It’s all about money. What we need to do is keep up public pressure for improvements in infrastructure, transport, sewerage.

– Sócrates Brasileiro Sampaio de Souza Vieira de Oliveira, footballer, doctor and political activist, June 20101

The world spotlight is firmly on Brazil nowadays, with the country hosting the world’s two largest sporting events2 inside two years. Yet trouble is brewing: the economy once touted as a future star performer, is dragging while the government uses a time-honoured method in an attempt to drag the country back up.

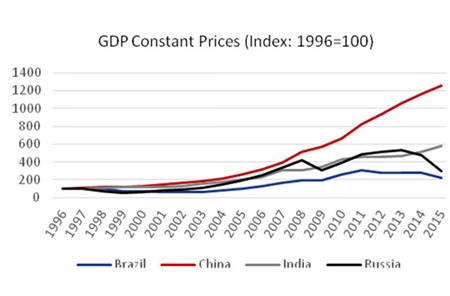

Back in 2001, then Goldman Sachs chairman Jim O’Neill coined the phrase BRICs in a report which pointed out that the largest emerging markets of Brazil, Russia, India and China already represented 8% of world GDP and would increase that proportion further in the coming decade.3

That report put these countries as the benchmark for the rest of the emerging markets and, to some extent, this has panned out (see chart 1). The group has since become formalised and the small ‘s’ has become a large ‘S’ as South Africa was invited to join the summits.

Chart 1 – Source: IMF

Chart 1 – Source: IMF

Not so strong now

For several years, the Brazilian Real was strong against the USD, reaching BRL 1.56 to USD 1 in July 2011. By the end of August this year, that level reached BRL 3.49. This should be helping exports; yet over 32% of sales out of Brazil are ores, oil seed and mineral fuels4 – raw materials whose world market prices have been falling dramatically. These include oil which represents 8.4% of its exports, and iron ore, which makes up 13% of exports.5

However, falling oil prices and local issues (such as Russia’s stock market and currency drops post-Ukraine crisis and Chinese poor trade results and stock market crash) have recently revealed chinks in the BRICS’ armour.

Brazil is a case in point – and a deceptive one at that. It had enjoyed year-on-year growth since 1992 (with the exception of the fallout if the GFC in 2009) and initiatives such as the Bolsa Família programme have been praised for their reduction in the percentage of people living in poverty.6 Furthermore, unemployment levels have been around the 5-6% mark since 2011 (2001-2006 saw rates between about 10% and 12%).

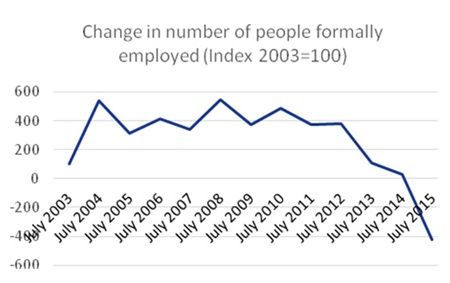

Chart 2 – Source: Ministério do Trabalho e Emprego do Brasil

Chart 2 – Source: Ministério do Trabalho e Emprego do Brasil

However, recent growth has stagnated. In 2014, GDP was only 0.1% higher than in the previous year and 2015 is expected to be -1% compared with last year.7 Not only that, those relatively impressive unemployment figures hide the truth: the year-on-year number of people formally employed is nosediving8 (see chart 2). Barclays Capital economist Marcelo Salomon puts this down to fewer people actually looking for jobs.9

Footnotes:

1 http://www.theguardian.com/theobserver/2010/jun/

13/socrates-brazil-football-world-cup

2 http://sports-facts.top5.com/the-worlds-top-

5-most-watched-sporting-events/

3 http://www.goldmansachs.com/our-thinking/

archive/archive-pdfs/build-better-brics.pdf

4 http://www.worldstopexports.com/brazils-top-10-exports/2951

5 MIT https://atlas.media.mit.edu/en/profile/country/bra/

6 http://www.coha.org/income-inequality-and-poverty-

a-comparison-of-brazil-and-honduras/

7 IMF World Economic Outlook, April 2015

8 Source: Ministério do Trabalho e Emprego do Brasil

9 http://www.forbes.com/sites/kenrapoza/2014/04/

17/why-brazils-unemployment-rate-is-so-low/