The change in government on 22nd May seems to have occasioned a very different response from inside Thailand compared with the world outside.

The international media were quick to condemn the coup, which to some extent can be understood. After all, the term coup d’état literally means a ‘state hit’ and to see the uniformed heads of the military sat at a table announcing they are in charge evokes images of Central America during the Cold War.

Of course, things aren’t always what they seem in Thailand, however. After all, the government was run mainly by the military, or military appointed politicians, for around 60 years, until 1992. Then, in 2006, there was another coup ousting Thaksin Shinawatra from power.

| Thai Military Government’s Economic policy framework 1) Spending will not exceed the initial budget, to maintain fiscal discipline, and prevent increasing public debt; 2) Revive the confidence of foreign and domestic investors; 3) Proceed with delayed projects under the 2014 budget; 4) Projects that have legality issues will be reprioritised based on their importance to the economy; 5) Consider special projects such as the promotion of border trade for small and medium enterprises; 6) The economic plans will adhere to rules and regulations of financial discipline, the capital market and registered companies; 7) Set up a private fund to lower public investment; 8) Modernisation of state enterprises; 9) Achieve energy stability; 10) Economic plans will be based on transparency. Source: UBS, www.nationmultimedia.com |

Thus, the country is used to coups and, given the political paralysis which seriously threatened the economy in late 2013 and early 2014, many people within Thailand feel it was necessary. So much so that when martial law was declared two days before the coup, a Suan Dusit Rajabhat University poll found that of 1,264 men polled nationwide, 76% agreed with the move.1 Read into that what you will.

Whilst the international media is drawn towards the men in uniform, prime minister General Prayuth Chan-ocha has appointed a mix of free-market and interventionist economic advisors. In early June, the government announced a framework of ten economic priorities.

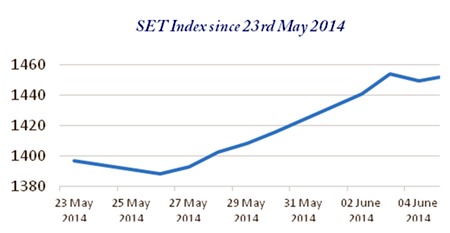

The coup may have delivered the coup de grâce to the political turmoil, which not only paralysed public policy but also saw international investors accelerating their already significant sell off of Thai assets. Foreign SET sales since January 2012 wiped out the balance of overall foreign purchases made in the previous 6 ½ years. This year alone2, foreign investors have sold nearly THB 33 billion of equities on the SET more than they have purchased.

Source: Bloomberg

Source: Bloomberg

The SET has rallied strongly in the aftermath of 22nd May as the foreign loss of confidence in Thailand has been offset by the return of local investors. In a recent note, UBS stated that it believed “pent up demand, combined with improved exports and an effective government will allow a recovery in growth into the second half of 2014.”3

The note did exercise caution, however, it questioned where growth would come from and how the government would help this. It said that it expected a policy rate cut by the Bank of Thailand and that, with elections not likely for another year the long run depends on the military government’s actions, the boost to growth is likely to come from private and state enterprise in the short term.

One of the Thai economy’s recent weaknesses has been a low level of demand, not helped by the termination of government-funded projects such as the first-buyer car scheme. The UBS report suggests that, because people didn’t spend in Q1 2014, a certain amount of demand is ‘pent up’. With that and its analysis on exports and the potential effect of government policy, UBS’s baseline scenario is that around 60% of domestic demand could be reversed in the next two quarters. It envisages that this would translate into a real GDP growth rate of between 5 and 6% in 2015.

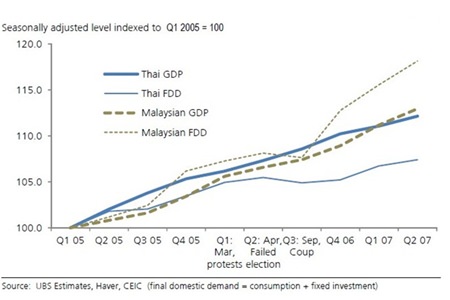

Experts seem to agree that a lot depends on how helpful the military government is to the economy. As Adrian Dunn, chief executive officer of the Brooker Sukhothai Fund, said at a recent event in Bangkok, the NCPO government seems to have learned from the mistakes of the military’s ponderous approach in 2006.

Thai GDP and Final Domestic Demand around the 2006 Coup

He analysed the economic measures taken by the new government so far – less than a month after having taken over. Decisions already made include fixing selected prices, reviewing fiscal spending and removing recently-imposed administrative impediments.4

The last of these measures implies that the government is attempting to speed up approval of infrastructure projects and foreign investment; therefore making doing business in Thailand easier, and in some cases cheaper. “Infrastructure spending will revitalise private spending, which has significantly lagged other ASEAN countries like Indonesia and the Philippines,” explained Dunn.

Action taken so far by NCPO

Source: Prachachart Turakit MoF |

Dunn suggested that this is feasible as he sees the government debt to GDP ratio as relatively low, in comparison with G7 countries. He added that Thailand’s economy has avoided catastrophe thanks to the coup and that if the suggested policies are indeed implemented, the country will be in a great position to further capitalise on the modernisation programmes underway in neighbouring countries (Laos, Myanmar, Vietnam and Cambodia).

At the same event, I said that Thailand now faced three main challenges: addressing the political division; tackling the increasing private debt burden; and the slowing of global trade. The latter is of course outside Thailand’s hands and it is particularly precarious given its heavy dependence on the export market: over the last twenty years, Thailand’s GDP growth pattern has been almost identical to that of its export volume.

With this in mind, stock valuations on the SET are not unreasonable and fundamentals, such as the baht are reasonable. That said, the country is not out of the political woods as yet; there remains the debt legacy of the previous government’s stimulus policy and that global trade could weaken or even collapse in the not-too-distant future.

Footnotes:

1 Source: http://www. mediachannel.org/army-clampdown-on-thailand-media-in-wake-of-martial-law/

2 www.set.or.th Data to June 5th

3 UBS Global Research, Asian Focus – Thailand: Post coup pent up demand, 10th June 2014.

4 UBS Global Research

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Private Equity Services, Corporate Services, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |