If you’re earning a Thai Baht salary, Retirement Mutual Funds (RMFs) and Long-Term Equity Funds (LTFs) can represent an opportunity for sizeable tax savings – but you may have to act quickly.

What are they?

The idea behind a mutual fund is that numerous people contributing to the pot is that it is a lot easier to invest than buying and selling individual stocks and bonds on your own.

A retirement mutual fund (RMF) is a pool of money put together by several investors with the idea of providing a long-term savings plan for when they retire. Investors are obliged to stay in the fund until they are 55 years old, as they are designed to be a retirement planning instrument.

Long-term equity funds (LTFs) are similar. The difference is that they offer more flexibility, as they have no age restriction. That said, they do have a holding period of five calendar years before any redemption can be made. The calendar part is crucial. It means you can actually be in the fund for as little as 3 years and 2 days, as the duration must occupy five different consecutive calendar years. However, this will change: as of 1st January 2016 the minimum holding period before redemption will become seven calendar years1 – thus a minimum of five years and 2 days.

To encourage investment into Thai markets, the Thai government sought to offer tax incentives to invest into Retirement Mutual Funds and Long-Term Equity Funds. In a nutshell, the amount that you invest in RMFs and LTFs can be deducted from your annual taxable income, reducing your income tax.

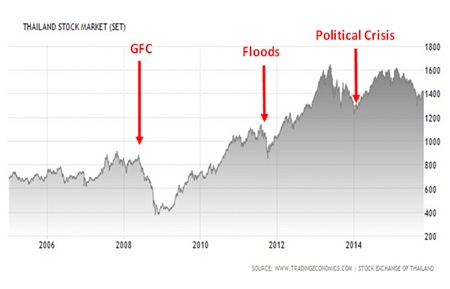

LTFs and RMFs invest into Thai equities markets, which have performed equally as well as the world’s major stock markets in recent times (see charts 2 & 3). The main stock market, the SET, has consistently been a reliable performer. It rebounded strongly from the impact of the Global Financial Crisis, the terrible flooding in 2011 and the political crisis in late 2013 and early 2014 (see chart 1).

Chart 1

Chart 1

Tax benefits

However, the return on investment is not only the performance of the investment itself but also on the tax savings for which the fund qualifies.

To qualify for tax benefits through and RMF, a minimum yearly investment is required of 3% of your annual income or THB 5,000 (whichever is higher).

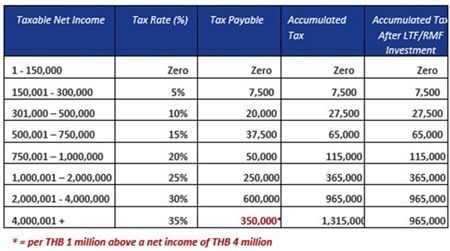

LTFs have a maximum yearly investment ceiling of 15% of your annual income, not exceeding THB 500,000. The same limits apply for an RMF, provident fund and state pension collectively. The example in chart 4 is illustrated on an annual net income of THB 5 million per annum. If, from that income, THB 1 million per annum is invested in an LTF and RMF, the tax saving of THB 350,000.

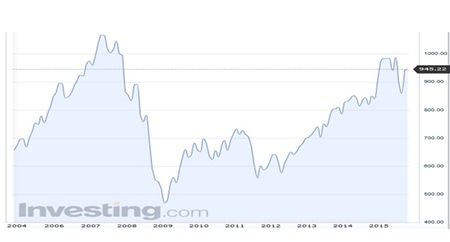

Euronext last 10 years

Chart 2 – Sources: Investing.com & Euronext

Chart 2 – Sources: Investing.com & Euronext

Thus, by investing THB 1 million split between an LTF and an RMF, you can reduce your assessable income from THB 5m to THB 4m. This is a saving of 35% on the THB 1 million of income at the top of the tax spectrum. Furthermore, any gains that the LTF/RMF make are not subject to Capital Gains Tax as long as no terms and or conditions are broken.

Time running out

Whilst these instruments could be an interesting opportunity to both invest in your future and receive tax benefits, their future is in the balance.

Although tax-reform plans (announced in mid-2014 and due to be implemented in 2016) initially looked like putting an end to tax breaks for LTFs,2 the Ministry of Finance has just announced a three-year extension to the scheme. A government official stated that the Ministry “acknowledged the severely negative effect on the stock market that might occur if it let the privileges expire in 2016, as a huge portion of investors are invested in LTFs to tap tax benefits.”3

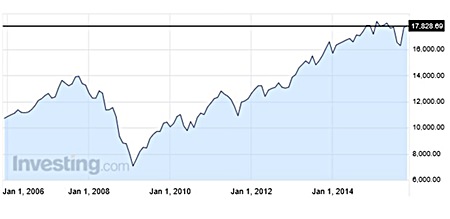

Dow Jones Industrial Average index last 10 years

Chart 3 – Sources: Investing.com

Chart 3 – Sources: Investing.com

So if you want to invest an LTF with a shorter lock-in period, you’ll have to invest before the current system expires at the end of the year.

It’s important to note that, like all other investment products, RMFs and LTFs do not suit everyone. After all, when we invest we all have different objectives, priorities and levels of risk we’re prepared to take. There are many deductible allowances in addition to RMFs and LTFs, so it’s worth exploring the possibilities. That’s why it’s important to ask an independent regulated advisor before making a decision.

Chart 4 – Source: MBMG Group

Chart 4 – Source: MBMG Group

Footnotes:

1 http://www.reuters.com/article/2015/11/03/thailandequity-funds-tax-extension-idUSL3N12Y2F620151103

2 http://www.bangkokpost.com/archive/ltf-rmf-allowances-to-go/416051

3 http://www.bangkokpost.com/business/finance/752276/ltf-privileges-get-3-year-extension

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |