The only function of economic forecasting is to make astrology look respectable

– Ezra Solomon, 1984

If we’re to completely believe the media, every 31st December, as the bells chime 12 times, the sparkling wine flows and the Spanish try to gobble 12 grapes in as many seconds, a line is drawn under the old year and a blank page awaits in the new one, just one second later.

That blank page could pave the way for anything: a healthier lifestyle, a plan to save more and spend less or – as people in the finance world tend to do – make predictions for the New Year, indicating possession of some special insight as to how the economy and markets will behave.

It’s fair to say that, once you have a few years’ financial advisory under your belt, you can make an educated guess at what could happen in the coming year. Experience and analytical skills can give us a reasonable idea of the prevailing winds but it’s quite a leap to suggest a 12-month timeframe. That’s why I avoid stock-picking: so many factors and rumours can affect an individual share price that it’s impossible to predict its trajectory at a given time.

This year is different, however. Not only is it impossible to predict the exact timing of events, as I wrote recently,1 I don’t even think it’s possible to forecast what those events are.

So, rather than wildly predict the next 12 months, I’ve decided to note down what I would like to see happen. I doubt some of my suggestions will take place by the time the bells welcome in 2017 but, if we’re to avoid an economic crisis which could make 2008 look like a mere tremor, the quicker they become reality, the better.

Fed rates

First on my list is for the US Federal Reserve to stop its failed attempts to try to create economic growth via the financial repression of Zero Interest Rate Policy. “Didn’t they already do that in December?” you might ask. Well sort of – but not really. The Fed Monetary Committee’s decision to increase the rate which banks generally use as a benchmark for their own lending rates, was the first in eight years. Yet, amidst all the speeches, commentary and other brouhaha, the new rate is just 0.5%. To put that into perspective, the average pre-crisis rate between January 2006 and January 2008 was 4.58%.

According to the US Federal Reserve, the aim of this policy is to stimulate the economy by improving banks’ balance sheets and therefore their capacity to lend. Consequently, so the theory goes:

The Fed can help spur business spending on capital goods – which also helps the economy’s long-term performance – and can help spur household expenditures on homes or consumer durables like automobiles. For example, home sales are generally higher when mortgage rates are 5 percent than when they are 10 percent.2

In other words, if a central bank encourages commercial banks to reduce lending rates, companies and individuals will borrow more money and spend it. That will increase consumption, allowing the economy to function ‘normally’ again.

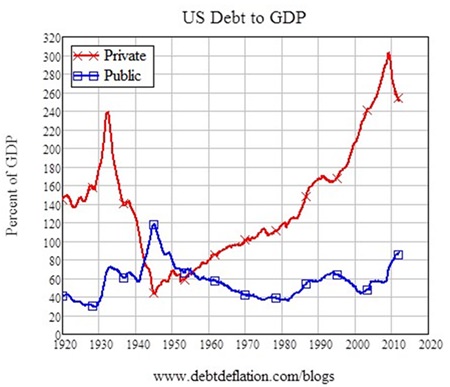

That sounds reasonable – until you factor in the reason that the 2008 crisis happened in the first place is that private debt in the US was through the roof (see chart).

All this makes the Fed’s policy sound like that forlorn hope of gambling addicts that one final bet will clear all of their debts.

On announcing the raise, Fed chair Janet Yellen said that the move “[…] recognises the considerable progress that has been made toward restoring jobs, raising incomes and easing the economic hardship of millions of Americans.”3

The figures used to justify this manipulation are hardly jaw-dropping: quarter-on-quarter consumption growth has averaged just 0.5% since interest rates were set to minimum in December 2008; unemployment has fallen to 5%, which is still slightly above the Q1 2007 (i.e. pre-crisis pre-emergency-interest-rate) figure of 4.5% and only 0.3% lower than when the Fed last kick-started an interest-rate-raising cycle in 2004; and inflation remains below the Fed’s target of 2%.

It seems to me that the Fed made its move because it was feeling the heat after hinting for almost a year that it would raise the base rate. The quarter-percent increase appears to be a half measure to appease the masses – more or less paying lip-service to outsiders – buying it time to see what effect the raise will have on the economy.

What it should really do is focus on eradicating the private debt burden that, even at zero interest rates, creates an inordinate drag on consumption.

Otherwise, a large part of corporate and household incomes are destined to be directed towards servicing debt payment over buying goods and services. This leads to a reduction in business volumes, putting downward pressure on hiring and salaries, sparking a vicious deflationary spiral of still lower business revenues and further downward pressure on hiring and salaries ad nauseam.4

Footnotes:

1 http://www.mbmg-investment.com/in-the-media/inthemedia/75

2 https://www.stlouisfed.org/publications/inside-the-vault/spring-

2011/low-interest-rates-have-benefits-and-costs

3 http://www.ft.com/intl/cms/s/0/46a9001a-a424-11e5-

8218-6b8ff73aae15.html#axzz3x0GN1DFs

4 http://www.ideaeconomics.org/basics/

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |