BANGKOK, Thailand – The recent 0.25% reduction in lending rates by commercial banks is expected to ease the financial burden on SMEs by more than 1.3 billion baht during the last quarter of this year.

This move aligns with broader efforts to stimulate economic recovery, particularly given global trends toward lower interest rates.

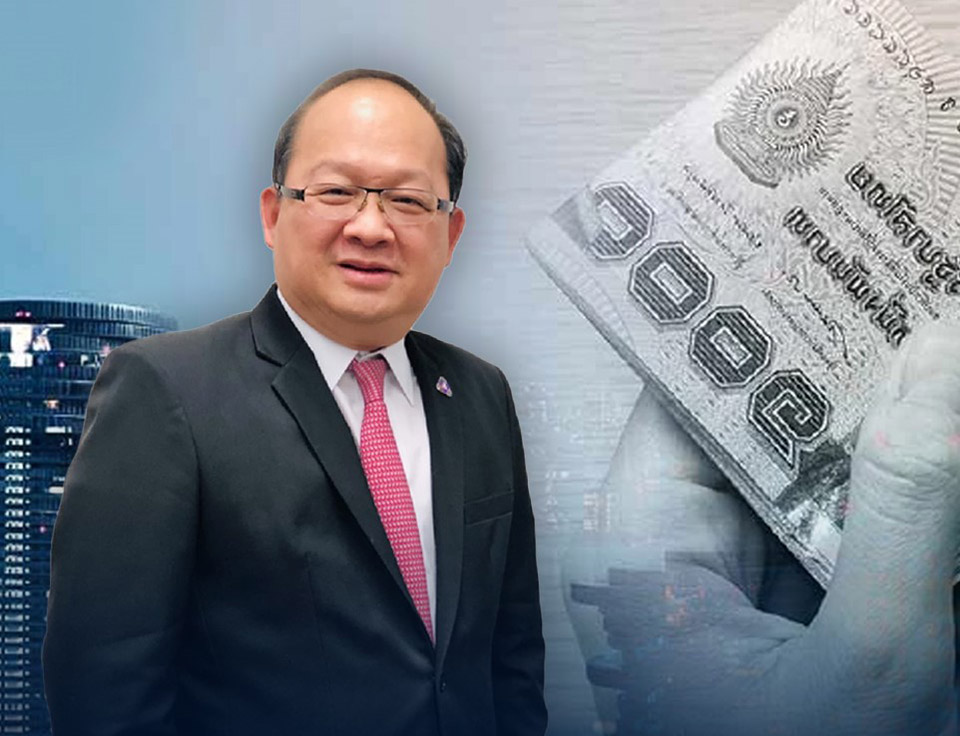

Kriangkrai Thiennukul, Chairman of the Federation of Thai Industries, welcomed the rate cut. He stated that the reduction would significantly ease financial pressure on SMEs. Kriangkrai also expressed hope that the Monetary Policy Committee (MPC) would consider further policy rate cuts to match global trends.

The MPC’s recent decision, effective from October 16th, reduced the policy interest rate by 0.25%, bringing it down to 2.25% per annum. This follows over a year of maintaining the rate at 2.50%. The aim is to address household debt and stimulate economic growth. In response, commercial banks announced that they would lower their lending and deposit rates by 0.25%, effective next month.

Kriangkrai noted that this rate cut would provide much-needed relief for SMEs. Estimates from the Kasikorn Research Center suggest the reduction will lower interest burdens by nearly 1.3 billion baht for the rest of the year. He emphasized that this would positively impact business operations, particularly in easing the burden of loan repayments.

However, he highlighted that commercial bank lending had contracted by 272.36 billion baht, or 1.87%, as of Q3 2024. This was due to stricter lending criteria, making it harder for SMEs in key sectors to access credit.

Kriangkrai called on the Bank of Thailand to take further action to encourage more flexible lending policies. While interest rate cuts help lower borrowing costs, he noted that banks remain cautious about extending credit. He also urged the government to continue implementing economic recovery measures, particularly in response to the recent flooding in northern and northeastern provinces, which has severely affected local economies and livelihoods. (NNT)