If you own a property in Australia but don’t live there all year round, it may be worth looking at changing your loan or even selling up. There are several reasons why.

Bubble trouble

It is almost six years since Prof. Steve Keen, my colleague at IDEA Economics, famously lost his wager about Australian house prices.

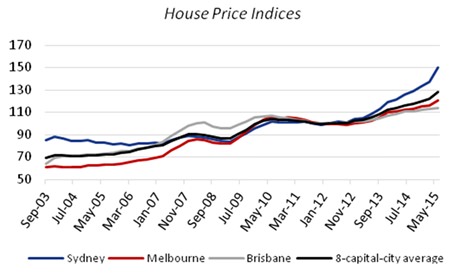

During a television interview, he told Macquarie’s interest rate strategist Rory Robertson1 that house prices in Australia would fall by about 40% over 10-15 years, as had happened in Japan. Robertson then reduced this ad absurdum by trying to pin down Professor Keen as to whether house prices by the end of 2009 would be the same or lower as in September 2008.2 Keen’s longer term outlook inclined him to answer that particular coin flip with “lower” and subsequently lost the bet. (See chart 1)

Chart 1 – Source: RBA.

Chart 1 – Source: RBA.

His forfeit was that he had to walk the 220 km from Canberra to Mt Kosciuszko, which he duly completed while turning it into a charity event for the homeless.

However, what fundamentally drew Steve into the bet – and what may eventually see him proven right is that a housing bubble clearly exists in Australia. As the index shows, prices continue to rise.

If you’re considering buying or selling in Australia, there are some fundamental questions to be addressed. If you’re buying, is it still possible to get on the crest of the wave, or is it worth waiting until prices go down? If you’re selling, are prices likely to continue to rise, or should you get out now?

Getting the timing right

Whilst, like Prof. Keen, I remain convinced that the bubble will burst, predicting the timing is close to impossible. That said, there are some indicators that can give us an educated guess as to whether now is the time to be in or out.

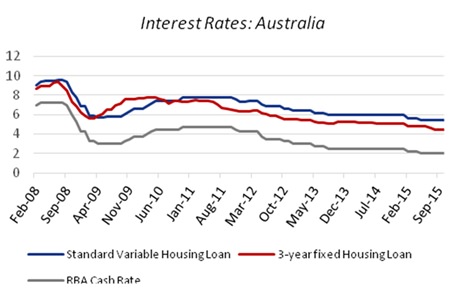

Like in many economies – the US, Eurozone and Britain included3 – interest rates on housing loans remain extremely low in comparison to the pre-GFC days (see chart 2).

Chart 2 – Source: RBA.

Chart 2 – Source: RBA.

The RBA’s benchmark Cash Rate is by far at its lowest point since official publication began in 1990.4 Like in many other developed economies, this is a deliberate policy to “support borrowing and spending;”5 although the central bank denies increased borrowing has further increased house prices (it’s all a supply issue, apparently).6 Sure enough, the banks have followed the RBA’s low-rate lead and the standard variable rate is currently at 5.45% – the lowest since July 1968 and more than 4% lower than in August 2008.

That 2008 figure was the highest point since 1996 and demonstrates how precarious variable rates can be: if borrowing costs go up but your income remains the same, you’re suddenly worse off. Rates may be low today but that won’t necessarily last forever. In early November, in anticipation that the RBA may keep its Cash Rate at 2%, or even lower it further, two banks decided to raise their rates to ease squeezed profit margins.7 The RBA did keep its base rate the same and with the US Federal Reserve hinting that it will increase its base rate in December8 – for the first time in seven years – the Australian central bank could well decide to follow the US trend in the near future.

Worth switching to a fixed-rate loan?

Thus, with either the central bank or the commercial banks themselves looking to increase lending rates, it could well mean that it’s worth switching to a fixed rate loan – particularly if you have another 10 years or more left on your loan. Fixed-rate home loans aren’t very popular in Australia, though. Apparently, in the last 22 years only 12% of Australian home loans taken out have been at a fixed rate.9 However, the overall fixed rate has been consistently lower than the variable rate since November 2010. Whilst the latter rate may yet go down, I can’t really see it happening in a significant way for a significant period, given the mood of commercial banks and over in the US.10

Is the timing right to sell?

That said, if you’re thinking of selling your Australian property, there are indications that now may be the time.

In Sydney, for example, the clearance rates of auctioned houses hit a three-year low in October, nosediving to 59.2% from 89.2% in May.11 It also seems that price gaps between the reserve price and the actual selling price at Sydney auctions have also diminished; it’s taking longer to sell; fewer buyers are doing so merely as an investment.12

Nationally, we can see that the unemployment rate is still rising: 6.06% in 2014 and expected to be 6.27% in 2015 (in 2008 the rate was 4.24%).13 That’s not a good sign, as a smaller percentage of people with jobs can mean a shrinking domestic housing market.

Added to that, there’s China. It’s not only the Australian export sector that is heavily reliant on the health of the Chinese economy (30% of Aussie goods and services exports are sold to China14); the property sector is too. In 2013-2014, China’s investment in Australia totalled AUD 27.7bn (USD 22.6 bn). Some AUD 12.4 bn (USD 9.9 bn) of that was in commercial and residential property – more than double that of second largest investor, the USA.15

However, the future doesn’t look good. The combination of a state-encouraged mounting private debt, a stock market crash and poor economic results16 has led to overseas transfers from China being restricted to a maximum of USD 50,000.17 Added to that, the Yuan was devalued in August, making overseas investment more expensive. Two Crédit Suisse analysts believe that Chinese demand for global property will fall by as much as 30%.18

Less tax

If you’re not a resident of Australia and considering selling your property there, it could well be worthwhile acting quickly for tax reasons. Prior to the changes to Australian capital gains tax (CGT), a non-resident tax payer was potentially entitled to a 50% concession when selling property.

The changes to the law abolished this concession on any CGT events (such as a property sale) after the cut-off date of 8th May 2012.

However, if you were a foreign or temporary resident and already held the property before the cut-off date, you could still qualify for the CGT discount on the capital gain accrued before that date. To do this, you’d need a market valuation as at 8th May 2012 from a licensed valuer.19 Thus the greater proportion of time you owned the property prior to the cut-off date, the greater part of the gain will be discounted.

So, whilst deciding whether to change loans or timing the sale of a property is dependent on various personal priorities and objectives, it could be better to do so sooner rather than later.

Footnotes:

1 http://www.debtdeflation.com/blogs/2010/05/12/a-monkey-off-my-back/

2 http://www.abc.net.au/news/2010-02-16/economist-keen-to-walk-canberra-kosciuszko/333138

3 Federal Reserve, ECB & Bank of England

4 http://www.rba.gov.au/statistics/cash-rate/cash-rate-1990-1996.html

5 http://www.rba.gov.au/media-releases/2015/mr-15-08.html

6 http://www.afr.com/real-estate/low-interest-rates-not-to-blame-for-property-bubble-rba-says-20150917-gjp6nx

7 http://www.smh.com.au/business/banking-and-finance/bendigo-first-to-lift-rates-after-rba-cash-rate-decision-20151103-gkpqdm.html

8 http://www.ft.com/intl/cms/s/0/9dbb18c8-86bc-11e5-90de-f44762bf9896.html#axzz3rGMQHc48

9 http://www.smh.com.au/business/banking-and-finance/australians-would-rather-float-than-fix-on-mortgages-despite-low-rates-20140724-zwj6t.html

10 http://www.smh.com.au/business/banking-and-finance/bendigo-first-to-lift-rates-after-rba-cash-rate-decision-20151103-gkpqdm.html

11 http://www.afr.com/real-estate/six-signs-show-sydneys-property-has-cooled-20151109-gku4ic

12 ibid

13 IMF World Economic Outlook, October 2015

14 Australian Department of Foreign Affairs and Trade

15 Australian Foreign Investment Review Board

16 http://www.mbmg-investment.com/in-the-media/inthemedia/59

17 http://www.lexisnexis.com/legalnewsroom/banking/b/banking-finance/

archive/2015/09/10/the-september-foreign-exchange-

notice-increases-difficulties-for-chinese-eb-5-investors.aspx

18 http://www.smh.com.au/business/the-economy/chinese-

demand-for-australian-property-wanes-20151103-gkq562.html

19 https://www.ato.gov.au/General/Capital-gains-tax/In-detail/

Calculating-a-capital-gain-or-loss/CGT-discount-for-foreign-resident-individuals/

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |