The last week of July saw the visit to Bangkok by the inspirational economist Steve Keen, who is about to publish his latest book Can we avoid another financial crisis? which surveys the prospects for 42 countries around the world (including Thailand, Singapore, Indonesia, Malaysia and Hong Kong).

As well as being Professor of Economics and Head of the School of Economics, Politics and History at Kingston University London, Steve is chief economist of IDEAeconomics,1 a body dedicated to reforming economics, where I am an advisory board member. Steve’s previous book Debunking Economics2 explained the many logical and empirical flaws in mainstream (and Marxian) economics without using mathematics and has been translated into Chinese, French and Spanish.

Given events over the past decade, you may not think the words inspirational and economist sit comfortably together. In fact, Steve himself may well agree. That’s because he’s a prominent critic of the conventional neoliberal3 form of economics which has dominated governments, central banks, universities and the media over the past fifty years or more.

As banks, debt and money play an integral role in Steve’s dynamic approach to economics, he was one of just six registered economists in the world to anticipate the 2007-2008 global financial crisis (GFC).4 “Mainstream economists failed to anticipate the crisis, not because it was an unpredictable Black Swan,” Steve explains, “but because false pre-determined beliefs meant they ignored the cause of the crisis: banks lending too much money to finance speculation rather than investment.”5

Neoliberalism dominates

Neoliberalism has played two decisive roles in the modern global economy. Firstly, it played an important part in creating the GFC through its ideology of lowering financial services regulations. For example, neoliberal thinking in the US brought about the 1999 Gramm-Leach-Bliley Act6 (or Financial Services Modernization Act7 as it was tragically nicknamed). This Act of folly removed the prevention of a financial institution from acting as any combination of an investment bank, a commercial bank, and an insurance company. It’s no coincidence that the restrictions were initially put in place as a reaction to the Wall Street Crash and is aftermath by the 1933 Glass-Steagall Act.8 A year later, the Commodity Futures Modernization Act allowed banks more freedom in the derivatives market and enabled them to become more aggressive in the home loan market.9

The second contribution neoliberal economics has made is to exacerbate the problems of the GFC, without reducing the threat of a new crisis. Neoliberals dominate the world’s major central banks – including the Federal Reserve, Bank of Japan, Bank of England and the European Central Bank. Their obsession with reducing government spending has led them to embark on a policy of fiscal austerity, combined with quantitative easing and zero/negative interest rates as tools.

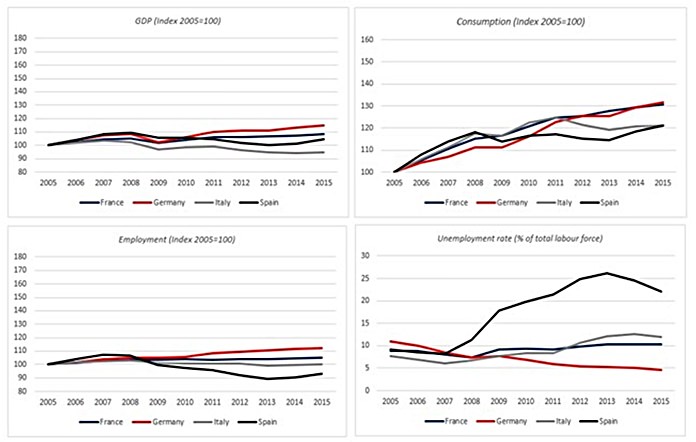

The net result of all of this is… pretty much nothing. Except the small matters of trillions of US dollars off central bank balance sheets,10 huge cuts in public services11 and widespread public anger at governments.12 And yet economies have hardly been boosted by all this tumult. As a case in point, eight years after the GFC hit, the Eurozone’s four largest economies have low GDP, pitiful consumption, little or no improvement in the number of people employed and scary unemployment levels (see charts).

Failing Eurozone

Why have central banks failed?

In his talk at the Dataconsult Breakfast in Bangkok, Steve explained that the current tools being used – quantitative easing (QE) and negative interest rates on bank reserves – are useless.

To start with, QE isn’t money printing: it in fact puts money into private bank reserve accounts held at the central bank, not into people’s bank accounts. QE has served to inflate already leverage-inflated asset prices and doesn’t even enable private lending anyway, as even the Bank of England has admitted in its now famous paper which contradicted its own recent policies.13

The policy of negative base interest rates is counter-productive as well. They don’t cause negative rates on personal bank accounts but instead give banks negative income assets, leading the banks to increase rates on private loans.

All this results in maintaining the symptoms of overvalued assets, instead of addressing the cause of the problem – the massive amounts of private debt.

I’ll take a closer look at private debt in Part 2.

Footnotes:

1 http://www.ideaeconomics.org/

2 Zed Books; Revised, Expanded ed. edition (September 1, 2011)

3 http://www.investopedia.com/terms/n/neoliberalism.asp

5 http://www.forbes.com/sites/stevekeen/#190e25b26e6b

6 https://www.law.cornell.edu/uscode/text/15/chapter-94/subchapter-I

7 http://www.investopedia.com/terms/f/financial-services-act-of-1999.asp

8 http://www.investopedia.com/terms/g/glass_steagall_act.asp

9 http://www.nytimes.com/2008/09/28/magazine/28wwln-reconsider.html?_r=1

10 http://www.telegraph.co.uk/finance/economics/11362087/ECBs-quantitative-easing-programme-launched-by-Mario-Draghi.html & http://www.zerohedge.com/news/2015-08-19/after-6-years-qe-and-45-trillion-balance-sheet-st-louis-fed-admits-qe-was-mistake

11 http://www.bbc.com/news/10162176

12 http://www.channel4.com/news/europes-anti-austerity-movements-from-podemos-to-the-snp

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter: @MBMGIntl; Facebook: /MBMGGroup |