Markets

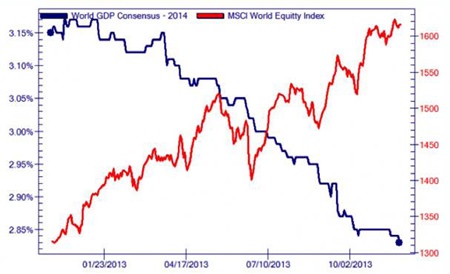

Developed equity markets tended to rise significantly in value in 2013, as the MSCI Equity Index shows (see chart 1). However, whether this is a sign of QE policies kick-starting the global economy, or just a temporary over-valuation of shares, is a matter of debate.

Economist David Zervos is convinced that signs of growth are there. He says he feels sorry for bears as they are living in the dark ages of monetary policy theory. “They are stuck thinking like witch doctors rather than modern doctors,” he believes.

Chart 1, Sources: Bloomberg & Peak Prosperity

Chart 1, Sources: Bloomberg & Peak Prosperity

Casting doubt over this assertion though is the observation made by Forbes that “More than 100% of equity gains since January 2009 have taken place during the weeks the Fed purchased Treasury bonds and mortgages.”

Added to that, the S&P 500 price/revenue ratio finished 2013 at 1.6, which is twice as expensive as the pre-bubble historical norm. To put that into context, the ratio at the S&P 500’s peak in 1987 was at below 1.0. Another indicator, the Russell 2000 price/earnings ratio, is estimated to be at 40 when counting 2014 earnings, yet at 60 when previous earnings are taken into account instead.

Those with large amounts of money at stake tend to agree with the over-valuation conclusion: Jeremy Grantham reckons the S&P 500 is around 75% over-valued1 and Cliff Asness, looking at a 60% stocks 40% bonds portfolio, believes that prices have been cheaper than they are now 98% of the time. David Einhorn claims that the S&P 500 expanded so much in 2013 because of multiple expansion – “The index is no longer cheap, particularly considering that we are now almost half a decade into an economic expansion and earnings growth is unexciting.”2

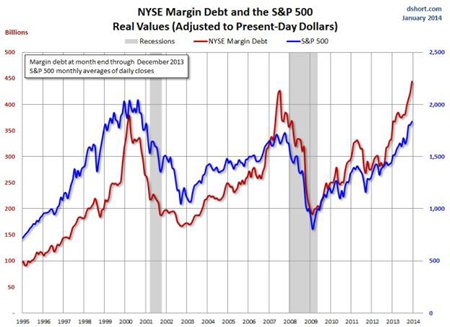

Chart 2

Chart 2

This is not just the case for the US – developed market stock prices look overpriced on a global-level too. Whilst the aforementioned chart shows prices rising last year, world GDP is still on the way down. Some individual stocks are showing symptoms of a bubble: Tesla’s market capitalisation is USD 20 billion but its sales at just 35,000 p.a., meaning its market cap per car is over USD 500,0003. Amazon.com’s share prices finished 2013 at 60% higher than in 2011 but their revenues have fallen by 50%. Another indicator is that margin debt is rising rapidly – so traders are purchasing equities greatly on margin. Chart 2 shows just how margin is estimated against the real value of the securities.

If all that isn’t enough of a warning, the example of online currency Bitcoin really opens the eyes. It began 2013 with an exchange rate of 1 Bitcoin to USD 1, shot up 100% in its first 15 minutes on the market and then increased 100 times over the following ten months. Another indicator is that margin debt is rising rapidly – so traders are purchasing equities greatly on margin. The fact that Bitcoin is a virtual currency brings back unpleasant memories of the Dotcom bubble or maybe its South Sea or tulip predecessors.

European Union

On the face of it the economy in the European Union is improving: unemployment is down and government debt as a proportion of GDP is down. Does this make for a rosier 2014? Not necessarily.

Chart 3 – Source: XE.com

Chart 3 – Source: XE.com

The stark reality of the numbers shows that any recovery is barely significant. Unemployment figures in December 2013 were only 0.2% lower than in January 2013.4 Spain, the member state with the highest level of unemployment, improved by a mere 0.7% to 25.8% by the end of the year. The proportion of government debt to GDP was also down in Q3 of 2013; however, this was the first drop since Q4 of 2007 and the figures are still alarming: 92.7% for the Eurozone and 86.8% across all 28 member states.5

Greece

The local joke that Greece is a poor country with rich people needs some modification: it is now a very poor country with a few very rich people. The unemployment rate was at 27.6% in Q4 of last year; 58% of those under 25 looking for work did not have a job.

Several big players on the Greek banking scene have collapsed, 2-3 branches are closing each day and the four main banks that remain collectively expect to reduce the number of branches by 1,000 between the end of 2013 and 2017.6

Many blame the IMF for its austerity measures and it has frequently become the target of protestors on the streets of Athens. However, this is to ignore the reasons why austerity was required in the first place. One crucial factor is public sector debt: Greek government debt measured nearly 172% of GDP in Q3 of 2013, that figure was 20% up on 2012 Q3.

Some commentators have taken to making cracks about the wisdom of the ancients and mythology but, frankly, it’s not funny anymore.

Next week: Spain, France, Germany & Cyprus…

Footnotes:

1 http://www.zerohedge.com/news/2013-11-18/jeremy-granthams-gmo-sp-approximately-75-overvalued-its-fair-value-1100

2 http://www.zerohedge.com/news/2013-10-31/david-einhorns-advice-how-trade-equity-bubble-spoiler-alert-dont

3 2013 Year in Review, David Collum

4 Eurostat: http://epp.eurostat.ec.europa.eu/tgm/table. do?tab=table&language=en&pcode=teilm020&table Selection=1&plugin=1

5 Eurostat: http://epp.eurostat.ec.europa.eu/cache/ITY_PUBLIC/2-22012014-AP/EN/2-22012014-AP-EN.PDF

6 Ekathimerini.com: http://www.ekathimerini.com/4dcgi/_w_articles_wsite2_1_03/11/2013_526081

| MBMG Group Investment Advisory is a Thai SEC regulated investment advisory firm in Thailand that provides sound and impartial advice to assist private, corporate and institutional clients in all aspects of their financial life. For more information, please contact us at [email protected] or call 02 665 2534-9. Please Note: 1.While every effort has been made to ensure that the information contained herein is correct, MBMG Investment Advisory cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Investment Advisory. Views and opinions expressed herein may change with market conditions and should not be used in isolation. 2. With investment comes risks. Please study all relevant information carefully before making any investment decision. 3. An investment is not a deposit, it carries investment risk. Investors are encouraged to make an investment only when investing in such an asset corresponds with their own objectives and only after they have acknowledged all risks and have been informed that the return may be more or less than the initial sum. |