Democracy is when the indigent, and not the men of property, are the rulers.

– Aristotle

Austerity is not the answer

Despite its co-operative rhetoric,1 the IMF and its Troika partners appear not to be giving ground and thus enforcing austerity measures in place since 2010.2 Five years on, it has long since been clear that these measures are, as the IDEA Economics article phrased it, “attempting to shrink your way to growth.”3 Even appointing a former vice-president of the ECB as Prime Minister4 under close watch of the French and German premiers5 did not work.

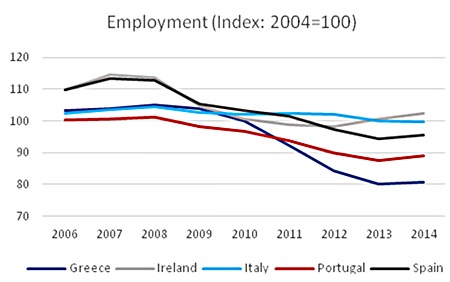

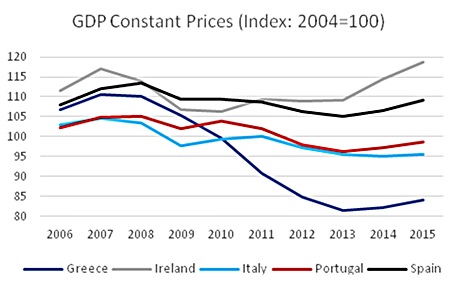

Even if 25 years of debt-deflation in Japan isn’t proof enough, evidence from Greece, Spain and Italy is clear that austerity is not the answer. During austerity, employment figures have become even worse and GDP has not improved in three of the five countries.6

Graph 1 – Source: IMF World Economic Outlook

Graph 1 – Source: IMF World Economic Outlook

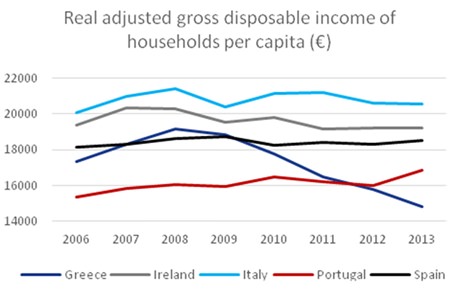

Not only that, austerity does nothing to improve people’s levels of disposable income. In most of the PIIGS countries there has been very little change.7

In Greece, the situation has become catastrophic; taxes have risen8, salaries have decreased – Greece is the only EU country where the minimum wage has actually gone down since 20089. With the number of people employed 20% lower than the 2006 mark (see charts), there is less income tax and fewer social contributions entering the government’s coffers as well.

All this leads me to pose two questions:

What exactly is the Troika trying to achieve?

The short answer to this is probably that the Troika wants its money back and doesn’t want to set a precedent. After all, if institutions like the IMF and the ECB give Greece a debt jubilee, I’d imagine the likes of Spain, Portugal and Italy would clamour for the same treatment.

Graph 2 – Source: IMF World Economic Outlook

Graph 2 – Source: IMF World Economic Outlook

Yet, with daily cash withdrawal limits of €60,10 it’s getting to the point now where there is a distinct possibility of cash shortages in Greece, making it difficult – almost impossible – for a cash economy to function. The reality is that if a population overall has a reduced income and is required to pay more in tax, it has little motivation to consume and thus get the economy flowing again.

This cannot be beneficial for the IMF or the ECB: the chances of receiving loan repayments would get even smaller and the institutions’ credibility would suffer a huge blow.

What should Greece do?

As we saw in Thailand after the 1997 financial crisis,11 the best policy is often to devalue the currency. This makes loan repayments cheaper, exports cheaper and even holidays in Greece cheaper. The latter is not to be ignored: the average number of visitors to Greece between 2009 and 2013 was around 16 million a year. At the last census in 2011, the country’s population was just under 11 million.12

Of course, the not insignificant obstacle to this is that Greece’s currency is the Euro. To achieve devaluation, it would have to pull out of the single European currency; a move that has not been legislated for in the Treaty on European Union.13

Graph 3 – Source: Eurostat

Graph 3 – Source: Eurostat

In January 2001, the Euro was officially fixed at 340.75 Greek Drachma.14 Logically, this would be the starting point at which a re-introduced drachma would enter the currency markets; allowing those markets to decide its true value. This move, combined with the ceasing of austerity measures, should give the Greek economy shoots of recovery and, most importantly, ease the squeeze on its people. Those factors, combined with a restructuring of the tax collection system,15 would put the government in a better position to pay its debts to the IMF.

If Greece were to pull out of the Euro, this would set a precedent for Spain, Portugal and Italy to follow. That may be disastrous for the ECB and the Eurozone, but it may be better for the European Union in the long run. After all, the Treaty on European Union states that the EU, “Shall work for the sustainable development of Europe based on balanced economic growth and price stability, a highly competitive social market economy, aiming at full employment and social progress.”16 Shouldn’t that be what Europe’s governments should be working towards, instead of making cheap headlines in their home countries?

If that were not enough, the German government should remember that it was able to become a competitive economy again after World War Two thanks to a debt cancellation granted by several countries including the US, UK, France, Spain and Greece.17

Footnotes:

1 http://www.imf.org/external/np/sec/pr/2015/pr15310.htm

2 http://blogs.wsj.com/brussels/2014/01/31/the-history-

of-the-imf-and-greeces-bailout/?mod=WSJBlog

3 http://www.ideaeconomics.org/blog/2015/

6/27/a-sad-day-for-europe

4 http://www.bloomberg.com/news/articles/2011-11-10/papademos-

who-took-greece-into-euro-must-now-save-country-s-membership

5 http://uk.reuters.com/article/2011/11/11/us-

greece-idUSTRE7AA2H720111111

6 IMF World Economic Outlook

7 Ibid

8 http://www.theguardian.com/business/live/2015/jun/23/greek-

crisis-athens-creditors-deal-imf-ecb-banks-live

9 http://www.ibtimes.co.uk/why-greece-only-eu-country-

where-minimum-wage-has-decreased-since-2008-1489676

10 http://www.reuters.com/article/2015/06/28/eurozone-

greece-limits-idUSA8N0Z302P20150628

11 http://www.mbmg-investment.com/in-the-media/inthemedia/46

12 World Bank data

13 Treaty on European Union, last revised 13 December 2007

(Consolidated version: http://eur-lex.europa.eu/legal-content/EN/TXT/

HTML/?uri=CELEX:12012M/TXT&from=EN)

14 Official Journal of the European Communities OJ C 177E, 27 June 2000

15 http://www.wsj.com/articles/greece-struggles-to-get-citizens-

to-pay-their-taxes-1424867495

16 Article 3, Treaty on European Union

17 http://jubileedebt.org.uk/reports-briefings/briefing/

europe-cancelled-germanys-debt-1953

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |