According to the Thai Board of Investment, Thailand is a Gateway to Asia. Yet can Thailand really compete with low-tax countries, strong neighbours and the economic might of southern China?

The idea of a business hub has long since been used by government FDI and development organizations to tempt cash-rich foreign businesses to invest in their catchment area over someone else’s. In some ways this scrap for riches is comparable with Italian city states during the Renaissance.

Geography

In these times of digital economy, it could be argued that location doesn’t count for much. However, that would be to ignore that services and industry have to be strategically placed to benefit from skilled labour forces, physical infrastructure and to understand the culture, dynamics and practices of the region.

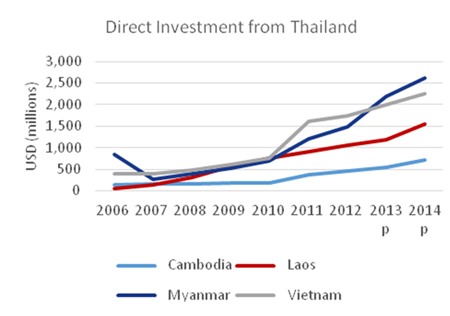

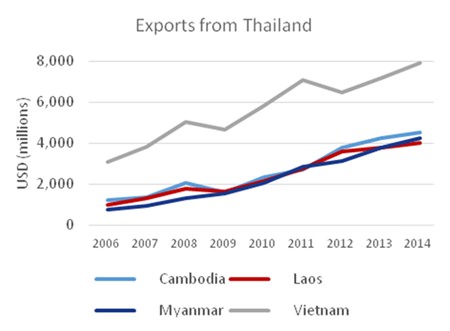

Thailand has a great geographical location: it is centrally located in the ASEAN region and benefits from being neighbour to the rapidly emerging economies of Laos, Vietnam, Myanmar and Cambodia (LVMC). It appears to be taking advantage of this: in 2014, 9.1% of its exports went to LVMC (the figure was just 5.3% in 2008) and direct investment to these countries has increased massively (see graphs 1 & 2).1

Graph 1 Source: Bank of Thailand

Graph 1 Source: Bank of Thailand

Graph 2 Source: Bank of Thailand

Graph 2 Source: Bank of Thailand

Infrastructure

To make full use of its geography, Thailand of course needs the infrastructure to go with it. In 2014, the Thai government approved an amended investment programme, at an overall cost of USD 75 billion. The main objective of this investment is to make Thailand-based business more competitive and less reliable on road freight by expanding and improving the railways.2

This project may reduce the heavy goods traffic on Thailand’s roads but one expert has found that a competitive minimum distance for rail freight is 1,000 km. Distribution centres in Thailand, however, tend to be only 300-400km from production centres.3

FDI Assistance

The Thai government’s Board of Investment offers four kinds of incentive for foreign businesses to come to Thailand: tax, non-tax; guarantees; and protection.4

Tax incentives include reduction in corporate tax and exemption or reduction on import duty; non-tax incentives centre on permits for employees, to own land and to transfer money abroad. In January of this year, the BoI implemented important changes to its acceptance criteria, with businesses no longer qualifying for incentives purely based on the sector in which they work. Companies operating in favoured sectors will receive lower basic tax rates; but those who also meet criteria in areas such as R&D, advanced technology, design and development of local suppliers, will enjoy additional incentives.5

Competitiveness

All of the above may attract potential foreign investors on paper; however, the country’s competitiveness is crucial. The latest WEF Global Competitiveness Report6 ranked Thailand 31st in the world overall. Regionally it lies behind Malaysia (20th) and Australia (22nd). Thailand was particularly strong is in inflation stability (joint 1st), strength of investor protection (12th) and macroeconomic environment (13th). These rankings are a direct result of the 1997 financial crisis, when Thailand (ironically, with the help of the IMF) was able to modernize the structure of its financial sector and regulate its inflation rate.

Nevertheless, it is unclear how the future will pan out. The aftermath of 1997 meant that Thailand recovered quicker than most from the global financial crisis; yet recent GDP performance has been below par.7 These figures may not have a direct effect on foreign investors; however, it is naturally more reassuring when a country’s economic performance is going steadily upwards.

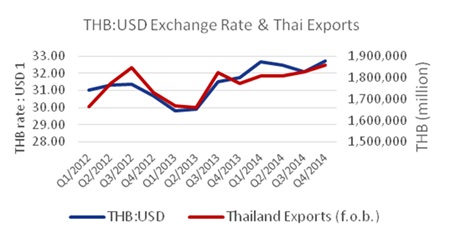

One element that will likely be of concern to potential foreign investors, particularly those in manufacturing, is the recent trend of a strong baht in relation to the US Dollar. Exports from Thailand are now more expensive to global markets than they were a couple of years back. The Bank of Thailand attempted to weaken its currency by lowering base interest rates from 2% to 1.75% in March of this year8 and again to 1.5% in late April9 which has had some effect so far.

However, historic evidence shows a significant positive correlation between baht strength and export performance (see graph 3). In other words, Thai exports are more reliant on the performance of the global economy than by foreign exchange rates; at least since the baht was floated in 1997.

Graph 3 Data: Bank of Thailand, Graph: author

Graph 3 Data: Bank of Thailand, Graph: author

AEC and all that

Like its ASEAN partners, Thailand will theoretically benefit from membership of the AEC, which opens its doors at the end of 2015. Some observers expect great changes,10 that the single market will allow easier movement of labour, goods and capital in the region. However, the absence of any combined legal structure to ensure such freedoms are granted in practice, means that these potential benefits are very much for the long term.

The verdict?

Whether Thailand is the best choice for an Asian hub depends on each business’s specific objectives and priorities. Whilst it will never be able to compete on tax with the likes of Singapore and Hong Kong, it does provide a stable economic environment with competitive skilled labour costs. However, for it to really stand out from the rest, promised improvements certainly need to come good in physical and digital infrastructure.

Footnotes:

1 Bank of Thailand figures

2 http://www.boi.go.th/tir/issue/201409_24_9/42.htm

3 http://www.nationmultimedia.com/business/Logistics-

cost-to-GDP-ratio-not-the-issue-expert-s-30206492.html

4 http://www.boi.go.th/index.php?page=incentive

5 idem

6 http://www.weforum.org/reports/global-

competitiveness-report-2014-2015

7 IMF World Economic Outlook, April 2015

8 https://www.bot.or.th/Thai/MonetaryPolicy/

Documents/MPC_22015.pdf

9 https://www.bot.or.th/Thai/MonetaryPolicy/

Documents/MPC_32015_n9621.pdf

10 http://www.nationmultimedia.com/business/Thailand-

set-to-boom-as-GMS-logistics-hub-under-AE-30225957.html

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook:/MBMGGroup |