On this bright and peaceful morning, I sat on my balcony with a hot cup of coffee, reflecting on the upcoming start of the new tax year. With the 2024 tax year coming to a close in just a few days, many people are preparing for their personal income tax filings. For expats in Thailand, this process can seem complex, so I’d like to explain it in simple terms, particularly concerning pensions.

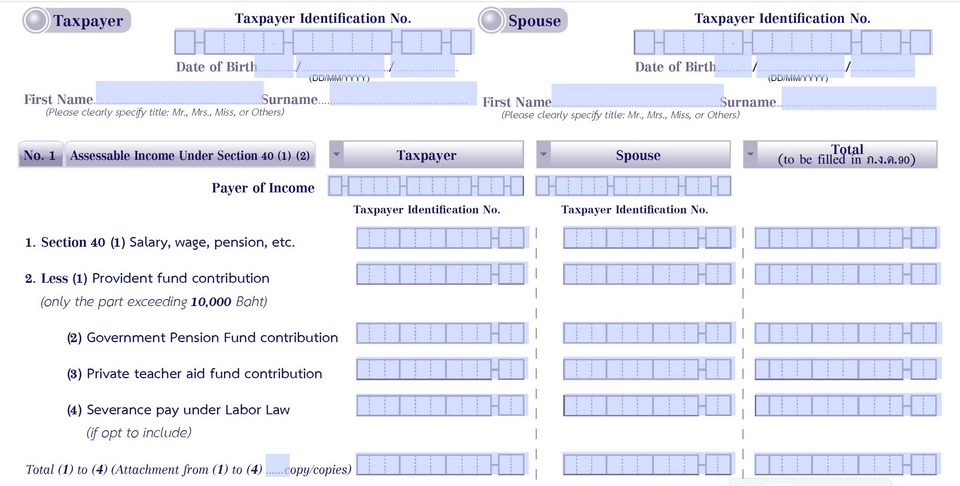

When it’s time to file taxes, many people wonder about the difference between P.N.D. 90 and P.N.D. 91. Here’s a quick breakdown:

֍ P.N.D. 90: This form is for individuals with multiple types of income, such as business income, dividends, rental income, or pensions.

֍ P.N.D. 91: This form is for individuals with only one source of income, such as a salary or wages from regular employment.

The choice of form depends on the type of income you earn, which is categorized under Section 40 of the Revenue Code.

Where Do Pensions Fit?

According to the Revenue Code, pensions fall under Section 40(1), which includes income derived from employment, such as salaries, wages, bonuses, gratuities, and pensions. Whether received domestically or from abroad, pensions are considered income resulting from past employment and are therefore classified as assessable income under Type 1.

For expats receiving pensions from abroad and bringing them into Thailand, two key factors must be considered:

- If the pension is earned and brought into Thailand in the same tax year

֍ It is considered income for that tax year and may be subject to taxation in Thailand.

- If the pension was earned in a previous tax year

֍ It can be brought into Thailand without being taxed, provided there is clear documentation to verify it was earned before January 1 of the current tax year.

Example Scenario

Suppose you received a pension from abroad in 2023 and transferred the money into Thailand in 2024:

֍ Without proper documentation confirming it as 2023 income, the Revenue Department may classify it as 2024 income, making it taxable.

֍ With valid proof, the pension would be exempt from taxation in Thailand.

For expats, pensions should be declared using P.N.D. 90 since they are not directly earned from employment in Thailand but still fall under Type 1 income as per the Revenue Code.

Understanding income types and relevant tax regulations can greatly simplify the process and increase confidence in managing your taxes. If you find tax filing overwhelming, my team and I are here to provide guidance.

I hope this morning’s discussion helps clarify things and that you’re well-prepared for the upcoming tax season. Wishing you all a productive and stress-free start to the year ahead!

Victor Wong (Peerasan Wongsri)

Victor Law Pattaya/Tax expert

Email: <victorlawpattaya@gmail.com> Tel. 062-8795414