PATTAYA, Thailand – On Wednesday, 5 March 2025, the Pattaya City Expats Club (PCEC) hosted two insightful presentations for Expats in Thailand. The first presentation was by Thomas Carden and Patcha (Cha Cha) Ingkudanonda from American International Tax Advisers Co. The second was by Ken Brown and Lee Stevens from Business Class Asia.

Thomas and Cha Cha provided valuable information on various tax-related topics, including pensions, social security, and remittance regulations. Cha Cha, a Thai tax attorney with extensive credentials, and Thomas, a knowledgeable expert in international tax law, shared their expertise with the attendees.

The presentation highlighted that most Dual Tax Agreements provide that pensions for government are taxable only in the country of origin and not in Thailand if the recipient is not a Thai national. However, for private pensions, the rules differ. Private pensions are taxable in Thailand if the recipient is a Thai tax resident, regardless of the country of origin, unless specifically made exempt by virtue of a Dual Tax Agreement between Thailand and the country of origin.

They explained that under their respective Dual Tax Agreements, social security benefits from countries like the USA are taxable only in the country of origin, while Australian social security is taxable only in Thailand. The non-discrimination clause in these tax Agreements was discussed, emphasizing that foreign social security should be treated the same as Thai social security, which is tax-exempt in Thailand. Although this clause should ensure fair treatment for expats receiving social security benefits, the Thailand Revenue Department has not yet taken a stance on this issue.

The presentation also covered remittance regulations for Thai banks, noting that money remitted into Thailand is subject to being reported to the Thai Revenue Department if it exceeds certain thresholds, such as 2 million Thai Baht or more than 400 transactions in a year. Expats were advised to be mindful of these thresholds to avoid unexpected tax liabilities.

They recommended filing a tax return in Thailand for transparency and to confirm tax status, even if the income is tax-exempt under double tax agreements. Their view is that this practice demonstrates compliance with Thai tax laws, thus avoiding future complications.

An interesting strategy discussed was gifting money to a Thai spouse to avoid taxes on remittances. However, it was emphasized that this must be done directly from an overseas account to the spouse’s Thai account. Further, that the Expat remitting the funds cannot benefit from this “gift”.

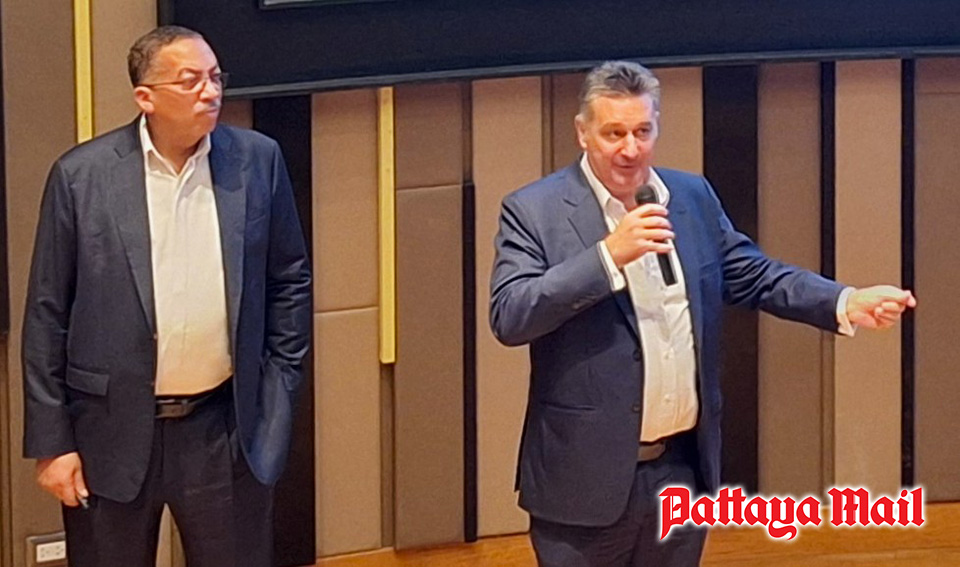

Ken Brown and Lee Stevens in the second presentation discussed Estate Planning and Tax Issues that Expats living in Thailand need know and understand. Ken and Lee, both seasoned experts in tax and financial planning for expatriates, began by emphasizing the importance of having a valid will.

They explained that a will ensures one’s assets are distributed according to their wishes and helps avoid complications with local laws. They also highlighted the Thai intestacy rules, noting that without a will, the distribution of assets may not align with the deceased’s intentions, particularly regarding the spouse’s inheritance.

The speakers advised appointing a trusted person as the executor of the will, rather than a lawyer, to ensure proper management and flexibility in handling the estate. They also discussed off shore trusts as an alternative to wills for managing and distributing assets efficiently, especially for those with significant wealth or specific distribution wishes.

Recent changes in Thai law regarding property leases were another key topic. Ken and Lee pointed out that clauses for automatic renewals are no longer valid and cannot be enforced. Thus removing a common practice in such long-term property arrangements. They also stressed the importance of understanding tax obligations, including potential issues with remittance-based taxation and the need for proper tax planning.

Health insurance was another critical area covered in the presentation. Ken and Lee recommended obtaining comprehensive health insurance, especially for expatriates planning to stay in Thailand long-term, as it can provide peace of mind and financial security. They also mentioned the difficulties expatriates face in opening and maintaining bank accounts in Thailand due to stringent regulations and reporting requirements.

In their final advice, Ken and Lee encouraged expatriates to seek professional advice for estate planning and tax matters to avoid potential legal and financial problems that they may otherwise encounter.

After the presentations, MC Ren Lexander brought everyone up to date on upcoming events. To learn more about the PCEC, visit their website at https:/pcec.club. To view a video of Thomas and Cha Cha’s presentation, visit the PCEC’s YouTube Channel at https://www.youtube.com/watch?v=RUEY-IwCO-E and for Ken and Lee’s presentation, visit https://www.youtube.com/watch?v=l7omDXiOLw8.