PATTAYA, Thailand – It was an interesting morning at the Pattaya City Expats Club meeting on Wednesday, June 12. The scheduled speaker, Mike Maran, provided insights into how he as a forensic handwriting expert goes about his analysis. He was followed by Thomas Carden from American International Tax Advisers commenting on the recent announcement that Thailand is considering imposing an income tax based on global earnings.

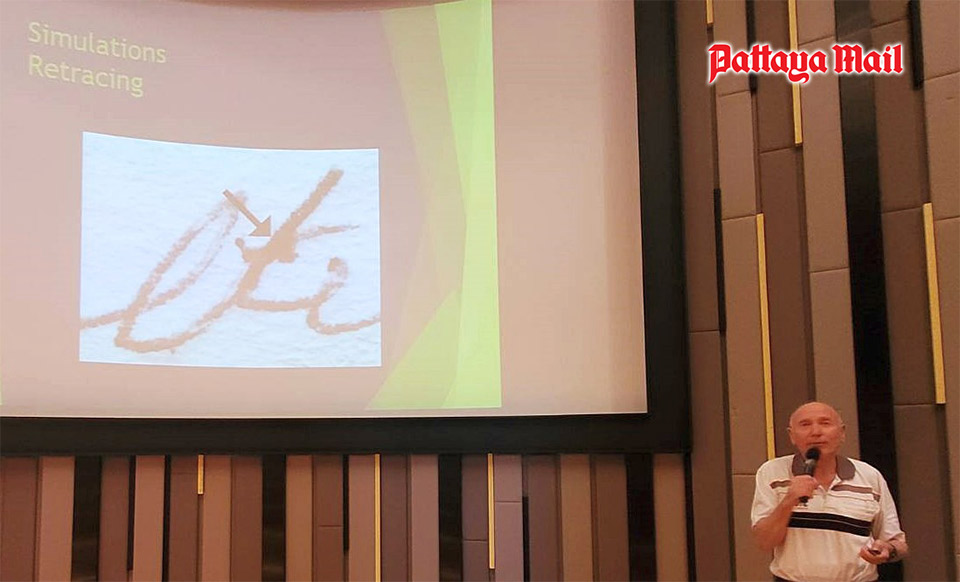

Mike, a seasoned forensic handwriting and document examiner, captivated the audience with an in-depth look into the meticulous world of handwriting analysis. Distinguishing his field from graphology, Mike delved into the complexities of signature verification and the detection of fraudulent writing.

He also touched on graphology, offering insights into personality traits inferred from handwriting. Attendees were treated to a hands-on experience, preparing writing samples. Mike then asked them to look at their sample as he described what it revealed about their personality traits.

With a keen eye for detail, Mike outlined the critical factors in examining questioned documents, such as line quality and pen pressure. He demonstrated the subtle differences between genuine, disguised, and simulated writing, providing examples that showcased his expertise.

Mike’s presentation concluded with an engaging Q&A session, where Mike addressed the audience’s curiosities about the impact of technology on his field and the intricacies of presenting evidence in court. To view a video of Mike’s talk on the PCEC’s YouTube channel, visit: https://www.youtube.com/watch?v=XSzoVHrsIbc.

Following Mike’s talk, Tom Carden addressed a topic much on the mind of Expats residing in Thailand due to the very recent announcement about how the Thai Revenue Department plans to amend the law and move to worldwide taxation, which means that Thai tax residents will have to report and pay tax on their income from any source, regardless of whether they remit it to Thailand or not.

Thomas conducts business in Bangkok as American International Tax Advisers. He is enrolled to practice before the US Internal Revenue Service. He has over 17 years of Tax and Financial Industry experience.

Expats who are considered tax residents in Thailand will most likely have to file a tax return reporting their worldwide income and show the taxes paid in other countries that have tax treaties with Thailand. They may be able to claim a tax credit or exemption for some types of income, but they will also face a complex tax situation and a potential tax liability in Thailand.

Pattaya Mail’s Barry Kenyon was present at the meeting. To read his article about the meeting, visit: https://www.pattayamail.com/latestnews/news/dont-panic-experienced-tax-adviser-tells-expat-club-in-pattaya-4630180. To view a video of Tom’s presentation, visit the PCEC’s YouTube Channel at: https://www.youtube.com/watch?v=fUNqat6b5ew.

After the presentations, MC Ren Lexander brought everyone up to date on upcoming events. This was followed by the Open Forum portion of the meeting where the audience can ask questions or make comments about Expat living in Thailand, especially Pattaya. To learn more about the PCEC, visit their website at https:/pcec.club.