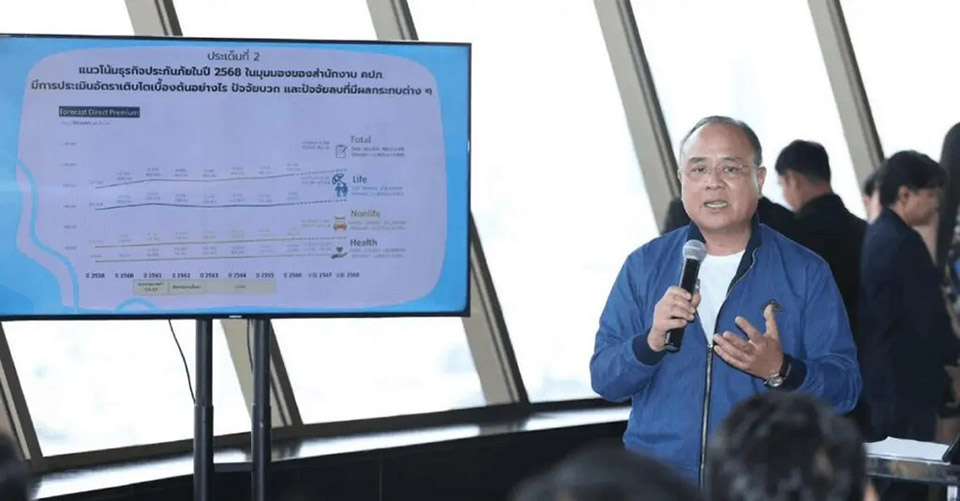

BANGKOK, Thailand – The Secretary-General of the Office of Insurance Commission (OIC), Mr. Chuchat Pramunpol, on November 17, has projected that Thailand’s insurance premiums could reach 1 trillion baht in 2025, driven by economic recovery and growth in sectors such as health insurance and electric vehicle (EV) coverage.

Key Drivers of Growth

The OIC anticipates that insurance premiums in 2025 will total between 970 billion and 980 billion baht, with the potential to surpass the 1-trillion-baht mark. This growth aligns with the recovering economy and increased tourism, which not only boosts travel insurance sales but also stimulates broader economic activity.

- Health Insurance and EV Insurance in High Demand

Health insurance continues to dominate the market share.

EV insurance is rapidly growing in popularity, reflecting the global shift toward electric vehicles.

- Investment-Linked Insurance Rising

Unit-linked life insurance policies are regaining traction among consumers.

- Digital Sales Channels

Insurance brokers and online platforms are adapting well, leveraging digital tools to enhance distribution efficiency.

OIC’s Oversight and Innovations

The OIC is committed to ensuring the stability of the insurance sector by employing an Early Warning System (EWS) to monitor the financial health of insurance companies. This proactive approach allows the OIC to address potential weaknesses or provide strategic advice for diversification.

New Year’s Gift for the Public

In line with government policies, the OIC plans to introduce affordable short-term insurance policies as a New Year’s gift. These policies will feature low premiums, offering coverage for one month, and will be available at convenience stores nationwide. The initiative aims to provide accessible insurance options tailored to the needs of the public during the holiday season.

As Thailand’s economy continues to rebound, the OIC remains focused on supporting sustainable growth in the insurance sector while ensuring robust consumer protection and expanding investment opportunities for insurers. (TNA)