The value of foreign holdings of Thai shares as of August 2023 was measured at USD 168.05 billion (THB 5.87 trillion), driven mainly by price increases in some stocks and IPO stocks in new listings, according to the Stock Exchange of Thailand’s SET Note Vol. 16/2023.

By percentage of market capitalization, the foreign holdings were 30.50 percent of total USD 551.39 billion (THB 19.26 trillion), slightly below 31.05 percent in May 2017. But its value hit a record high.

The value of foreign ownership at the end of August 2023 showed an increase of USD 21.76 billion (THB 760 billion) or 14.95 percent from July 2022.

If anything, the increase in foreign holding value is at odds with this year’s net outflows from the Thai stock market mainly stemmed from the US Federal Reserve (Fed)’s higher for longer policy and China’s stuttering economic recovery. This indicates that the sell-off largely comes from short-term investors while long-term investors’ appetite for Thai shares still prevails.

In the period, some sectors managed to run against the tide: among all sector indices that showed positive gains were the Electronic Components sector, up 97.90 percent and the Banking sector, 12.61 percent. This matched foreign investment portfolios in which the Electronic Components, the Energy and Utilities, and the Banking sectors were the top three of their holding value. As shown by SET Note Vol. 16/2023, foreign ownership of Thai shares in these three sectors valued at USD 87.89 billion (THB 3.07 trillion) or 52.34 percent of total.

Foreign ownership of Thai stock market was consolidated in three industry groups – the Technology, the Services and the Financials – to which these sectors belong. Foreign ownership in these three industry groups, valued at USD 116.81 billion (THB 4.08 trillion), or 69.40 percent of the total holding value at the end of August 2023, particularly that for the Technology that soared 67.07 percent to USD 55.25 billion (THB 1.93 trillion) in line with a 26.33 percent increase in the Industry Group index.

Notably, the Services Industry Group moved up from the 4th place in the previous report, to the second with value of USD 31.21 billion (THB 1.09 trillion). The Financials, falling from the 2nd place, showed USD 30.35 billion (THB 1.06 trillion) of foreign holdings. That increased by USD 1.47 billion (THB 51.24 billion) or 5.09 percent against a 0.97 percent drop in the Industry Group index.

Sector by sector, the Electronic Components enjoyed the largest chunk of foreign holdings, at USD 39.51 billion (THB 1.38 trillion) or 23.56 percent of total. Trailing behind were the Energy & Utilities and the Banking.

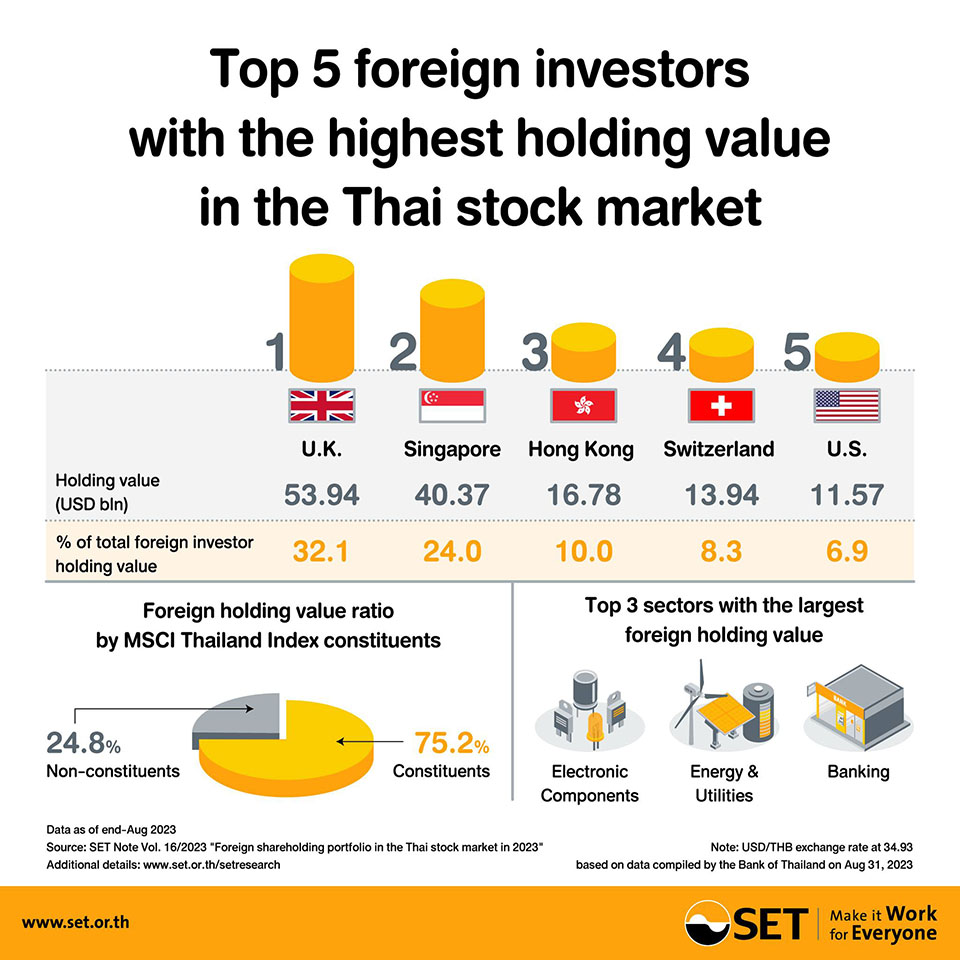

The report showed that foreign investors owned all 41 constituents of the MSCI Thailand Index, with the combined amount of USD 126.54 billion (THB 4.42 trillion) or 75.2 percent of their total holding value at the end of August 2023. Foreign ownership value in the globally recognized benchmark’s constituents rose 19.70 percent from July 2022.

Foreign investors also poured USD 1.99 billion (THB 69.53 billion) into IPO stocks allocated by 45 newly listed companies during April 2022 and March 2023.

In the latest report, the UK remained on the top, holding shares worth USD 53.94 billion (THB 1.88 trillion) or 32.10 percent. Singapore maintained the 2nd place, while Hong Kong snatched the 3rd place from Switzerland which fell to the 4th place. The US and Japan maintained the 5th and 6th places. Others in the top 10 which constituted 96 percent of total foreign ownership were the Netherlands, Mauritius, Taiwan and France.

Foreign investors are still here, waiting to hunt for good bets.

*Note: Average USD/THB at 34.93 at the end of August 2023 according to data compiled by the Bank of Thailand (NNT)