Property prices in Australia are still rising. Is that because the market is immune to a bubble burst or is everyone just putting off the inevitable?

Back in 2010, Professor Steve Keen – my colleague at economics think tank IDEA Economics – walked 220km from Canberra to Mount Kosciuszko wearing a T-shirt emblazoned with “I was hopelessly wrong on house prices! Ask me how!”

That was because in 2008 he’d lost a bet with Rory Robertson of Macquarie that house prices would be lower in September 2009 than a year earlier.1 In fact, Steve’s initial point was that Australian property prices were in real terms in general at least some 40% above trend – he explained that this could be resolved by an immediate fall of 40%, a price stagnation for so many years that the trend eventually caught up with the gap or, most likely a combination of a fall over a protracted period of time. However, Rory reduced this to the coin flip question of “yes, but will they rise or fall in the next 12 months?” and didn’t seem to comprehend that such a coin flip wasn’t really the point here – Steve was observing a much bigger, more structural phenomenon, which may well be precisely why Rory didn’t seem to understand it.

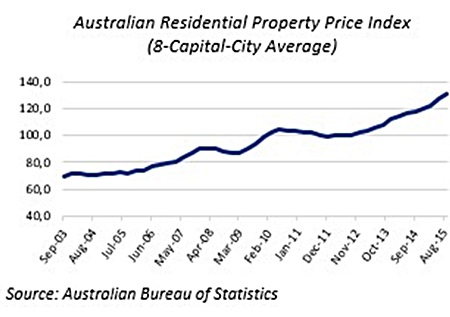

With the latest house price index figures still showing a rise in the house price index (see chart 1), Steve has written two articles in the last few weeks explaining how he got it ‘wrong’.2

Chart 1

Chart 1

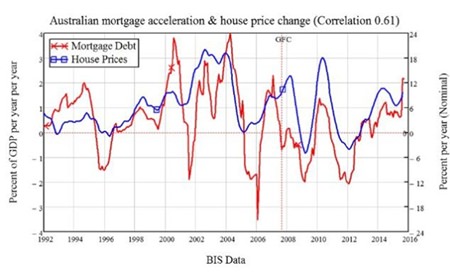

Keen saw that, whilst he’d got the cause of the housing bubble right (i.e. mortgage debt), he’d got the direction of the cause wrong. He’d expected, as happened in the US and Japan, that after the global financial crisis (GFC), the Australian economy would start to reduce the amount of private debt it was taking on. This didn’t happen for two reasons: the Rudd government stimulus and the RBA policy of raising interest rates in November 2011.

The Rudd government’s stimulus package, introduced in October 2008, included an increase in the federal government’s grant to first-time property buyers. The existing AUD7,000 grant was doubled for those buying existing homes and trebled for buyers of new properties. Added to that, state governments threw in their own grants, meaning purchases in Victoria, for example, could receive a total of AUD36,500.3 First-time buyers came flooding into the market, leveraging up the grant by a factor of ten of more in additional mortgage debt, until the reward ended in mid-2010. Of course this should be seen as an additional stimulus package in that there are permanent incentives, in the form of negative gearing tax breaks, to borrow in order to buy property in Australia – something that already creates a structural distortion in the property market.

Having first gone against the trend of the world’s central banks by increasing its reserve rate, the RBA lowered it dramatically from 7.25% to 3% in eight months. It then increased the rate before deciding, in late 2011, that it was right to drop rates all along. It currently stands at 2%.

The share market was scary and bond rates were falling, so investors bought into the housing market, causing mortgage debt to rise again: the consequence of which is a rise in house prices (see chart 2).

Chart 2

Chart 2

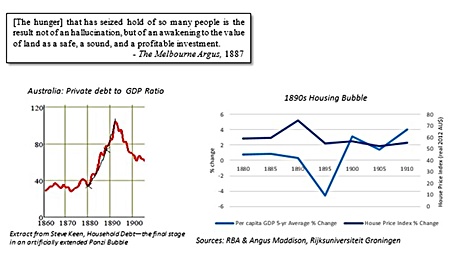

Of course, when talking mortgage debt in Australia, it’s not a question of small numbers. A report on debt published last December by AMP/NATSEM4 shows household debt in Australia stands at a huge 185% of annual income (see chart 3).

Chart 3

Chart 3

That means Australian households have nearly twice as much debt as annual income. This is a level that historically constrains any further consumption and leads to market corrections – in other words, a classic indication of bubble vulnerability. A case in point is the Australian housing bubble of the 1890s (see charts 4 & 5).

Chart 4&5

Chart 4&5

A more recent example is what happened in the US in 2008-2009,5 partially caused by sustained increases in private debt and house prices over several years, only for the housing market to reach its nadir and begin to fall rapidly.

One lesson we can learn from these examples is that the fundamental problem is, at some point, the level of mortgage debt relative to income will stabilize. Well before that happens, though, the acceleration of mortgage debt will decline, and prices will fall.

This hasn’t happened in Australia in recent years because of the 2008 and 2011 government interventions. On both occasions, the result was an acceleration in mortgage debt and a price bubble. Thus, when prices begin to fall, the government could theoretically step in once again and keep prices up.

The problem with this scenario, however, is that right now Australia has the highest levels of mortgage debt and total household debt in the world. At some point this appetite for living in a bubble will have to wane – as it has in the US, Canada, Europe and elsewhere6 and as it did in Australia 125 years ago (see charts above) – as people will no longer want or be able to increase debt repayments, particularly as deflation stifles any increase in income.

Thus, when the rate of growth of private debt inevitably starts to slow, the economy will experience what the rest of the world went through in the GFC. And that includes falling house prices.7 But Australia’s will be falling from a much greater height.

Footnotes:

1 http://www.debtdeflation.com/blogs/2010/05/12/a-monkey-off-my-back/

2 http://www.businessspectator.com.au/article/2016/2/29/economy/i-was-wrong-australian-house-prices?utm _source=exact& utm_medium=email&utm_content=1 864654&utm_campaign=kgb&modapt=#.VtPDs0YxIvE.gmail

3 http://www.businessspectator.com.au/article/2016/2/29/economy/i-was-wrong-australian-house-prices?utm_ source=exact&utm_medium=email&utm_content=1 864654&utm_campaign=kgb&modapt=#.VtPDs0YxIvE.gmail

4 Buy now, pay later: Household debt in Australia, AMP/NATSEM, Issue 38, December 2015

5 http://www.mbmg-investment.com/in-the-media/inthemedia/44 & http://www.mbmg-investment.com/in-the-media/inthemedia/45

6 http://www.mbmg-investment.com/in-the-media/inthemedia/77 & http://www.mbmg-investment.com/in-the-media/inthemedia/78

7 http://www.businessspectator.com.au/article/2016/3/7/economy/why-house-price-bubble-still-hasnt-burst

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |