Benchmark for recovery?

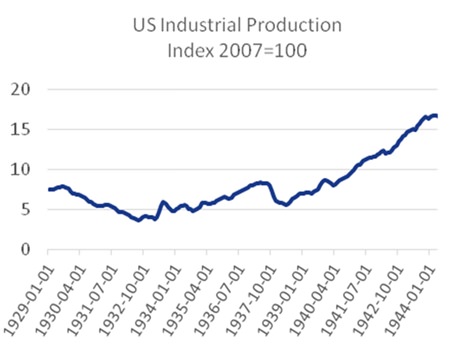

Once the Great Depression took hold in the 1930s, FD Roosevelt famously promised a “New Deal for the American people.”1 Attempts to regulate the financial system and increase economic activity were hampered by unemployment, which was still close to 15% in 1940.2 As for industrial production: it took America’s entry into World War II for US figures to improve with any significance.

Thus we currently have no practical benchmark for emerging from any downturn as prolonged as the Great Depression, without resorting to destruction of the planet (see graph).

Source: St Louis Federal Reserve.

Source: St Louis Federal Reserve.

The debate rolls on

86 years on, there is still widespread disagreement among academics as to what caused the 1929 Wall Street Crash and the Great Depression of the 1930s. One Princeton professor wrote a book in 2004 analyzing the causes of the Great Depression, in which he suggested, amongst other things, that flooding the system with money would help avoid a depression.3 That professor was one Ben Bernanke – Fed chairman during the GFC. Along with Larry Summers, Ken Rogoff, Paul Krugman and the IMF’s Olivier Blanchard – his former colleagues in Stanley Fischer’s MIT class – he shows tendencies towards Milton Friedman’s thinking that the economy is linear and the objective is a return to normal.

Others question the actual existence of normal. Economists such as Nikolai Kondratieff, Charles E. Mitchell and Joseph Schumpeter claimed that the Wall Street Crash was part of an economic wave and its impact was merely to speed up the arrival of a depression that was coming anyway.4 Some economists, including Steve Keen (my colleague at economics think-tank IDEA Economics), believe that this is analogous to the situation we’re in today. Steve, unlike Bernanke and friends, was one of only 13 economists who predicted the GFC.5 He has spent many years developing an economic model that is actually able to replicate upturns and downturns, rather than merely being able to be manipulated to produce never-ending expansion.

It’s quite possible then that the cycle theory is the correct one and that the market manipulation being attempted today will merely create stability. Hyman Minsky argued that stability was the exception rather than the norm, leading us to revise our expectations upwards, thus causing speculative bubbles.6 Persisting in following this path upward path could well mean that collectively, we have learnt nothing whatsoever about 1929 and its consequences.

Footnotes:

1 The Roosevelt Week, Time, 11 July 1932

2 Gene Smiley, “Recent Unemployment Rate Estimates for the 1920s

and 1930s”, Journal of Economic History (1983) 43#2 pp. 487–93

3 Ben Bernanke, Essays on the Great Depression¸

Princeton University Press, 2004

4 http://blogs.wsj.com/marketbeat/

2008/05/30/springtime-for-kondratieff/

5 http://barnabyisright.com/2013/05/30/

an-historical-warning-for-proponents-of-a-modern-debt-jubilee/

6 Hyman P. Minsky (1982). Can “it” happen again? : Essays on instability and finance. Armonk, N.Y., M.E. Sharpe. p. 24, extracted from http://www.debtdeflation.com/blogs/2012/04/16/inet-presentation-minskian-perspective-on-instability-in-financial-markets/

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook:/MBMGGroup |