Is the Australian property market truly resistant to a bubble burst, or is it just a disaster that’s taken a while, but is now ready to happen?

Between 2011 and the end of 2014, bond prices were also on the up; although since then government bond prices in general have tailed off.

In addition to QE, several central banks have embarked on zero-interest-rate, or even negative-interest-rate, policies in a forlorn attempt to promote consumption, through cheap borrowing. The problem with this policy is that it was private debt which was a major contributor to the global financial crisis in the first place. In fact, whilst public debt levels seem to gain governments’ concentration, they are dwarfed by private debt.

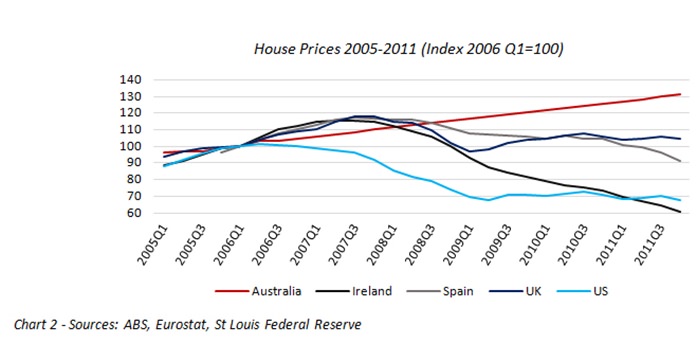

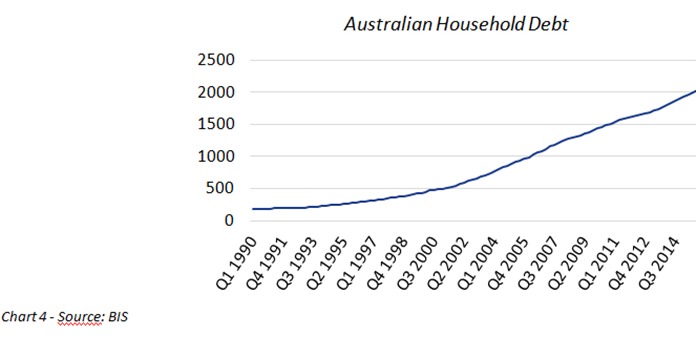

As Steve Keen recently pointed out, a large part of the growth that Australia has enjoyed since the GFC, while many other countries plunged into recession, has been fuelled by a 60% rise in household debt, encouraged by the RBA. He explains that Ireland did the same thing when they called themselves the Celtic Tiger, “and they don’t call themselves that anymore,” he added. “Spain was doing the same thing during its housing bubble and [Australia has] replicated the same mistakes.”1

In the context of global economic performance – certainly in the form of stagnant GDP amongst the G7 countries, as well as Australia – all this means that assets are hugely overpriced and there is still a mass of household debt.

What these economic conditions mean in terms of Australian property prices is that there prevails a global context of overvalued assets and piles of debt. Consequently, attempts to deflate the bubble gently will likely face a pushback.

In the years after the GFC, many countries have seen some deleveraging of that debt and this has, in some cases, been apparent in a drop in house prices. But Australia hasn’t followed this trend: the housing boom has instead carried on and on.

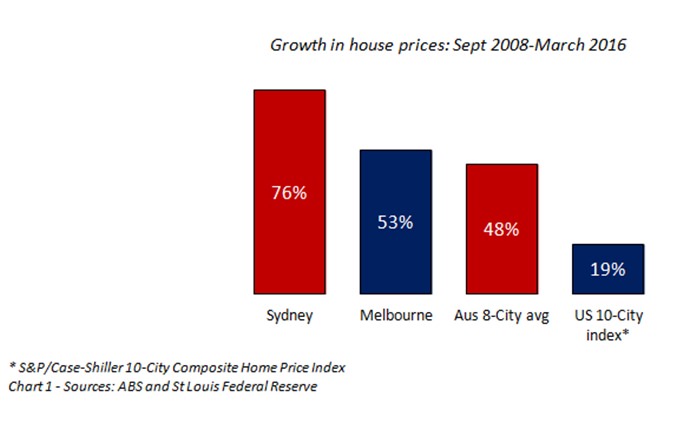

Sydney and Melbourne in particular have experienced huge rises in prices since autumn 2008: 76% and 53% increases respectively (see chart 1).

Don’t panic?

Such debt-fuelled growth is a repetition of the run-up to many of the great crises of the past: not least the US sub-prime crisis which led to the GFC.2 However, there seems to be a feeling in Australia that they are the exception to the rule – and with it come a range of excuses to support a visibly over-valued market.

Excuses for overvaluation

One reason given for why everything is just fine down under is population growth, due to a large number of births and immigration.3 This is curious because new-born children don’t generally buy houses and many new immigrants would surely rent, whilst establishing themselves in the country (see chart 2).

Another point made is that the economy is healthy.4 Relative to the average growth G7 economies, it is. Yet for the last seven years, year-on-year growth has hardly been booming.5

Not only that, China continues to be Australia’s top export market. In 2014-15, around 32% of exports crossed the China Sea and just over 14% of Australian services were delivered in China. Also, 45% of Australia’s total exports comprised of minerals and fuels.

Having all of your eggs is so few baskets is always risky. Given the concerns and uncertainties over the Chinese economy,6 as well as a massive drop in mineral and fuel prices in the last two years or so,7 it’s extremely dangerous (see chart 3).

Apparently, confidence amongst Australian businesses and consumers is high though.8 But confidence measures are fickle. In July 2007, a report suggested that pre-GFC America was experiencing a six-year high in consumer confidence;9 yet ten months later – still before that autumn’s bank failure drama – was said to be at its lowest point since 1992.10

The other excuse for overvaluation that really caught my eye was the assertion that there is a “healthy level of household debt.”11 Even the most hardened optimist has to admit that such a massive increase in such a short time (see chart 4) can in no way be deemed to be healthy.

To be continued…

Footnotes:

2 http://www.investopedia.com/articles/economics/09/financial-crisis-review.asp

4 idem

5 See IMF GDP figures

6 http://blogs.wsj.com/chinarealtime/2016/09/28/warning-sounded-over-chinese-economy/

7 http://pubdocs.worldbank.org/en/328921469543025388/CMO-July-2016-Full-Report.pdf

9 http://www.marketwatch.com/story/after-2007-records-oil-expected-to-turn-back-toward-100

10 http://money.cnn.com/2008/05/27/news/economy/consumer_confidence/?postversion=2008052713

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation.

MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: |