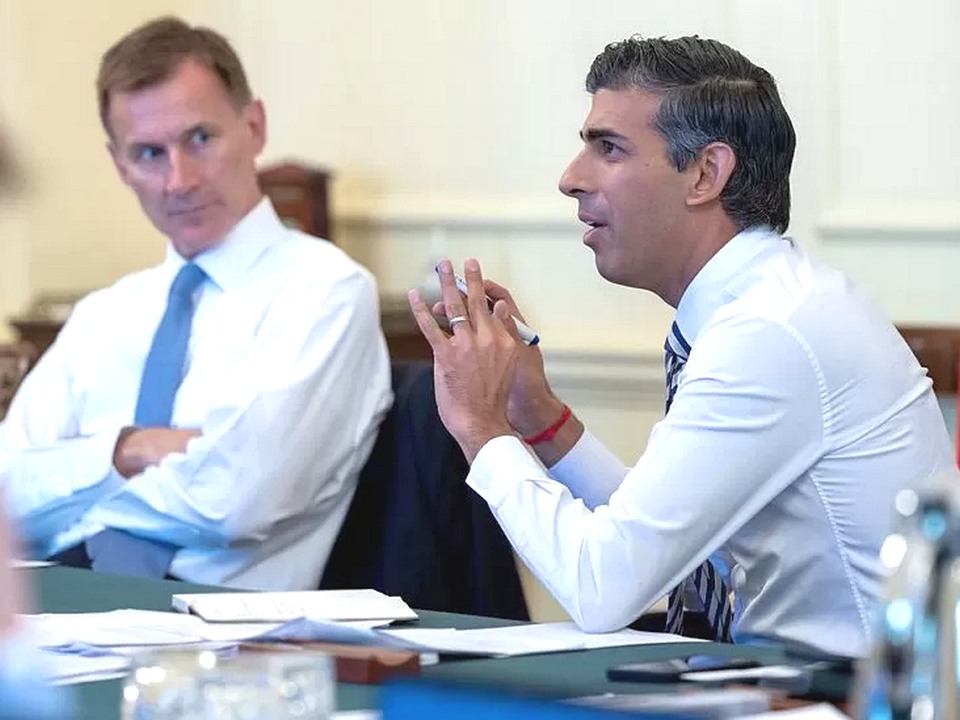

With the British Treasury looking to fill a financial black hole of up to 50 billion pounds, the UK general public has been warned to expect tax increases as part of an unwelcome pack of measures to be announced on November 17. But premier Rishi Sunak and chancellor Jeremy Hunt have not exempted expats from a bitter pill to swallow, whilst the Treasury has emphasized that absolutely everyone rich and poor will be expected to chip in.

Brits with a status of “non-ordinarily resident” already are penalized because in most countries of residence, including Thailand, their so-called old age state pensions are frozen unless they go back to the UK for several months to unfreeze them. Campaigns over the years to abolish the cash discrimination have got nowhere with officials usually hinting that restitution would cost the British tax payer around 2 billion pounds annually to an unpopular group: those who choose sunshine over patriotism.

In 2014 the then chancellor George Osborne set up a review further to penalize expats by abolishing their right to a tax-free personal allowance which is now 12,570 pounds a year (2021-22 Inland Revenue figures) per individual. Osborne at the time said, “The personal tax allowance is essentially for people living in the UK using British public services and not to subsidize living abroad.” His policy was aborted when the government collapsed following the 2016 European Union referendum fiasco. If the tax allowance is now removed, each UK expat who fills in an annual tax return will be around 2,500 pounds a year actually worse off, assuming the basic rate of tax remains at 20 percent.

In practice, they might well be additionally worse off as the abolition of the personal allowance would lower the threshold for them paying the higher rate of tax at 40 percent. Not to mention the whole issue of expats owning property in UK and renting it out to improve their overseas income. Forth Capital, a Scots-based finance house, has already predicted a move along these lines and suggested that some expats may have to return to UK and live in their property to safeguard their standard of living. Otherwise, their loss of annual income could reach 5,500 pounds. Other financial planners have made similar predictions if the worst comes to the worst.

Of course, the argument to the contrary is that expats in most countries have already been penalized by the frozen state pension and the insistence of many UK banks that expats must close their mainland accounts and re-apply in the Isle of Man or the Channel Isles, crown dependencies which are not part of UK and where monthly bank charges are higher. There is also the point that ageing expats living abroad are not a drain on scarce national health resources at home and should be rewarded rather than punished. But whether Messrs Sunak and Hunt will be impressed by such special pleading is another matter altogether.

|

|

|