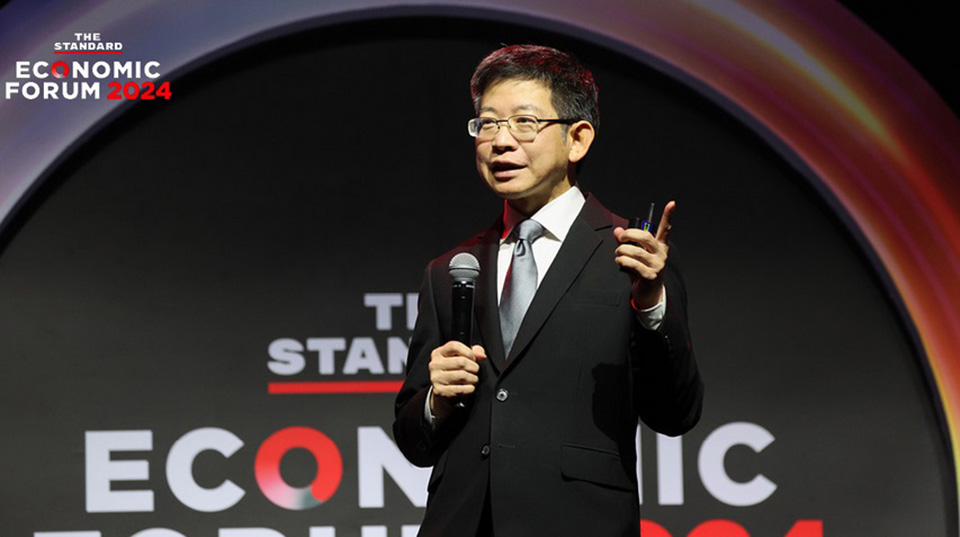

BANGKOK, Thailand – Deputy Prime Minister and Finance Minister Pichai Chunhavajira highlighted the need for increased investment in Thailand to stimulate economic growth, with a targeted GDP growth rate of 3.5%. Speaking at The Standard ECONOMIC FORUM 2024 on “Navigating Thailand’s Economic Storm with Fiscal Policy,” on November 13, he acknowledged Thailand’s continued investment shortfall, which has stagnated at around 20% of the national budget instead of the optimal 40%. This shortfall has held GDP growth to an average of 1.9%, while inflation this year is expected to remain below 1%, with public debt now at THB 12 trillion, equivalent to 67% of GDP.

To reduce public debt, Minister Pichai emphasized the importance of increasing investments, especially as high liquidity levels persist within the financial system. However, he noted that banks remain hesitant to lend due to elevated household debt, leading to structural issues that have stalled the Thai stock index at 1,400-1,500 points for an extended period. Although Thailand appears economically stable, he stressed that without new investments and machinery, the country’s growth trajectory remains uncertain.

One area the government is exploring is energy resources in the Thailand-Cambodia joint development area, which contains substantial petroleum reserves, including crude oil. Developing these resources could sustain Thailand’s energy needs for the next 20 years while transitioning toward renewable energy. Minister Pichai urged continued negotiations to maximize these shared resources.

In line with the administration’s fiscal goals, efforts are underway to maintain a fiscal deficit of 70% of GDP, finding pathways to mobilize up to THB 3 trillion in new debt, or THB 750 billion annually. This debt would finance logistics and infrastructure projects, connecting major economic centers and expanding the country’s rail system, with private sector partnerships encouraged through incentive measures.

In the real estate sector, the government aims to revitalize the industry, which impacts various economic segments. As part of this, state-owned land, including assets from the State Railway of Thailand, will be introduced to the market under long-term leases of up to 80 years. This initiative is intended to foster investment without concerns over foreign ownership and is integrated into the current budget to stimulate progress.

A key topic for the upcoming Economic Stimulus Committee meeting on November 19 is the proposed digital wallet distribution, which the government views as a temporary economic boost. The collaboration with the Bank of Thailand will also prioritize household debt restructuring, aiming to alleviate debt burdens on citizens.

Additionally, Bangkok Bank Director and Senior Executive Vice President, Kobsak Pootrakul spoke on “Macroeconomic Trends in 2025,” forecasting U.S. economic impacts under Donald Trump’s policies, such as the “America First” agenda. Expected measures include border closures with Mexico, personal tax cuts, and increased tariffs on Chinese imports. Trump’s vision to position the U.S. as a cryptocurrency hub could have ripple effects, as evidenced by Bitcoin’s rise to USD 90,000. He predicted that the U.S. dollar, yen, and baht would all experience fluctuations, with the dollar strengthening against other currencies, including the baht, projected to move from THB 32 to THB 35 per USD. (TNA)