During last September’s election campaign, Australia’s eventual new Prime Minister Tony Abbott promised tax cuts and no new taxes, pledging “no surprises, no excuses”.1

Then, seven months later, Treasurer Joe Hockey announced two surprises – both of them were new taxes: on high earners and motorists. From July this year, anyone earning more than AUD 180,000 a year will have to pay an extra 2% on income tax. The other new tax affects most of the population, lining petrol taxes up with inflation – reintroducing a practice that was in place until 13 years ago.

Individuals & Business: cuts & savings

Added to that, the government announced it will become more difficult to become eligible for a state pension: the government plans to raise the retirement age to 70 by 2035. The previous government had already raised it from 65 to 67 by 2023. Plus, visits to doctors in the public health system will now require a seven-dollar contribution, bringing in a predicted AUD 3.5bn to the state.

Savings will be made through the family tax benefits system: a freeze in payments will save AUD 2.5 bn; a 33% cut in the threshold will cut expenditure by AUD 1.2 bn; and cutting the benefit for families with children over six years old keeps a further AUD 1.9 bn in the state purse.2 The government also saves AUD 7.6 bn by not following through on the promised increase in foreign aid.

Hockey’s announcement predicted that this June’s unemployment figures will reach 6% (0.2% more than the current level), eventually rising to 6.25% and remaining there until June 2016.3 His reaction to this was to announce that unemployed people aged under 30 will have to wait six months to receive unemployment benefit. Furthermore, public sector workers will have salaries frozen for a year.

A further AUD 3.2 bn will be raised through deregulation of university fees, cutting funding to academic institutions and charging students higher interest rates in government-funded loans.4

Businesses received good and bad news: 800,000 firms will benefit from a 1.5% reduction in company tax and there will be a growth package implemented to stimulate the construction industry and to build roads. However, Hockey also announced that AUD 850m in other business subsidies will be stopped.5

What’s the plan?

It will doubtlessly come as no surprise to learn that the Australian government has undertaken this belt-tightening exercise to reduce the public deficit. This is an exercise which has been undertaken in many developed economies since the fall-out of the 2008 Global Financial Crisis became clear. In fact, Messrs. Abbott and Hockey had suggested that the first step to fixing the economy was to “fix the budget.”6

The government announced that the measures announced in the budget will help cut the budget deficit, currently at AUD 50 bn, by about AUD 20bn in fiscal year 2014-15 and will be at AUD 2.8 bn just three years later, eventually becoming a surplus of 1% of GDP by 2024-25.7

On the face of it, this seems logical. As anyone with a credit card knows, cutting spending and a bringing in a higher income makes life much easier. Yet, closer analysis reveals some holes in the government’s arguments. To start with, reducing the deficit in this way may help the government balance its books, but the wide-ranging tax increases and savings stand to make many people worse off, not only in the short run but also long-term.

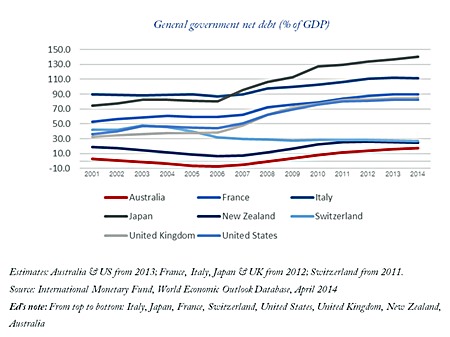

Added to that, it’s debatable as to whether reducing the public deficit is really such a priority. Despite Mr Abbott’s declaration to the contrary,8 when compared with some of world’s wealthiest economies, Australia has a very low public debt/GDP ratio (see chart).

Economic concerns

It could be argued that the reason for the government’s concern about public spending is that, with its huge reliance on exports of mineral resources to China, the Australian economy is vulnerable to any slump in Chinese demand.

Government figures are not encouraging: GDP growth of 2.75% is expected to drop a little in the next year before increasing again the year after. Also Mr Hockey revealed during the budget announcement show private sector demand will grow a mere 1.75% on average over the next two years and public sector demand by just 1.25%.

Yet, in spite of the weakness in demand, Hockey did not suggest any measures to aid it.9 In fact, while the government appears to concentrate on cutting costs to create what Hockey describes as “smaller, less interfering government,” Abbott promised two costly measures prior to his election. These consisted of generous parental leave payments for new mothers earning up to AUD 100,000 a year; and a pledge of AUD 2.5 bn government payments to encourage low carbon emissions. Furthermore, the budget announcement pledged to increase spending on defence to a total of 2% of GDP.

Thus, even if a public sector surplus were to help an ailing economy – which is debatable, given there are few signs extra public money would be used as direct economic assistance – it becomes apparent that the above-mentioned cuts are not designed to bring the public balance sheet to surplus, rather to spend money elsewhere in the public sector.

Footnotes:

1 http://www.smh.com.au/federal-politics/federal-election-2013/tony-abbotts-campaign-launch

-speech-full-transcript-20130825-2sjhc.html

2 http://www.theguardian .com/business/grogonomics /2014/may/13/budget-2014-the-six-graphs-that-matter-for-australia

3 ibid

4 ibid

5 http://www.theguardian .com/world/2014/may/13/budget-2014-who-are-australias-winners-and-losers

6 http://www.economist. com/blogs/banyan/2014/05/australias-budget

7 ibid

8 ibid

9 http://www.theguardian. com/business/grogonomics/2014/may/13/budget-2014-the-six-graphs-that-matter-for-australia

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Private Equity Services, Corporate Services, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |