Housing and Mortgages

The US housing market, the place where the realities of the 2008 crisis first became apparent, is back on the up. Official US government statistics showed September 2013 to have the sharpest monthly rise in house sales since 1980.1 Closer examination reveals the fact that 60% of new buyers of ‘single family homes’ are paying with cash. How can they afford to do that in such stringent times? It’s simple: the buyers are large banks, private equity firms and hedge funds investing their expanding money supply to buy houses. Where has this money come from? Quantitative Easing. As Collum rightly points out,2 the trillion-dollar-a-year money printing project undertaken by the Federal Reserve is being used to assist financial institutions, which are securitising the houses to sell rent-backed bonds and real estate investment trusts.

GRAPH 1

Chart 1 Source: dshort.com

Chart 1 Source: dshort.com

However, single family home rentals have a reputation for losing money, despite making good money on IPOs. Two such companies were what some Goldman Sachs traders infamously lined up to sell to clients they called “muppets”.3 These companies may not be worth much soon after they go public but their visible failure distorts the market, tending to fuel a short-lived recovery, otherwise known as a ‘dead cat bounce’.

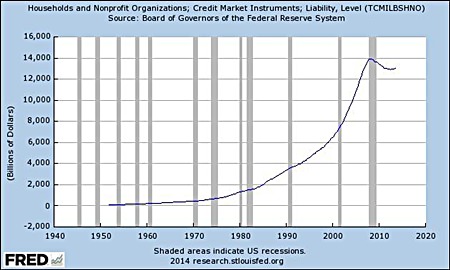

Personal Debt

It is true to say that many of the examples used here are from the US – its influence on the global economy, as shown in 2008, provides a useful yardstick. Some six years on, debt in the US remains a major issue: interest rate comparison website Bankrate.com surveyed Americans in 2012 and found that 46% of them have more debt than savings and 1 in 4 US citizens is in net debt.4

GRAPH 2 : US 10-Year Treasury Bond Interest Rates 1975-2014

Source: Yahoo! Finance

Source: Yahoo! Finance

Added to that, pensions are in such a state that the average taxpayer is having to pay USD30,000 to top off US municipal pensions and each taxpayer’s share of total unfunded liabilities is USD 2 million. As Simon Black, who writes the Sovereign Man blog, puts it, “America’s debt challenge is not a political problem. It’s an arithmetic problem.”5

Debt is not exclusive to governments or people with below average salaries who go on exotic holidays. A typical person in employment and nearing retirement has less than two years’ income put aside, with median estimates of USD70,000 retirement savings for 55-year-olds. If we say the interest rate is 4%, then that salary gives USD2,800 a year.6 A Wells Fargo survey of 2,000 middle income Americans, aged 20-60, revealed that the average American in their fifties will have USD190 a month to live on during retirement.7

GRAPH 3

Source: Bloomberg.com

Source: Bloomberg.com

Wages as a percentage of US GDP have declined to 54% from 59% in the past 10 years8 and a fifth of those who have a defined-contribution pension plan (401K) have taken out a loan against it.9

In his Review of 2013, David Collum gives three important pieces of advice to young people: “Save more and spend less; stop buying cigarettes and lotto tickets; and read Millionaire Next Door in your early twenties.”10

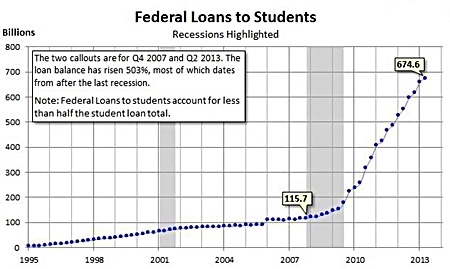

Student Debt

Of all the debt around in the world, it may be easy to overlook the students. However, it is reaching alarming levels: in the US it rose to USD 1 trillion in 2013, with government-financed loans at USD 674.6 bn. At the beginning of the global financial crisis in late 2008, this last figure was at a mere USD 115.7 bn.

GRAPH 4

Figures: Bank of England, Chart compiled by author

Figures: Bank of England, Chart compiled by author

In spite of student loans having a tradition of being highly protected, the reality is that 7 million US student loans are in default11, 50% of them in deferment or under forbearance agreements12 and USD 146 billion of the outstanding debt was only from students who began courses in 2010. These debts are now entering the subprime category and defaulting.13 Sally Mae has been forced to cancel debt offerings14 and Stafford loans interest rates are on the verge of doubling (from 3.4% to 6.8%).15 Meanwhile, tuition fees reflect the damaged economy: they behave more like an asset in a crescendo towards a bubble, while people borrow more and more to pay them – it looks like 2008 all over again.

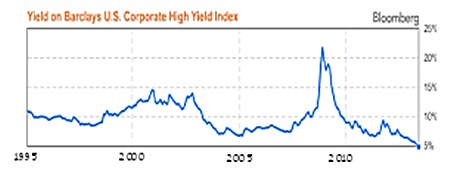

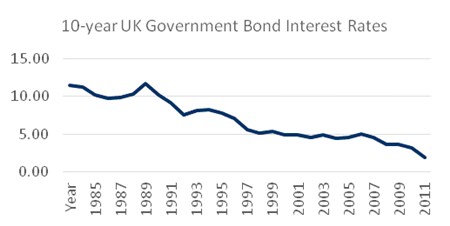

Bonds & Sovereign Debt

The bond markets are also showing signs of bubbles: US Treasury rates may be at a thirty-year low, in the region of only 3%, but a crisis would send them drop even lower – UK government bonds show a similar trend since the mid-1980s. If junk bonds go below 5% they generally blow out. Government bonds are different, however; they’re not in a good place for the long term but technically they do have some short-term value. The junk bond market, in contrast, looks like it’s in a horrible bubble.

GRAPH 5

Source: Federal Reserve Bank of St. Louis economic Research

Source: Federal Reserve Bank of St. Louis economic Research

Whether the Fed tapers again and other central banks follow, there is still so much debt that bond markets are at great risk of a burst. Investor Jim Rogers, who is convinced the bonds bull market is a bubble, has stated that a 1% rise on a 10-year bond shaves 9% off the principal. That may be true but any event, even a reduction in government yields could also halve junk bond prices.

Is this bubble suddenly going to burst? Not necessarily. Although there are attempts to reduce debt levels throughout the world (see the chart representing US debt normalised to GDP, for example), we must remember that a lot of it comprises defaults on mortgages and thus the real deleveraging of the global economy hasn’t even begun yet.

Consequently, the implication is that there could be a 30-40 year continuation of the ‘new normal’; in other words a slow-motion bubble burst that will eventually bring us back to the ‘old normal’. This is the glide path that Japan has been trying to follow since 1989 and if we look at Japan’s adoption of Banzai stimulus, a.k.a. Abenomics, it’s questionable if they’ve addressed their structural issues or are simply prescribing the same old medicine but in ever-increasing doses.

Next week: Part 5 – Markets & European Union

Footnotes:

1 Jann Swanson, Biggest Monthly Advance for New Home Sales since 1980, Mortgage News Daily, 4th December 2013 http://www.mortgagenewsdaily.com/12042013_new_home_sales.asp

2 2013 Year in Review, David Collum

3 http://www.zerohedge.com/news/2013-08-01/scramble-exit-housing-market-peaks-american-homes-4-rent-ipo-pricing-44-discount

4 http://www.bankrate.com/finance/consumer-index/survey-shows-savings-triumphs-debt.aspx

5 http://www.sovereignman.com/finance/when-countries-go-broke-12850/

6 2013 Year in Review, David Collum

7 http://www.aaboomers.com/home/transitions/410-average-boomer-will-only-have-190-per-month-in-retirement

8 http://www.businessinsider.com/bill-gross-abby-cohen-barrons-roundtable-2013-1#ixzz2IQZXiPf2

9 http://www.zerohedge.com/news/2013-04-12/usage-401ks-atm-soars-28-q4

10 2013 Year in Review, David Collum

11 http://www.americanbanker.com/issues/178_150/more-than-7-million-student-borrowers-in-default-cfpb-1061118-1.html

12 http://www.marketwatch.com/story/more-students-delay-repaying-loans-2013-01-30?mod=wsj_share_tweet

13 http://www.zerohedge.com/news/2013-10-01/next-subprime-crisis-expands-student-loan-defaults-hit-146-billion-highest-default-r

14 http://cfa-cfa.blogspot.com/2013/04/sallie-mae_29.html

15 http://mobile.bloomberg.com/news/2013-06-27/student-loan-rates-set-to-double-unless-congress-acts.html

| MBMG Group Investment Advisory is a Thai SEC regulated investment advisory firm in Thailand that provides sound and impartial advice to assist private, corporate and institutional clients in all aspects of their financial life. For more information, please contact us at [email protected] or call 02 665 2534-9. Please Note: 1.While every effort has been made to ensure that the information contained herein is correct, MBMG Investment Advisory cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Investment Advisory. Views and opinions expressed herein may change with market conditions and should not be used in isolation. 2. With investment comes risks. Please study all relevant information carefully before making any investment decision. 3. An investment is not a deposit, it carries investment risk. Investors are encouraged to make an investment only when investing in such an asset corresponds with their own objectives and only after they have acknowledged all risks and have been informed that the return may be more or less than the initial sum. |