It seems that all the financial news over the last couple of months has been about China. The dramatic crash brought international focus on the world’s second largest economy:1 yet as the media vans pack up and head off, the problems haven’t gone away and the government seems to be up to some funny tricks.

Wise economists have warned us that if America sneezes, we would catch pneumonia. – Peter Thorneycroft, president of United Kingdom Board of Trade, 1954

There are a couple of revisions I’d like to make to the above quote. Firstly, there’s the implication that there are plenty of wise economists; then the point that nowadays it’s China’s expulsion of air that creates health concerns.

Given that only around 13 of the 36,000 registered economists foresaw the Global Financial Crisis2 – the actual event itself, not the timing – the number of wise economists strikes me as quite low.

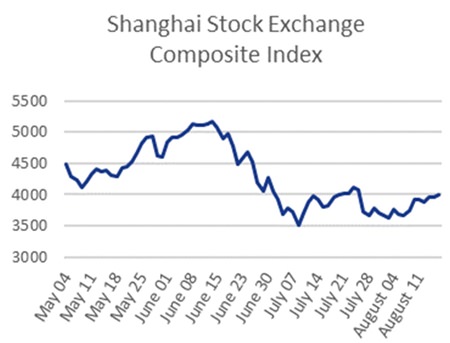

Chart 1 – Source: Financial Times.

Chart 1 – Source: Financial Times.

Regarding China; whilst it has been documented for over ten years that it is a major world economic player,3 many commentators seem to have suddenly woken up to the reality that it is in a highly precarious position.4 This is something that I have been concerned about for several years; however, I fear we don’t yet know the half of it.

History shows that economic miracles eventually run out of steam – mid-1960s Germany and 1990-2008 Japan are cases in point.

Chart 2 – Source: Agnus Maddison, Rijksuniversitonieit Grngen.

Chart 2 – Source: Agnus Maddison, Rijksuniversitonieit Grngen.

In fact, Japan is still in the depths of a 25-year plus debt deflation;5 however, as many countries experienced a downturn post GFC in 2008, I thought taking the chart further would be labouring the point. Poor trade results, economic results, property and stock market bubbles and astronomical levels of corporate debt are bringing China closer to the Japanese model.6

It’s not just the size of China’s economy that makes it a leading player and concern – the country is a major exporter and importer to several nations.7 Consequently, June and July’s prolonged crash provoked dramatic headlines, accompanied by pictures of people looking forlornly at a giant digital screen showing share prices heading south.8 The government took measures to control the negative effects of the crash; cutting interest rates, halting scheduled IPOs and allowing speculators to use their houses as collateral for marginal loans.9

Chart 3 – Source: Agnus Maddison, Rijksuniversiteit Groningen.

Chart 3 – Source: Agnus Maddison, Rijksuniversiteit Groningen.

Then, in late July, trade figures reports revealed an 8.3% year-on-year drop in exports and an 8.1% year-on-year descent in imports.10 This seemed to prompt the PBOC to abandon its strong yuan policy and in mid-August, the currency was devalued three times in as many days, as the central bank looked to rebalance the economy through cheaper exports and lower foreign currency debt repayments.11

Dollar Dump

Unsurprisingly, these measures grabbed the headlines, as it quickly became clear to what length the PBOC would go to maintain control of the economy. However, it is curious that there has been little mention of another big move. China’s central bank has been actively dumping US dollars from its balance sheet for the best part of a year.

At first glance, this isn’t at all apparent. China is a major investor in US Treasury Bonds, for example, and the PBOC appears to have been gradually selling them off in 2014; yet 2015 figures show it soon bought them all back again (see chart 4).12

Chart 4 – Source: US Treasury.

Chart 4 – Source: US Treasury.

However, this conflicts with other information: the amount of foreign currency the PBOC holds in reserve has plummeted in the last year or so. Since June 2014, the Chinese central bank has shed 11% – some USD 435 billion – of its foreign reserves from its balance sheet, including a 3% sell off in August 2015 alone.13

Here’s where the detective work comes in. It has been suggested for some months that China likes to use Euroclear, a Brussels-based securities trader,14 in order to provide more anonymity for its transactions. If this were the case, some of China’s T-bond trading would show up on Belgium’s list of holdings.

Funnily enough, if we compare the rate at which the PBOC has been shedding its foreign reserves with the amount of both Chinese and Belgian-held T-bonds, there is a striking correlation (see chart 5)15.

Chart 5 – Sources: POBC, US Treasury.

Chart 5 – Sources: POBC, US Treasury.

Sales now on!

So why would China go on such a selling spree? Especially as selling foreign reserves would run counter to the programme of weakening the RMB to boost exports.16 Although admittedly it does appear that the PBOC may have used considerable sums of foreign exchange reserves to boost the RMB when they felt that it had declined too far against the USD.17 Either way, the central bank still has plenty left in its war chest. It currently holds more foreign reserves than any other country in the world – some three times more than second-placed Japan.18

Whilst the PBOC’s Chief Economist Ma Jun has stated that further intervention in currency markets would only happen in exceptional circumstances,19 I find it hard to believe that China’s addiction to attempting market control has been cured. Its moves, such as multiple interest-rate cuts and the whopping 1% cut in banks’ reserve requirement ratio (RRR)20, often smack of desperation. If it has the power and will to do this, why would it stop?

Still, my curiosity is not completely satisfied. I can understand the use of foreign reserves to stabilise currency but why was it done via Belgium? Normally China does transactions from home and through UK-based offshore banks.21 It seems to me that the PBOC is hiding something; and not very subtly either. It could be that China has learned from Japan’s strait jacket of being such a large investor in US T-bonds that it couldn’t sell any substantial part of its holding without damaging the value of the remainder. China wouldn’t want to get caught out like that.

If so, it would make sense to hide behind as much privacy as possible. Or maybe, just maybe, we’re entering a phase of the China debt crisis that’s so severe that China is being forced to liquidate the sovereign equivalent of the family silver. If things are that bad, it’s a real worry and it’s definitely something that Chinese policymakers would want to keep as quiet as possible.

Footnotes:

1 IMF

2 http://barnabyisright.com/2013/05/30/an-historical-

warning-for-proponents-of-a-modern-debt-jubilee/

3 Eswar Prasad, China’s Growth and Integration into the World Economy, IMF 2004

4 MBMG IA Research Note China’s Turning Japanese

5 Steve Keene’s 2015 Economic Outlook, http://www.ideaeconomics.org/

6 China flatters to deceive, MBMG IA Update,

June 2015 http://www.mbmg-investment.com/in-the-media/inthemedia/49

7 idem

8 http://www.dw.com/en/chinas-stock-market-

crash-by-the-numbers/a-18566733

9 http://www.forbes.com/sites/jessecolombo/

2015/07/19/is-chinas-stock-market-crash-over/

10 Wall Street Journal http://www.wsj.com/

articles/china-exports-imports-drop-in-july-1439000442

11 http://www.theguardian.com/business/2015/aug/

14/china-halts-yuan-devaluation-with-slight-official-rise-against-us-dollar

12 US Treasury

13 People’s Bank of China

14 http://www.zerohedge.com/news/2015-06-15/china-

dumps-record-120-billion-us-treasurys-two-month-belgium

15 PBOC and US Treasury

16 http://www.ft.com/intl/cms/s/0/c54a47f6-4422-

11e5-af2f-4d6e0e5eda22.html#axzz3lEHbCdW1

17 idem

18 IMF figures

19 http://www.ft.com/intl/cms/s/0/c54a47f6-4422-

11e5-af2f-4d6e0e5eda22.html#axzz3lEHbCdW1

20 http://www.mbmg-investment.com/in-the-media/inthemedia/42

21 http://www.zerohedge.com/news/2015-07-17/china-

dumps-record-143-billion-us-treasurys-three-months-belgium

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |