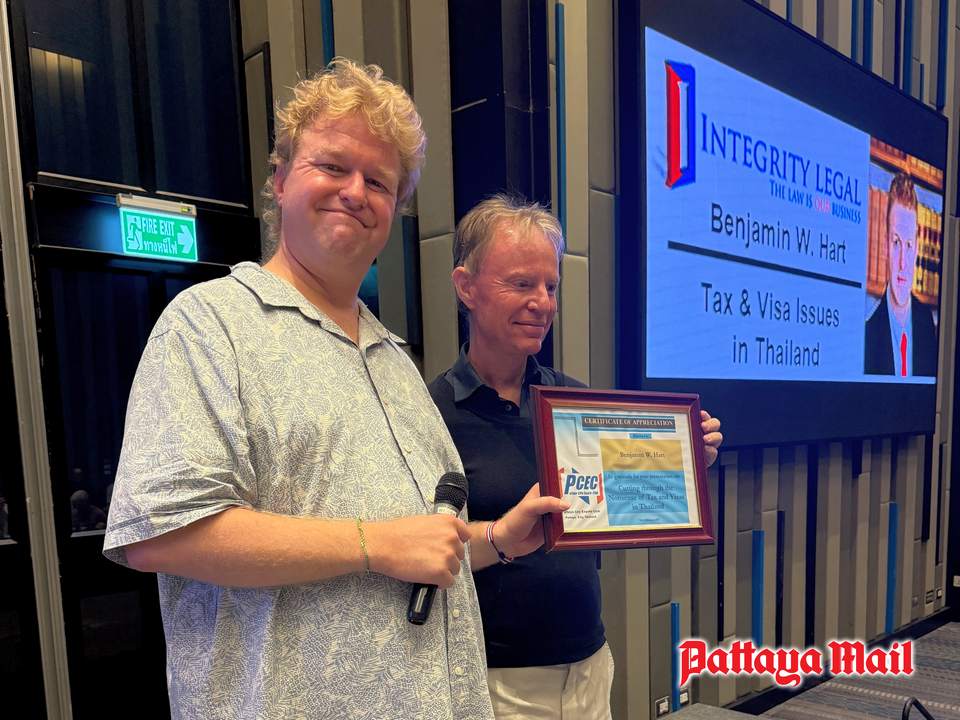

PATTAYA, Thailand – A packed audience of the Pattaya City Expat Club, mostly retirees, heard that far and away the best visa for most of them was the “O” retirement category and annual extension of stay. Benjamin Hart, managing director of Integrity Legal in Bangkok and a naturalized Thai citizen, argued in a breezy and combative speech that the permit had several decades of success, was cost-effective and did not currently require medical insurance. Typical holders, said the speaker, had nothing at the present time to fear from the Thai tax authorities.

He criticized alternatives such as the 10-year Long Term Residence Visa, with its compulsory audit after five years, which could well produce unpleasant surprises about Thai taxation exemptions and promotions. He was also suspicious of the 5-years Destination Thailand Visa, noting that its digital application procedure could, in later years, become a protocol to widen Thailand’s personal income tax net for “residents” (staying at least 180 days in a calendar year). Most DTV holders, especially digital nomads, are much younger and richer than run-of-the-mill retirees.

Mr Hart followed up a familiar theme in his widely-watched internet videos by doubting that most retirees should register with the Thai Revenue Department (TRD), especially if they were living on previously taxed income or savings from their first country. He said that there had not been a change in the law about remitted income to Thailand, but merely a reinterpretation by TRD. Mr Hart claimed that the target groups were corporations exploiting loopholes by bringing in huge sums of untaxed income from offshore banks.

But the founder of Integrity Legal also emphasized that TRD was not in the business of refusing offers to redress its revenue shortfall. Tax officers were, at the government’s behest, looking for extra cash and would not turn away any Thai or foreigner wishing to make a contribution. He criticized foreign accountants and lawyers – who were not qualified under alien labour laws to advise on Thai legal matters anyway – for scaring people into the tax office. He returned several times to his main theme: TRD in its cost benefit analysis wants mega cash and not pennies.

Turning to the relationship between retiree-orientated visas and personal income tax, Mr Hart doubted that immigration officers currently wanted to get involved in adjudicating permit applications. However, this could not be ruled out for the future. He speculated that 2025 might be a transitional year, but advised members to keep cool for now whilst doubting that Thailand would actually join the international Organization for Economic Cooperation and Development or inflict taxation on worldwide income. Separately, he highlighted that double taxation treaties were extraordinarily complex documents which were incompatible with generalizations.

Answering questions, Mr Hart dealt mainly with general tax issues for American expats and (wisely) refused to be drawn on the tax problems of individual members of the audience. He concluded by hoping that he had calmed the nerves of typical retirees and had dissuaded a stampede to the local TRD offices – at any rate for now. He was followed by guest speaker Thomas Householder, from Mitchells Artisan Chocolates, who described the history of Valentine’s Day through chocolate candies which date back to the 1840s. The first heart-shaped box of chocolates went on sale in 1861. However, he warned that candy prices were currently bound to rise as the wholesale cost of cocoa had doubled in recent months. Back to harsh reality indeed.