Recently there have been reports that China will cut back in Rare Earth exports. As China has 97% of the world’s supply of rare earth minerals, is this something we should be worried about?

Many manufacturers all over the world are extremely reliant of China for the supply of these minerals as they are a vital component in the manufacture of many electrical goods such as computer screens and televisions. They are also used in the production of hybrid cars and wind turbines as well as fibre optics and batteries. As stated above, China has all but three percent of the world’s supply and so can ride roughshod if it wants to. It has been a topic of much debate in the past when it has come to trade negotiations with many different countries.

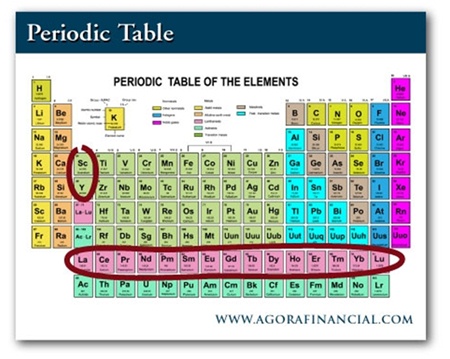

Before we progress any further, what are these Rare Earths? They are seventeen different chemical elements in the Periodic Table and consist of Scandium, Yttrium and fifteen Lanthanides. The most important thing to remember about these Rare Earths is that they are not particularly rare. As stated in a report on the BBC, “Some are as common as copper or zinc, while even the rarest occur in greater quantities than gold or platinum.”

America has said it is “very concerned about China’s export restraints on Rare Earth materials” and it may take its complaint to the World Trade Organization. However, one thing to consider here is that the Chinese are not being xenophobic but have cut back to cope with what is going on at home. Nonetheless, if the Chinese do reduce on exports to any significant degree then it could become a real problem for global business which may then result in higher process for many consumer goods.

The reason for this is that mining and processing of these Rare Earths is both difficult and expensive as it needs a lot of energy. On top of this an unfortunate by-product is toxic emissions and residues – some of which are radioactive. Naturally, these need to be disposed of and this is not a cheap process either.

It is not just the economic side of things that are causing a problem. Some analysts fear the Chinese could use Rare Earths as a bargaining chip in disputes with other countries. This can be seen by the alleged blocking of Rare Earths to Japan from China by the latter’s government during a recent dispute. It does not take Einstein to work out how seriously this would damage the automotive and electronic manufacturers. Therefore, it should not come as a surprise to find that Toyota and Sony, to name but a couple, have recently decided to find alternative sources of what it needs and so reduce their reliance on Chinese Rare earth elements. They are presently looking at Australia and Vietnam as potential suppliers to complement China. Other companies are exploring possibilities in India, Canada and Brazil.

America is also looking at re-opening the mines it closed when the Chinese were producing these elements for a much cheaper cost. However, opening up mines is expensive. The re-opening of Mountain Pass in California will be around USD500 billion as it will have to comply with Health & Safety issues. If national governments do not help and the Chinese take advantage of the slow set up time which could, potentially, damage the countries that rely on Rare Earths so much then the present supply will get even less and the price of manufactured goods will get even more.

Despite this the alternatives to China are still worth looking at as it is predicted that world demand could be up from the present amount of 125,000 tonnes to 200,000 by 2014. This is why the Chinese are also trying to buy Rare Earth mines around the globe. Not only to compete with international production but also to safeguard its own supplies.

Also, “As energy prices become more expensive, a lot more is going to be invested in developing rare earth mines,” says Richard Lockwood, manager of the City Natural Resources High Yield Trust. “It is difficult to imagine any new technologies that will not rely on rare earth down the line and the US government is offering huge amounts to companies that can discover new sources.”

Another reason the west is getting concerned is, as Byron King states, “Basically, rare earths are exotic elements that are critical to the future of high tech, clean energy, Big Science and – oh by the way – national defense.” For a country that spends so much on its defence, the latter is a real problem as every single missile in American has some quantity of Rare Earth in it somewhere.

What does all of this mean for the potential investor? Junji Nomura, Head of Research and Development at Panasonic believes, “Rare earths will be a big problem for two-three years, but in four-five years, the problem will be gone.” This indicates he is confident that alternative supplies of Rare Earths will become available by 2015, thus avoiding any long term economic damage to any country.

However, caveat emptor. Rare Earths should not be more than two to three percent of your portfolio and that is for the adventurous amongst you. If an alternative to Rare Earths appears then the stocks and funds which concentrate in this market will do badly. However, if there is no alternative the fact is this particular asset will fare very well indeed. For example, the shares in two Australian mining companies which hope to take advantage of what has happened in China have gone up dramatically over the last few days (Lynas = 10.8% and Arafura = 11%).

So, is this something we should be worrying about? Potentially it is, but I am also told that in Chinese the same word for ‘crisis’ is that of ‘opportunity’…

The above data and research was compiled from sources believed to be reliable. However, neither MBMG International Ltd nor its officers can accept any liability for any errors or omissions in the above article nor bear any responsibility for any losses achieved as a result of any actions taken or not taken as a consequence of reading the above article. For more information please contact Graham Macdonald on [email protected]