Another case of debt

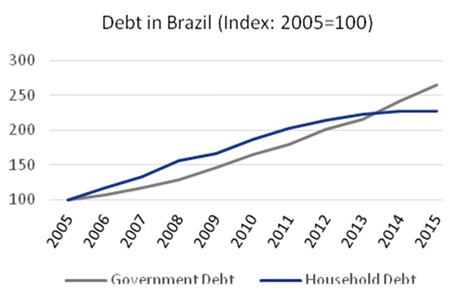

As happened in Spain during the growth years,1 the private sector began to accumulate debt at an astounding rate – in the last ten years household debt alone rose by almost 150%.2 Public sector debt – never one to be outdone – has risen at an even sharper rate in the last decade (see chart 1).

The amount of public sector debt should not be the first priority. After all, a government is not supposed to turn a profit – it should be there to provide services to the public. Besides, if the private sector makes money, the public sector receives more income through tax.

Chart 1 – Source: IMF & Banco Central do Brasil

Chart 1 – Source: IMF & Banco Central do Brasil

And more austerity

President Dilma Rousseff’s government followed many other countries in laying down an austerity programme. However, it suffered a setback in August when parliament blocked an attempted freeze on the salaries of government lawyers, state prosecutors and police chiefs.3

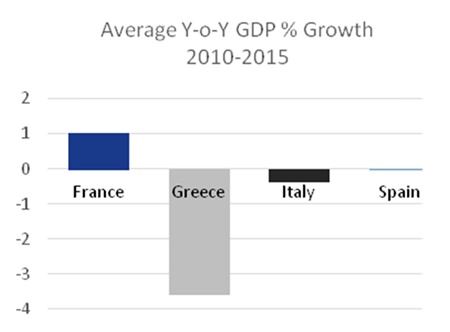

It has become clear from European examples that austerity measures merely contract an economy that needs to grow: Greece, Italy and Spain have all experienced negative average year-on-year growth since 2010 (see chart 2) and France hasn’t fared much better with an average growth rate of just 1%.4

Chart 2 – Source: IMF

Chart 2 – Source: IMF

What is even more galling in Brazil’s case is that BRL 65.6 bn (USD 24.6 bn) has been spent on hosting football’s World Cup and the 2016 Olympic Games in Rio – that’s the equivalent of Brazil’s debt in 2014 or 48% more than the last year’s education budget.5

The way out?

As we can see in Europe,6 austerity usually brings deflation; yet Brazil is currently experiencing high inflation (9.6% in August7). Whilst some inflation is welcome to keep up wages up and thus consumption, such an elevated rate eats too much into personal wealth. To arrest this, the central bank has raised base interest rates from 7.5% in September 2012 to 14.25% today.8 By comparison the US Federal Reserve’s rate has been at 0.25% since December 2008.9

I think the Fed and the European Central Bank’s almost-zero inflation policy contracts economies as, though it may encourage people and companies to take on more debt, they use it to pay tax instead of consumption and expansion.

On the other hand, the Brazilian central bank’s strategy of using extremely high base interest rates to curb inflation doesn’t work either. The private sector won’t borrow at those rates, especially as government austerity measures include raising taxes on fuel and personal loans.10 The private sector is therefore being squeezed at both ends, contracting the economy even further.11

The solution is to focus on reducing private sector debt. This would give people confidence to consume. In turn this would enable businesses to expand by spending more on machinery and employing more people. All of this would automatically increase government revenue through taxation.

Historically there have only been two ways to achieve this: collapse or jubilee. In the first, the economy collapses under the weight of debt; we enter a depression while the debt is written off and assets are written down. In other words, almost another form of austerity but at least the eventual outcome is favourable.

The second method is to have a debt jubilee. This did work in the Sumerian and Judaic eras;12 yet today it is only on a minority agenda (such as at IDEA Economics, where I am an advisory board member).

Realistically, we’ll probably end up with no choice but to do the right thing but in the worst and most painful and destructive way possible. This is because policy makers won’t re-engage with the only, proven possible way of doing it.

As with the US, the Eurozone and Japan (amongst others) we see a government prioritizing the wrong type of debt. In fact, analysts Euroasia Group don’t even see the parliamentary vote to increase salaries as an attack of common sense in the face of austerity. It sees the vote merely as retaliation for investigations into a corruption scandal allegedly involving the national energy company Petrobas.13

So despite its idiosyncrasies, Brazil is very much part of the austerity-contracting-the-economy group and therefore no longer a benchmark for other emerging markets.

Footnotes:

1 http://www.mbmg-investment.com/in-the-media/inthemedia/57

2 Banco Central do Brasil

3 http://www.ft.com/cms/s/0/fb09e8b6-3c6f-11e5-

8613-07d16aad2152.html#axzz3llkvZWoP

4 IMF World Economic Outlook, April 2015

5 http://www.forbes.com/sites/kenrapoza/2014/06/11/

bringing-fifa-to-brazil-equal-to-roughly-61-of-education-budget/

6 IMF World Economic Outlook, April 2015

7 http://www.ft.com/intl/cms/s/3/3a4b7780-45b5-

11e5-b3b2-1672f710807b.html#axzz3llkvZWoP

8 Banco Central do Brasil

9 St Louis Federal Reserve

10 http://www.ft.com/intl/cms/s/0/ff3c9d22-a032-11e4-

aa89-00144feab7de.html#axzz3llkvZWoP

11 IMF World Economic Outlook, April 2015

12 http://www.washingtonsblog.com/2011/07/we-have-forgotten-what-

the-ancient-sumerians-and-babylonians-the-early-jews-

and-christians-the-founding-fathers-and-even-

napoleon- bonaparte-knew-about-money.html

13 http://www.ft.com/cms/s/0/fb09e8b6-3c6f-11e5-

8613-07d16aad2152.html#axzz3llkvZWoP

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |