The Asean Economic Community – a sort of common market for Southeast Asia – is set to become some kind of reality at the end of the year and it’s already possible – in theory at least – to invest across borders. However, there’s no proof as yet that all this is built to last.

A few weeks back, Myanmar’s ministry of commerce reported that trade with its four neighbouring countries had reached almost USD 2.5 billion. To put that into context, it’s similar to the value in services the US exports to the Philippines.1

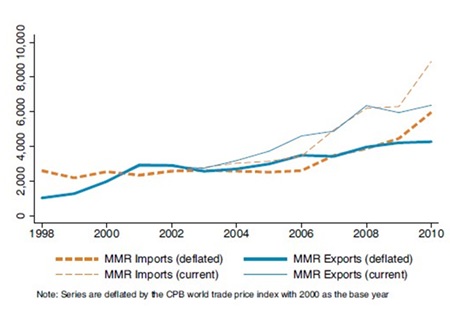

That may not be anywhere near the same scale as China-US trade but, considering where Myanmar has come from, it’s quite a step. Overall trade has increased massively since 1998 (see chart) and in that time so has GDP, which has gone up by a huge 348% (in Burmese Kyat terms or 747% in US Dollar terms).2

Myanmar: Total Merchandise Trade

Source: Asian Development Bank

Source: Asian Development Bank

That bodes well for the future of the AEC, which is due to open for business at the end of this year. Myanmar has been consistently in the bottom two Asean member countries since Cambodia joined the group in 1999, in terms of GDP per capita (in current USD as well as based on PPP in International Dollars).3 As one of the AEC’s stated goals is to create a region of ‘equitable economic development’4 the fact that one of the region’s least developed economies is quickly catching up with the likes of Vietnam, the Philippines and Indonesia, is welcome news.

The AEC’s administrators have certainly followed the example of the European Union’s Single Market, in establishing fundamental freedoms on which the new common market will be based,5 which include: the free flow of goods, services and investment, as well as the freer flow of capital.

What does this mean for investors?

Although these objectives may sound purely theoretical, they may in fact become an everyday reality for Southeast Asian investors.

In August of last year, Asean announced that the offering of cross-border collective schemes between Thailand, Singapore and Malaysia was now permitted, under its Asean CIS Framework.6 The rules of the game are that schemes must receive their home regulator’s approval first before being able to be offered within one of the other two CIS countries. By September 2015, eleven funds had been granted such home approval; although none of them to my knowledge have yet received the green light from either of the two host countries.

CIS is following in the footsteps of the European UCITS framework, which first appeared in 1985 and allows investment schemes authorised in one EU country to be sold or promoted in another.7 Whatever UCITS’ strengths and weaknesses, with around USD 8.8 trillion of assets under management8 and accounting for around 75% of all collective investments by small investors in Europe, it can hardly be described as unused.

UCITS allows a fund management firm based in, say, northern Sweden sell its authorised financial products to someone in southern Portugal. The reality, however, has been a concentration of management firms in the jurisdiction which offers the best conditions regarding tax treatment, accessibility, regulation and investor protection. In Europe’s case, this is Luxembourg.9 It’s now up to the three Asean jurisdictions who have already rolled out the CIS framework to take advantage of their head start and provide the best conditions for managers and investors to do business.

Where UCITS differs significantly from CIS is that in the former only the home regulator’s authorisation is required. This exposes a gap in the system – and in the whole AEC plan for that matter. Whilst the different UCITS laws have passed through legislative processes, such as consultation, hearings in the European Parliament and the Council of Ministers, such mechanisms do not exist in Asean. For the CIS framework, the rules were drafted and those national regulators who agreed signed up. That’s why there are only three of the nine member states where a CIS is possible.

Not only that, once the CIS becomes used, there is no-one to regulate the regulators? If one national regulator decides to block CIS funds for no particular reason other than national interest, unlike in the EU, there is no supranational body with the legal power to stop it.

If regulators are really serious about an Asean environment where investors can buy properly regulated financial products with the peace of mind which meaningful protection can give, there has to be a supranational regulator and dispute settlements system in place.

Of course when we look at that, we face the bigger obstacle: how a group of nine states, including kingdoms, people’s republics and a sultanate to agree on the roles and limits of institutions. Such a process has taken the EU fifty years to get where it is today and its members have far more in common than the Asean states currently do.

The AEC as a whole, and the CIS in particular, are based on commendable objectives which may not bring about greater prosperity in Southeast Asia but could well enable it. I truly hope the project works, but I wouldn’t hold my breath.

Footnotes:

1 https://ustr.gov/countries-regions/southeast-asia-pacific/philippines

2 IMF World Economic Outlook, October 2015

3 ibid

4 http://www.asean.org/news/item/the-asean-

framework-for-equitable-economic-development

5 Asean Economic Community Blueprint, Asean 2008

6 http://www.theacmf.org/ACMF/webcontent.php? content_id=00067

7 http://www.ucitsxxv.eu/index.php/about-ucits/

8 http://ec.europa.eu/information_society/newsroom

/cf/fisma/item-detail.cfm?item_id=20756&lang=en

9 http://www.kwm.com/en/au/knowledge/insights

/asian-retail-funds-passporting-20150916

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |