Es mantequilla! (It’s butter)

– Panamanian expression meaning something is irrelevant.

In the current charged environment there seems to be a great deal of (perhaps deliberately provoked) confusion about degrees of wrong. The UK Prime Minister seems to have been fully aware of what appears to be fraudulent and criminal tax evasion from which he directly and indirectly benefitted.1 However, the technicalities of that seeming criminality are quite complex. The same applies to his own alleged capital gains avoidance or evasion.2 These are extremely serious matters; but the UK media seem more interested in the existence of the relationship with Mossack Fonseca; the fact that Cameron’s wife, Samantha, works for a company which appears to have used aggressive, although not necessarily improper offshore tax mitigation;3 that Gideon Osborne’s family business has, seemingly not paid any tax during Osborne’s Chancellorship;4 or, to show that this isn’t just a single party issue, the claims that Cameron’s predecessor Tony Blair faces questions over the non-disclosure of assets held within a (apparently legitimate) tax planning trust.5

The press seems to have been side-tracked by the fascinating question of whether it is actually ‘wrong’ or even ‘immoral’ to hold money in another country, where tax rates are lower. On the face of it, it seems reasonable to argue that doing so deprives a government of tax money, with which it could provide better services to its citizens. But then isn’t some of this money is used to drop bombs on citizens of other countries? And why does one government deserve to receive that tax money over another government?

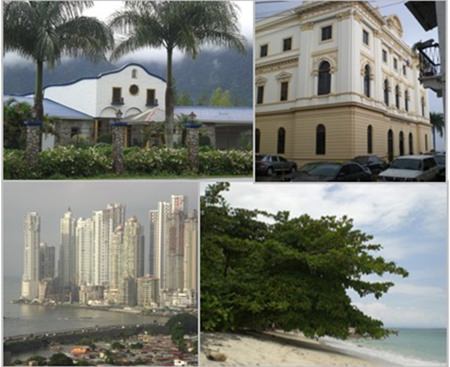

Clockwise: El Valle de Antón, Panama City Old Quarter, Panama City Av. Balboa, Bocas del Toro. Photos: Simon Harrow

Clockwise: El Valle de Antón, Panama City Old Quarter, Panama City Av. Balboa, Bocas del Toro. Photos: Simon Harrow

Politicians tend to apply the limits of their own remits to other people’s lives. They seem to think that because someone has a passport from a certain country, they live there, receive income there, owe tax there and thus holding money somewhere else must be secretive and immoral. For those of us who live in a different country to the one in which we were born, however, circumstances are different. Where should we be taxed? Who should determine this?

How governments receive tax money and how they should spend it is a fascinating debate. But it shouldn’t be confused with morality. As American judge Justice Learned Hand put it in 1947:

Over and over again courts have said that there is nothing sinister in so arranging one’s affairs as to keep taxes as low as possible. Everybody does so, rich or poor; and all do right, for nobody owes any public duty to pay more than the law demands: taxes are enforced exactions, not voluntary contributions. To demand more in the name of morals is mere cant.6

Back in the UK, opposition leader Jeremy Corbyn has even called for London to take direct control of British overseas territories which have lower tax rates.7 He probably made this soundbite because half of the companies mentioned in the Panama Papers are incorporated in the British Virgin Islands. However, this idea ignores the fact that the BVI is a legitimate, regulated financial centre, which adheres to OECD initiatives, as well as the Financial Action Task Force (FATF), an inter-governmental body, set up to combat money laundering, terrorist financing and “other related threats to the integrity of the international financial system”.8 The same can be said of other low-tax countries and territories, such as the Cayman Islands, Gibraltar, Guernsey, Isle of Man, Jersey, Malta, Mauritius, Monaco, etc. All of these jurisdictions are among the 133 countries and territories which are members of the OECD’s Global Forum on Transparency and Exchange of Information for Tax Purposes; as well as the FATF, with which just Iran, Myanmar and North Korea have been listed as not cooperating sufficiently.

So if these territories cooperate internationally over possible criminal activity and tax transparency; and have regulated banks, offering legitimate accounts; why have so many politicians felt the heat on revelations that they have benefited from such accounts?

To date there have been no legal charges, or even concrete accusations of illegal activity, made against the British and Icelandic Prime Ministers for whatever reasons, or the Spanish minister. In fact the main reason why Mr Cameron is under pressure is the double standard of previous statements, whilst benefitting from his father’s offshore trust rather than the apparent criminality.9 Messrs. Gunnlaugsson and Soria both resigned because it was revealed they had failed to disclose their offshore interests when taking on their roles.10

What is really happening is that politicians – even those who have offshore interests – are using offshore finance as a scapegoat, in order to at least be seen to be hounding ‘immoral’ tax avoiders. As is often the case in politics, there’s a huge dollop of butter.

Footnotes:

1 http://www.theguardian.com/news/2016/apr/07/david-cameron-admits-he-profited-fathers-offshore-fund-panama-papers

2 https://panamapapers.icij.org/20160403-panama-papers-global-overview.html

3 http://www.independent.co.uk/news/business/news/smythson-leather-goods-and-luxury-stationery-company-that-employs-samantha-cameron-is-based-in-a-tax-10017572.html

4 Gideon Osborne’s family business has, seemingly not paid any tax during Osborne’s Chancellorship

5 http://www.telegraph.co.uk/news/2016/04/15/tony-blair-used-secret-fund-to-manage-multi-million-pound-fortun/

6 Commissioner v. Newman, 159 F2d 848 (1947)

7 http://www.politico.eu/article/uk-tax-havens-should-face-direct-rule-says-labour-leader/

8 http://www.fatf-gafi.org/about/

9 http://www.independent.co.uk/news/uk/politics/david-cameron-panama-papers-tax-avoidance-father-offshore-investment-fund-ian-cameron-blairmore-a6974546.html

10 https://panamapapers.icij.org/20160405-iceland-pm-resignation.html & https://panamapapers.icij.org/20160415-pakistan-pressure-spain-resignation.html

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |