You can sway a thousand men by appealing to their prejudices quicker than you can convince one man by logic.

– Robert A. Heinlein, If This Goes On, Chapter 10 (p. 426)

If there’s one conclusion that can be drawn from the build-up to the UK’s referendum on its membership of the European Union, it’s that if you’re not British, you should feel quite lucky right now.

Frankly, the whole charade is getting tiresome. That’s not because I don’t find the topic of the benefits and the downfalls of the EU interesting; nor is it because I don’t have a view on the way forward for a union which incorporates some of the world’s largest economies. The issue I have with it all is that, in the run-up to the referendum, political rhetoric has long since diverted itself away from the most important tools of my trade: fact and analysis.

On one side you have former Mayor of London Boris Johnson and former Education Secretary and current Lord Chancellor Michael Gove flag-waving and tub-thumping about non-issues. On their soap boxes they talk of putting money saved by exiting the EU into the health service. Yet Johnson’s oft-quoted figure of GBP350m is plainly inaccurate and even the more accurate figures don’t take into account the amount channelled back into the UK through social and development projects.1 Another example is the clamour to veto Turkey’s membership of the EU, which conveniently ignores the facts that a) Turkey’s membership is not even on the table until certain human rights issues have been resolved; and b) membership can only be obtained by unanimous agreement of all EU members – if they think that either Cyprus or Germany will allow that, it demonstrates a total lack of understanding of European politics.

The other side fairs no better. Prime Minister David Cameron has offered anyone who will listen his four pillars on which EU reform should be based.2 They are competitiveness (which talk about the size and influence of the Single Market but doesn’t mention its bureaucracy and inefficiencies); a multi-currency Single Market (but the euro aggregates national interests of Eurozone members, whilst going against the interests of the non-euro members); sovereignty (he wants the UK to stay out of a closer political union, yet the German government wants a more federal union); and migration (forget jingoism, the British economy has benefited greatly from immigration for centuries, but through the EU it is done randomly, rather than through demand for certain skills).

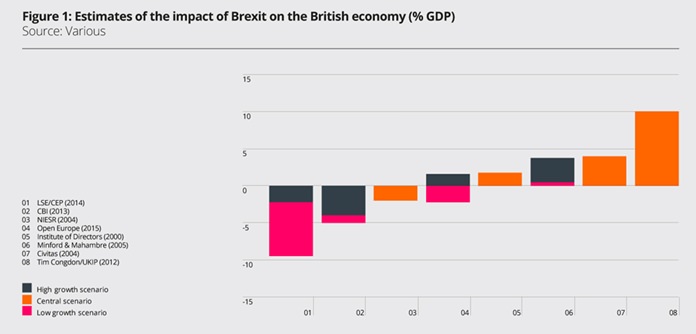

The result of all this politicking is that the answer to the big question what would happen to the UK economy if it left the EU? is, “It depends who you believe.” Chart 1 shows how varied forecasts are, depending on which side of the fence they land.

The reality of course is that we don’t really know. That’s not only because of newspaper stories as twisted as the bananas they purport to defend3 but also, as I said at the beginning of the year,4 we’re in unusual times; as it is impossible to predict what shape the global economy will be in over the coming months, never mind years and decades.

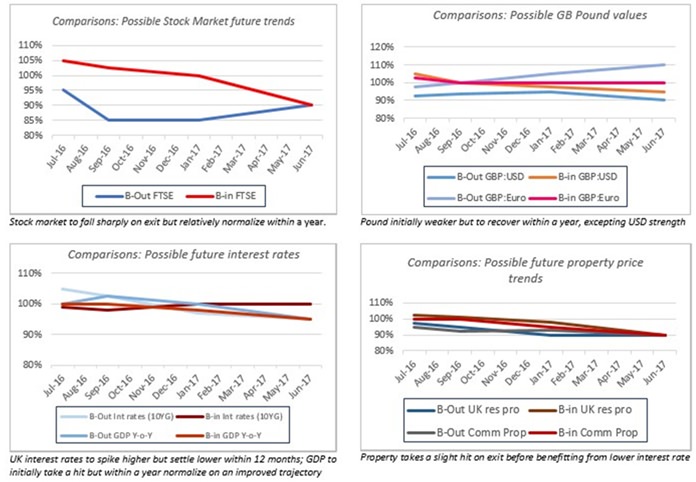

With that in mind, I decided to compare in which direction I think the FTSE, the pound, interest rates and property prices could in both In and Out scenarios (see graphs). On the whole, I see an Out vote having an immediate negative effect on prices, before levelling out around 12 months later.

Gambles’ guesses on the effects of BR-In and (orderly) BR-Out

My own concern about the UK remaining in the EU is that, although 80% of European legislation5 is drafted through a procedure as, if not more, democratic than Westminster, the big policy decisions – such as the euro – are made across the negotiation table between the heads of government. The natural consequence of that is that France, Germany and UK have tended to be able to call the shots because they have the largest populations and economies. However, that changed dramatically when Angela Merkel agreed that Germany could underwrite the Greek euro crisis in return for being able to dictate EuroZone members’ sovereign economic policy – for Greece, think Esau, for bailout think pottage. Non-membership of the Euro debacle excludes Britain from any significant voice in EU economic policy making – something akin to Prussia’s strength in the days of the Zollverein, which led to German unification and ultimately World War I.

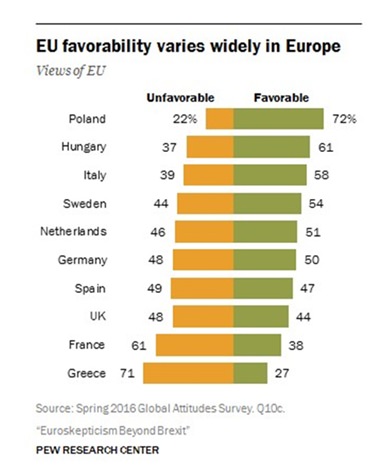

A Pew Research Centre survey published in early June suggests that citizens of other EU countries are unhappy with the Union as well. It reports that EU favorability is down in five of the six nations surveyed in both 2015 and 2016. France is down 17% and Spain 16%.

Maybe if the UK were to leave the EU, momentum would build to the point where it would disintegrate, allowing modern equivalents of Monet and Schuman to create a new platform on which countries can co-operate rather than dominate. One thing is for sure, whatever the result of the referendum, UK politicians need to take a long, hard look at their conduct during this campaign and evaluate how democratic their own political system is.

Footnotes:

1 http://www.bbc.com/news/uk-politics-eu-referendum-36040060

2 https://www.gov.uk/government/speeches/davos-2016-prime-ministers-speech-to-the-world-economic-forum

3 http://blogs.ec.europa.eu/ECintheUK/bananas-and-brussels/

4 http://www.mbmg-investment.com/in-the-media/inthemedia/77

5 http://europa.eu/eu-law/decision-making/procedures/index_en.htm

| Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation. MBMG Group is an advisory firm that assists expatriates and locals within the South East Asia Region with services ranging from Investment Advisory, Personal Advisory, Tax Advisory, Corporate Advisory, Insurance Services, Accounting & Auditing Services, Legal Services, Estate Planning and Property Solutions. For more information: Tel: +66 2665 2536; e-mail: [email protected]; Linkedin: MBMG Group; Twitter:@MBMGIntl; Facebook: /MBMGGroup |