BANGKOK– To ease the impact of the coronavirus disease 2019 (COVID-19) on the business sector in Thailand, the Revenue Department has extended personal income tax filing to August 31, 2020, while the Office of the Insurance Commission has resolved to postpone payment of car insurance premiums for six months. As for entrepreneurs, particularly small and medium-sized enterprise (SME) operators, they are allowed to suspend loan payments for up to 12 months.

Debt-ridden SME operators, who have not been prosecuted by financial institutions before February 29, can register to receive assistance at any branch of the SME Development Bank from April 10 to June 30. Interested entrepreneurs are required to provide a statement on their intention to have their loan payments suspended and explain how the current situation is affecting their businesses. They can also request additional assistance, in marketing, finance and manufacturing.

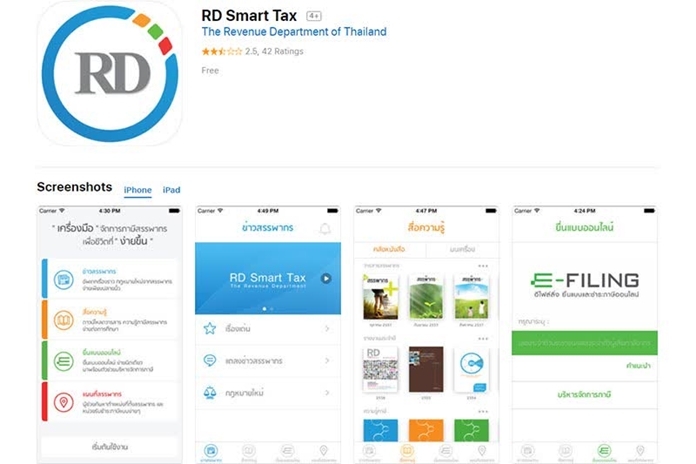

The Revenue Department has extended personal income tax filing (Por NgorDor 90 and 91 forms) to August 31 this year, from the previous deadline of March 31. The department has invited taxpayers to file their personal income taxes via its e-Filing system or the RD Smart Tax mobile application, so they don’t have to submit their documents at its offices. For more information, please contact the Revenue Department’s call center at 1161, or visit any of the department’s offices nationwide.

The Office of the Insurance Commission has resolved to postpone car insurance payments for six months. The measure applies to vehicles from the third to fifth groups with vehicle insurance policies. The deadline for contributions to life and non-life insurance companies has been extended from April 30 in the first quarter to June 30, from July 30 in the second quarter to September 30 and from October 30 in the third quarter to December 30, in an effort to ease the impact of COVID-19.(NNT)

|

|

|