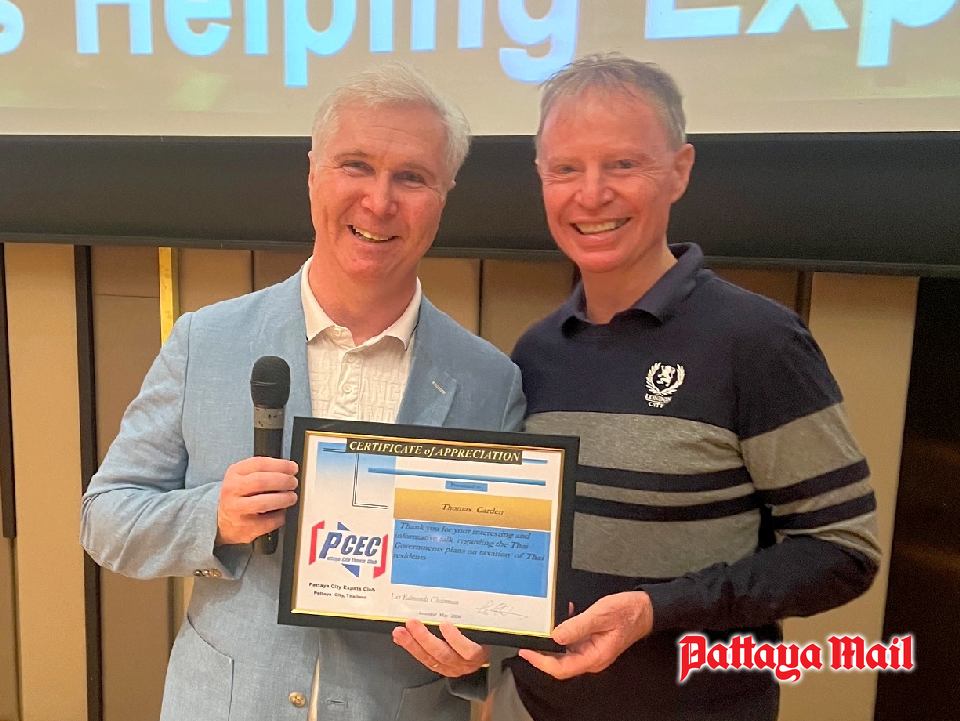

PATTAYA, Thailand – About 100 members of the Pattaya City Expat Club turned up to hear Thomas Carden on the complex changes to income tax rules recently announced by the Thai Revenue (TR) authorities. Mr Carden, who conducts business in Thailand as American International Tax Advisors, emphasized that the Thai government’s principal aim was to start taxing very rich individuals, mostly Thais, who had enjoyed virtual tax-free status in the past from their huge cash assets held abroad.

He began by explaining what has already been agreed and what has not. Tax residents – Thais and foreigners spending at least 183 days in the country in 2024 – are expected to fill in tax forms not later than the end of March 2025 to cover “assessable” income transmitted to Thailand in the current calendar year. He said that TR did not require further authorization from the government and accepted there were many ambiguities as regards the position of retirees living on already taxed income.

Mr Carden pointed out that detailed advice from TR had been very thin on the ground. It was always open for TR to backtrack, for example by exempting those foreigners on one year visa extensions such as retirement or marriage: there is a woefully insufficient number of tax officers at TR to process the forms of 200,000-plus foreign tax residents. An audience member pointed out that the long-threatened tourist entry tax had suddenly and unexpectedly been withdrawn by the prime minister. However, there was absolutely no guarantee he would do likewise on remitted income from overseas in 2024.

The guest speaker then moved on to the Revenue’s suggestion that, from January 2025, tax residents’ worldwide income, whether remitted to Thailand or not, would be taxable. However, this plan needed the approval of Thailand’s parliament which had not yet even begun to consider the notion. Answering a series of member’s questions Mr Carden said 61 double-taxation treaties would be important in the hypothetical scenario – although the detail varied one agreement from another. Many issues would need to be addressed, for example whether income deemed to be tax-free in the home country would be considered tax-free here. The example given was UK premium bonds whose winnings are specifically exempt from taxation under UK law.

Mr Carden said that, even if world-wide income was included in a future Thai tax reform, there remained many tax-efficient escape routes. One was to invest funds in a range of international retirement plans which are extremely tax friendly for people wanting to send cash to Thailand. However, the transfer of assets to Hong Kong would need to be done before any relevant Thai law was formally passed to get the full tax advantages. Representatives of Business Class Asia, contact for the Hong Kong retirement plan, were present at the meeting. Mr Carden’s basic message in his address was to keep calm in an admittedly volatile situation. “Talk of fleeing the country is certainly premature,” he concluded.