From August 11, the maximum deposit protection in individual Thai bank accounts is reduced from 5 million to one million baht, or about 22,000 British pounds. Inevitably, this has set off a wave of social media frenzy with foreign retirees and others alarmed that their cash deposits might disappear overnight or even that the whole of the Thai banking system is in danger of disintegration. Best to calm down.

The Deposit Protection Act of 2008 was introduced in the wake of the world financial crisis of that era. The amounts protected have been regularly reduced over the years until they reached five million baht. Then, in April 2020, the Thai Cabinet announced the one million limit would come into force in August 2021. But this still covers 98.03 percent of total depositors investing in 35 financial institutions, according to Kasikorn Research Center.

Comparisons have to be made with other countries. There is no common pattern. Cambodia has no regulatory deposit protection yet in force, whereas the Philippines guarantees most accounts for 500,000 peso or about 7,000 pounds. The UK mainland has an upper limit of 85,000 pounds, which falls to 50,000 pounds in the Isle of Man and the Channel Isles where most British expats have been forced in recent years to lodge their accounts. The EU protection limit is 100,000 euros.

As usual, the devil is in the detail. Refunds are not automatic in every case. As the online Moneyfacts reports, the Halifax and the Bank of Scotland in UK are under the same banking licence, so investors’ protection is limited to one account and not two. In Thailand, foreign currency accounts are not covered. In almost all countries, temporary surges in funds (such as receiving an inheritance or a bonus) will not count in the deposit protection scheme.

Bloomberg, the international business and media company, says that the economic ramifications of Covid are far from clear. But its list of most likely banking failures internationally doesn’t even mention Thailand – but does list the USA! Kasikorn Research Center reports that the main intention of the forthcoming depositor reduction in Thailand is to encourage fiscal responsibility in businesses and consumers alike. Even so, there is no denying that Thai banks are overly dependent on unpaid loans and repossessed properties whose notional value may be much higher than reality. Money and risk can never be separated.

According to the Economic Intelligence Center, linked to Siam Commercial Bank, banks registered with the Bank of Thailand have a liquidity coverage ratio of 195.14 percent, greater than the BOT’s requirement of 100 percent. It should be added that most very rich people in Thailand have most of their money in stocks, bonds and other types of investment. The returns are usually so much better.

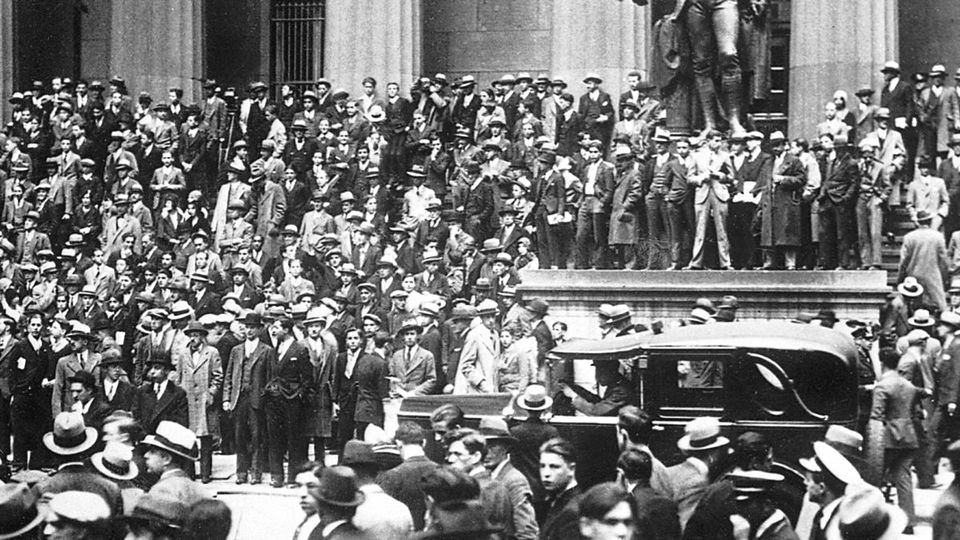

The best advice for foreigners in Thailand who maintain millions of baht in Thai banks, a very small number of expats, is to spread their cash around more than one financial institution or even to make use of banks in other Asean countries. In reality, in any country, the government is the security for investors. If one bank goes bust, the central authority can bail it out as the UK did in the case of Northern Rock in 2008 which was saved by nationalization. If all banks go bust, your currency will be worthless in any case. Hello the Weimar Republic.

Some people in times of insecurity turn to gold. But the precious metal is notoriously volatile in price, is hard to move around and has untraceable origins and destinations. The brave might want to consider cryptocurrencies which, according to some gurus, will replace financial institutions sooner than you think. So if you are clear about blockchains, decentralization, digital deposits and software wallets give them a whirl. But don’t expect Thai immigration to accept bitcoins any time soon.

|

|

|