As with everything, there are pros and cons to Tracker Funds. Some people think it is almost impossible to beat the markets so why not join them?

For those who do not know, a tracker fund is one that tracks the actual performance of a particular market or sector. The funds are usually cheap and can help those new to investing get a feel for marketplace(s) and how equities will perform in the long run. It also means you get automatic diversification within a specific market area.

It should be remembered that tracker funds are not actively managed and there is no fund manager trying to pick the best performing stocks and shares. What the manager will be doing is copy the index that is being followed (tracked). For example, if the fund is tracking the FTSE350 then it will just be looking at the 350 companies in that index and will not consider anything else. The advantage of the former is that the fund manager may outperform the index; the disadvantage is that he/she may not.

This is where tracker funds come in. They will never be the best but they will never be the worst either. As stated above, trackers are a great way of getting into stocks and shares without taking all the inherent risks. However, please remember that index trackers are exactly that. They are meant to do exactly what the markets they are tracking do – therefore, if the market goes up then the tracker will too, but if the market does down so will the tracker fund. You must know that at no time will be a manager jump in to get rid of poorly performing shares so you have to take the rough with the smooth.

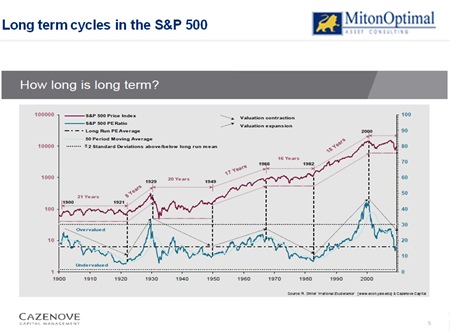

However, in the long term, tracker funds can always do well as equities historically outperform in the long run.

So, how to these funds work? As stated above, the idea is for a fund to track a particular index. The implication here is that all tracker funds perform the same. This is definitely not true. They can vary quite a lot. This is due to many different factors but the main ones are:

1. If the tracker fund is to precisely follow what the index does then it must invest in the all the companies in exactly the same way. For example, if XYZ company’s market value is five percent of the index it is in, then the tracker fund will also have the same percentage in XYZ company. This sounds simple but it is not always easy to buy and sell when it is necessary so a tracker can quickly get out of kilter. Also, buying and selling can prove to be expensive.

2. Where the manager will buy the top shares/stocks in the market and then just top up with the rest of the companies at a smaller rate. What happens to the leading shares is usually a fair reflection of what happens in the marketplace.

3. Some index fund managers will sometimes use derivatives to purchase options. This should give the same performance as the index it is following.

Now the problem with all of the above is they can be susceptible to mistakes and this creates something called ‘Tracking Error’ which is the difference between how the index and fund performs. This is why you should always look at how the fund has performed in the past although I have to cover my backside here and say past performance is no guarantee of how a fund will do in the future.

So now you know how the funds work. The next thing to do is select what kind of indices you want to track. Obviously, there are many out there. What you have to decide is how having a tracker fund will complement what you already have in your portfolio. If you have funds, stocks and shares in the UK, European and US markets then you may wish to look at various trackers in Asia. The implication from this is to maintain variety and keep liquid. Nothing does well forever and stock-markets certainly go up AND down.

| The above data and research was compiled from sources believed to be reliable. However, neither MBMG International Ltd nor its officers can accept any liability for any errors or omissions in the above article nor bear any responsibility for any losses achieved as a result of any actions taken or not taken as a consequence of reading the above article. For more information please contact Graham Macdonald on [email protected] |