September was marked with a number of key events: ECB & Fed Policy meetings, German Constitutional Court decision on the legality of a second Euro zone bailout fund, the Dutch elections and a decision on providing continuing loans to Greece and the possibility of bailing out the Spanish banks. In South Africa mining labour relationship tensions reached critical levels. All these decisions have the ability to derail or re-ignite risk asset rallies overnight, but that does not mean one should change one’s investment strategy due to one or two key event risks which we have no control over.

The developments in global economies are clearly demonstrating that we should expect a sub-trend global growth path, disinflation and accommodative monetary policies. Fund managers all around the world have been discussing various economic conundrums. These include: the ‘search for yield’ argument; the relative value of developed versus emerging market equities; Emerging Market currencies and bonds versus Developed Market counter parts and Gold as a store of value. For this article, let us just look at one of these themes: Emerging Market Bonds.

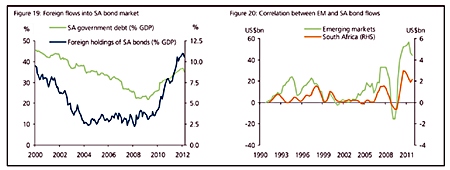

In the event of increasing EM Bond inflows, the SA government bond market should benefit due to its inclusion in both the EMBI and WGBI* (*from 1 October 2012). It is therefore critical for SA to maintain its credit rating to ensure portfolio inflows continue in the near future.

In the event of increasing EM Bond inflows, the SA government bond market should benefit due to its inclusion in both the EMBI and WGBI* (*from 1 October 2012). It is therefore critical for SA to maintain its credit rating to ensure portfolio inflows continue in the near future.

Emerging Market Bonds have experienced positive inflows in the past three years in the ‘search for yield’ trade. A few issues spring to mind when comparing Emerging Market Bonds (Corporate and Government) to that of Developed Market Bonds. One is that the emerging economies percentage debt relative to GDP is within acceptable parameters – for example South African Government debt is less than 40% of its GDP – while developed market counterparts are above 100%.

The JP Morgan EMBI+ Global Index (EM Bond Index) is trading at a spread of 300bps above treasuries (after a 100 bps decline over the past 3 months), while the US 7-10 year BBB rated Corp Bond Spreads trades at 260 bps over Treasuries. Both asset classes have traded higher in the past three years, indicating that in a risk-on environment EM Bonds and High Yield Corporate Bonds can still attract capital flows. According to Capital Economics the implied probability of US 7-10 yr BBB rated Corporate Bond default within 5 years are about 19% which is close to its long term average.

As an aside, I wonder what the implied probability of US, UK, European and Japanese Government Bond default would be considering that the combined ‘printing press’ have increased G7 balance sheets by about USD8 trillion since 2006?

The positive carry trade of emerging market bond yields and currencies is another attraction and should benefit from potential portfolio inflows in the short term – if there are no event surprises from central bankers or politicians. According to BCA Research Emerging Market Bonds as an asset class is still under-represented in many investment mandates. BCA reports that most funds do not disclose a target allocation to Emerging Market Bonds as an asset class, but estimates of Emerging Market bond allocations in Developed Market Funds are low – between 2-3%.

In the event of a continued risk-on rally a slightly higher allocation to Emerging Market bonds (an overwhelming majority of EM Bonds trade with positive real yields at the moment) could generate enormous capital flows relative to the size of these markets. The improving credit rating quality of Emerging Market local currency sovereign and corporate bonds can be an additional positive attribute.

Although Emerging Market local currency returns are more sensitive to cyclical factors and monetary responses, one thing is certain: the global economy is now more dependent on Emerging Markets to generate global economic and output growth than ever before. According to IMF numbers, published by BCA, the Emerging Market’s share of global growth is 64%, while its share of global output is 36%.

Therefore, given all this, all eyes are firmly on China, India, Brazil, Russia and South East Asia to lead global economic growth in this new century.

I would like to take this opportunity to wish all the Pattaya Mail readers a Merry Xmas and a Happy & Prosperous New Year.

| The above data and research was compiled from sources believed to be reliable. However, neither MBMG International Ltd nor its officers can accept any liability for any errors or omissions in the above article nor bear any responsibility for any losses achieved as a result of any actions taken or not taken as a consequence of reading the above article. For more information please contact Graham Macdonald on [email protected] |