As well as ‘getting more exercise’, one of the items that can be difficult to achieve in a To Do list is setting – and more importantly, sticking to – a personal budget.

It seems simple to do, doesn’t it? First you make a list of your income; then write down your basic outgoings. After that, divide what’s left over between savings, clothes, as well as that sleek new tablet with apps for reading the newspaper while simultaneously making you a hot, frothy cappuccino.

The problem is that life – or at least financial life – is far more complicated nowadays. If you have more than one bank account, in more than one jurisdiction, you have to factor in your balance in each account. Plus, whilst some current and savings accounts are free to maintain, many charge a monthly or annual fee. Already you have a little bit less in there than you thought.

Then, if you wish to transfer money from one account to another, you are likely to have to pay charges and be subject to the receiving bank’s exchange rate of that day. By which time you have already lost the value of an item of clothing or two from your budget.

With all that in mind, it’s worth considering a few things when creating a personal budget.

Identifying goals

It sounds simple, but in the hustle and bustle of everyday life, it’s easy to forget what we’re actually trying to achieve. What do you want to do with your money in the short, medium and long term?

This point is the keystone of your budget, as it can help you see the bigger picture when you’re tempted to buy that wall-to-wall home cinema, instead of investing in the future.

Check exactly where your money is going

Do you check your money at the end of each month? You would be surprised to see where it all goes – especially if you are subject to those bank charges I mentioned earlier.

That’s why it’s important to stay aware of what really goes out. One handy way is to use a spreadsheet to track and categorize one month’s expenses. Then, make sure you add in your expenditure once a day – that way you know where everything goes and you quick spot any anomalies.

You could categorize your expenses as follows:

1. Fixed needs – necessary expenses which are the same amount each month (e.g. housing and savings)

2. Variable needs – necessary expenses which tend to vary from month to month (e.g. electricity, grocery shopping)

3. Non-essentials – going out, electronics, clothes, etc.

Pay yourself first

You may have noticed that I’ve put savings into the Fixed needs category. This is because I believe that personal savings should really be held in equal importance to bills and loan payments, if not higher. If you have a savings plan with a decent interest return, you could accumulate a healthy nest egg with compound interest.

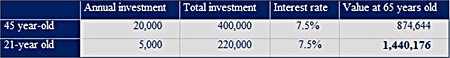

In other words, the sooner you start saving, the better. Money invested today creates greater wealth at retirement than a greater amount invested several years down the line. For example, if a 45 year-old starts to invest USD 20,000 a year and a 21 year-old invests USD 5,000 a year at the same interest rate until they are 65, the result is as shown in the table on this page.

This is because each time the interest is calculated, it is applied to the total amount in your account. Thus after year 2, the 45-year-old in the example has already received 7.5% interest on the initial USD 20,000 investment, added a further USD 20,000 and accrued a further 7.5% interest on the total.

So, if you prioritize saving above all, starting right now, you could stand to benefit greatly.

List sources of income

On the spreadsheet, make a list of all the different sources of income and how much you receive. You may be able to rattle your monthly income off the top of your head; but to have it noted down on a spreadsheet against your outgoings enables you to see in black and white exactly how much money you have left.

Make adjustments

Your personal budget shouldn’t be something set in stone. You may find that some items cost more than you expect (we’re back to those bank charges again!). You may have switched on your air-con for longer than usual – resulting in a large-than-life electricity bill. That’s why you need to allow for an adjustments category – a bit of money on the side to allow for going over-budget.

Additionally, you may be going slightly overboard in the non-essentials category. This can be managed by listing what your usual non-essentials are and setting a realistic monthly limit for each. Thus, if you discover you’ve gone over-budget in eating out, you can quickly adjust by reducing your expenses on gadgets. You’re overall non-essentials budget will be balanced and you won’t have to compromise on the essential items – particularly those savings!

If you can’t trim enough of your non-essentials to enjoy life, putting everything on a spreadsheet in this way will at least allow you to make an informed decision on which fixed or variable needs can be reduced – exchanging that villa for a condo, or eating more noodles and less caviar, for example.

Keeping to it

This is of course intended merely as a suggestion for planning a budget. There are many different ways, as everyone has different priorities and types of expenses. What is essential is to find a way of keeping a record that works for you, so that you keep noting expenses, check it regularly and adjust it accordingly. You could use a classic spreadsheet or there are various smartphone & tablet apps available, which enable you to make quick updates as you’re spending.

Whichever way you choose, keep to it so you can make the most of your money.

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook:/MBMGGroup |