015 and a GBP 5,000 savings income exemption is proposed for 2015 as well.

What people do with their lump sum

Having more control of your money can certainly mean an improvement in the value of your savings through more appropriate investment and risk management. That said, there is also always a risk of bad financial decision-making.

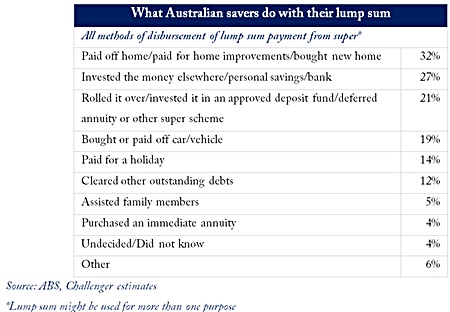

A 2012 study, carried out by Australian investment management firm Challenger,4 revealed that nearly a third of those members of Australian pension schemes who exercised their rights to receive a lump sum from their pensions used their pension money to buy a home, pay off an existing mortgage or improve their home (see table). Any similar trend in the UK could further increase rising house prices, inflating the real estate bubble even more.

What does this mean for offshore pensions?

At the moment it’s not clear what the implications are for offshore pensions such as QROPS in terms of allowing full access to accumulated capital or how the various jurisdictions where QROPS are domiciled will react in terms of adapting their own rules to reflect the advantages of the proposed changes.

What is clear is that if the main reason to set up a QROPS is to avoid annuitisation, then a QROPS transfer justified purely on these grounds no longer makes any sense. Other benefits of offshore pension schemes could remain very viable or even become even more relevant. For example, with a QROPS there is no UK income tax and no inheritance tax to pay; plus you’re not directly at the mercy of changes to UK legislation.

In the worst case any holders of pensions that have been transferred overseas from the UK will almost certainly have the option of being able to transfer back again. Yet if you take the opportunity to transfer your pension overseas, there is a significant risk that the door may be closed to this option later.

Public sector pensions

The UK government holds the view that the proposed changes could mean that many public sector workers will move their pensions from final salary schemes to defined contribution schemes. As public sector schemes are underfunded, the government is attempting to ban transfers from UK public sector schemes. If they are able to pass the law, it will likely be implemented in April 2015. However, this move could be challenged on legal grounds – the Treasury is paymaster to the Judiciary, after all.

Ask an advisor

It is more vital now than ever to seek advice from a qualified independent advisor, who can help guide you through the greatest changes to the pension system to take place in our lifetimes.

Footnotes:

1 http://www.ft.com/intl/cms/s/0/e9f20c86-b03c-11e3-8efc-00144feab7de. html?siteedition=intl

2 http://www.telegraph. co.uk/finance/personalfinance/pensions/9838554/FSA-launches-pension-annuity-probe.html

3 http://www.ft.com/intl/cms/s/0/764b7f28-af52-11e3-bea5-00144feab7de.html

4 http://www.challenger .com.au/funds/Technical Updates/CRIR_How_ much_super_do_Aussies _have_Apr12.pdf

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Private Equity Services, Corporate Services, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |