Pattaya Mail continues to receive so many enquiries about when Thai Revenue will publish a voluminous explanation of who exactly will need to pay tax under its much-publicized enforcement beginning January 1 2024. Of course, we don’t know and maybe the answer is never. But we explore below the issue from the Revenue point of view rather than from the perceptions of potential expat payees whether in panic mode or not. Although most income tax payers are Thais, and always will be, the article examines only the expat perspectives.

There’s no hurry is there? Any international cash transfers to Thailand from January 1 are not in any case taxable upon entry. Thailand does not operate a PAYE system and those with tax to pay will only record transactions on their income tax form – for the financial year 2024 – in the period January to March 2025. Eleven months to go.

Tax registration voluntary. The Thai tax system has always operated on an honour basis, relying on voluntarism for the most part, quite unlike the mandatory requirements of the internal revenue services in the UK or most of Europe. It is unlikely that this situation will change quickly in Thailand, not least because the officers would be overwhelmed if a compulsory registration was introduced. In any case, Revenue has many other national fish to fry including VAT, commercial activity within Thailand etc. But we should add that financial penalties can be, and are, levied on those deliberately hiding taxable income.

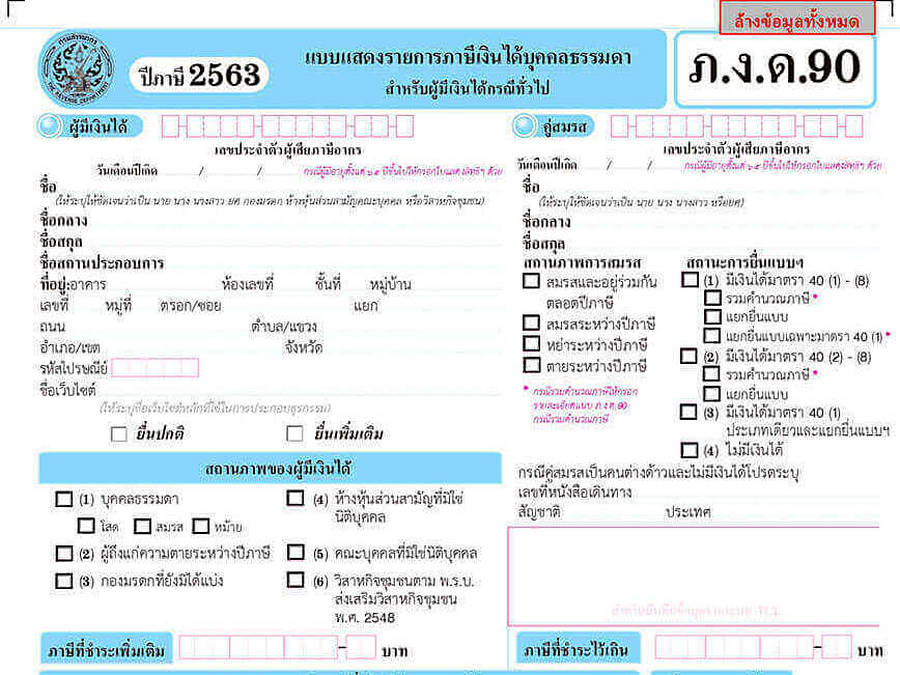

So will I be required to obtain a TIN or tax registration identification? Up to you. Some expats, for example with work permits, already file tax returns via their TIN. If you believe you are a Thai taxpayer, go ahead. Examples include currency speculators, investors in tax free overseas enterprises and holders of off-shore bank accounts for example in Hong Kong or Singapore. Digital nomads could be caught in this particular net but not if they stay in Thailand less than half the year. The vast majority of TIN holders use the services of a tax accountant since the detail can be complex.

Are there specific exemptions? Amongst those who do not need to file are foreigners with less than six months Thai residency in a year, those who do not bring any overseas cash into Thailand in the entire year 2024 and those with a 10-year Long Term Residency visa whose benefits include specific exemption from the particular issue we are discussing here. Thai Revenue, of course, could add to this list at any time.

What about pre-taxed income and double taxation? Ah yes the million dollar question! Double taxation agreements are not holiday reading and are not primarily concerned with the welfare of pensioners, so don’t expect too much. The best advice, endorsed by major tax accountants in Thailand, is to assume that pre-taxed pensions and income are exempt from the current Revenue enforcement unless and until a government source tells you otherwise. That applies whether your home country has a double taxation agreement or not.

What is the Thai Revenue rationale? To raise more cash on behalf of the Thai government to help pay for populist schemes is the most likely answer. But the Revenue hasn’t changed a lot of detail in its enforcement decree. It simply says tax must now be paid on foreign income no matter in what year that was brought into Thailand. The old rule, which covered Thais and expats too, stated that tax was due only if the cash was brought into the country in the same tax year it was earned.

So what’s different? The vast majority of countries (exceptions include North Korea, Afghanistan and the Vatican) are now operating a standard reporting system which means that financial institutions worldwide report information on customers who are resident outside of the country where they hold their accounts. In means, in practice, your international transactions as a Thai tax resident are visible to Thai Revenue. Many commentators believe that, in the early years, the Revenue will be on the lookout for those who, in the past, effectively used tax loopholes to make vast profits. That’s probably not you. And it’s certainly not me.